[ad_1]

alexsl

Last week, Oaktree Specialty Lending Corporation (NASDAQ:OCSL) presented a well-performing, first-loan-focused investment portfolio with a 0% non-accrual ratio.

The business development company (“BDC”) increased its dividend to $0.17 per share after continuing to cover its dividend payments with net investment income.

The BDC’s stock is trading at a small premium to book value, but given how well the portfolio is performing, it deserves to trade at a higher premium.

During a recession, I would like to own Oaktree Specialty Lending as a business development company.

Well-Performing Loan Portfolio, No Non-Accruals

Oaktree Specialty Lending, a business development firm that primarily invests in first and second liens, delivered another strong quarter of portfolio results.

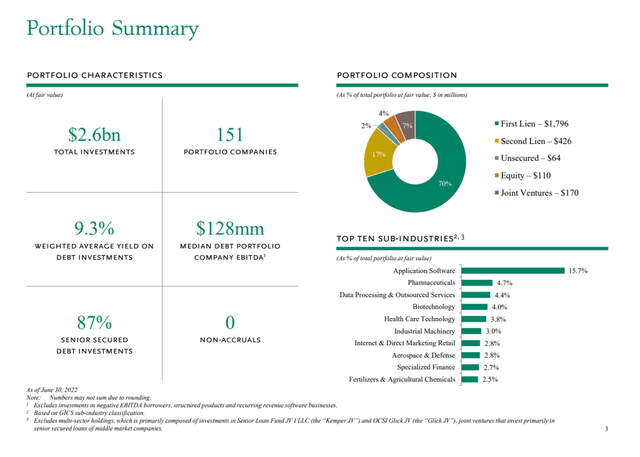

At the end of 3Q-22, Oaktree Specialty Lending had invested in $1.8 billion in first liens and $426 million in second liens, accounting for 87% of the BDC’s investments.

There have been no significant changes since the previous quarter. In the third quarter, unsecured investments, equity, and joint ventures accounted for $344 million, or 13% of the BDC’s total portfolio investments.

Portfolio Summary (Oaktree Specialty Lending)

Investors will be pleased to learn that the company kept its excellent 0% non-accrual ratio in 3Q-22. Non-accrual loans are those in which the borrower is under financial stress, making the collection of interest and repayment of principal at least somewhat doubtful.

As of June 30, 2022, Oaktree Specialty Lending had 0% non-accruals, which was unchanged from the previous quarter. The BDC’s portfolio remained valued at approximately $2.6 billion due to limited new investing activity.

Oaktree Specialty Lending’s Dividend Remained Covered With NII, 3% Dividend Raise

In 3Q-22, Oaktree Specialty Lending covered its dividend with net investment income, giving management the confidence to increase the dividend yet again.

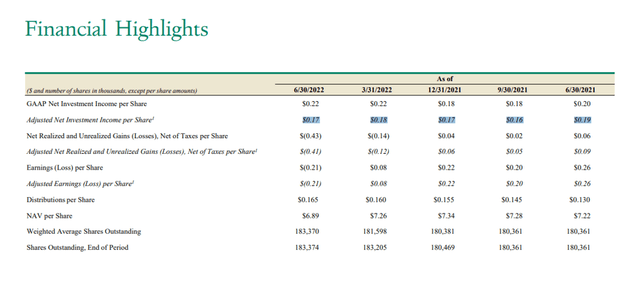

In the most recent quarter, the business development company earned $0.17 per share in adjusted net investment income, which was enough to cover Oaktree Specialty Lending’s $0.165 per share dividend payment.

In the previous year, the BDC earned $0.68 per share in adjusted net investment income and paid out $0.625 per share, implying a 92% NII-based pay-out ratio.

Financial Highlights (Oaktree Specialty Lending)

Due to excess dividend coverage, Oaktree Specialty Lending was able to increase its dividend payout by 3% to $0.17 per share. OCSL stock has a dividend yield of 9.5% based on the new dividend payment.

