[ad_1]

Getty Images

Thesis

Morgan Stanley (NYSE:MS) is one of the best financial institutions in the world, with diversified strength on multiple verticals, including investment banking, global markets, asset management and wealth management. Moreover, the bank’s stock is also trading relatively cheap. Accordingly, I am bullish on Morgan Stanley stock. Based on a residual earnings valuation framework, I calculate a fair implied target price of $146.69/share (60% upside).

About Morgan Stanley

Morgan Stanley is arguably one of the world’s top 3 global financial institution, along with Goldman Sachs (GS) and JPMorgan (JPM). The bank employs about 60,000 people worldwide and has reputable strength in investment banking, global markets (securities sales & trading), wealth management, and asset management.