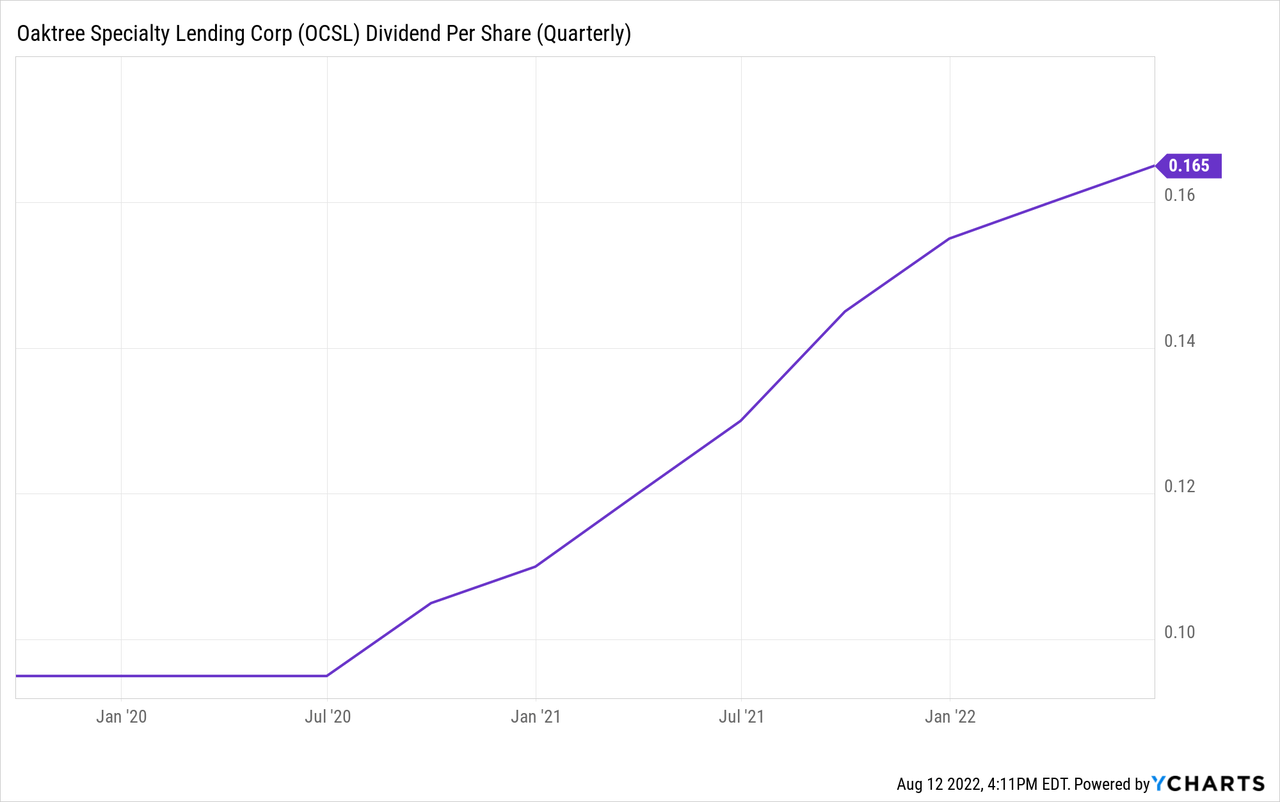

Oaktree Specialty Lending has one of the most impressive dividend growth records I’ve seen since the pandemic, which also distinguishes it from other BDCs. Oaktree Specialty Lending has increased its dividend pay-out nine times in a row since the start of Covid-19.

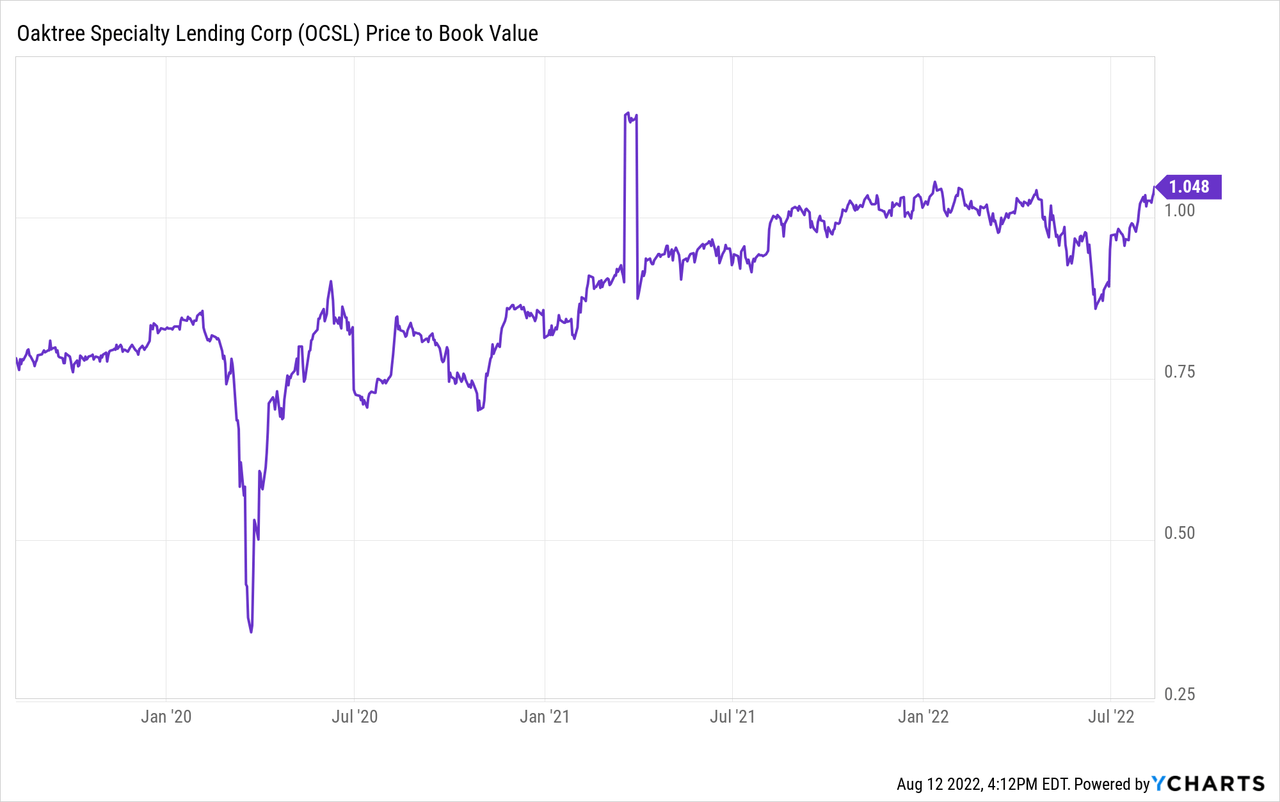

Trading Only At A Small Premium To Book Value

Given the BDC’s portfolio’s perfect credit quality, Oaktree Specialty Lending’s stock should trade at a higher premium to net asset value. Based on a 3Q-22 net asset value of $6.89 and a current stock price of $7.15, the current premium to net asset value is 4%.

Because of its 0% non-accrual ratio and first lien focus, Oaktree Specialty Lending could trade at a 10% to 15% premium to net asset value, implying a fair price target of $7.60-7.90 for OCSL. If OCSL rose to this level, I would consider selling.

Why Oaktree Specialty Lending Could See A Lower Stock Price

A recession could have a significant impact on the performance of Oaktree Specialty Lending’s credit portfolio. If more borrowers face financial difficulties and fall behind on making interest payments according to the agreed-upon payment schedule, the BDC’s non-accrual ratio may rise.

Given Oaktree Specialty Lending’s stellar track record, I believe the risk of a significant increase in non-accruals and potential book value losses is relatively low.

My Conclusion

The credit portfolio of Oaktree Specialty Lending remained in excellent shape in the last quarter, and the portfolio’s 0% non-accrual ratio speaks volumes about how well the company selects and manages its credit investments. In addition, the BDC continued to cover its dividend with adjusted net investment income and increased its dividend pay-out for the ninth time since 2020.

The fact that the stock is only trading at a small premium to net asset value is an added bonus. Given the quality of the investment portfolio, OCSL is one of the best business development companies out there, and the stock could justifiably trade at a higher premium to net asset value.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.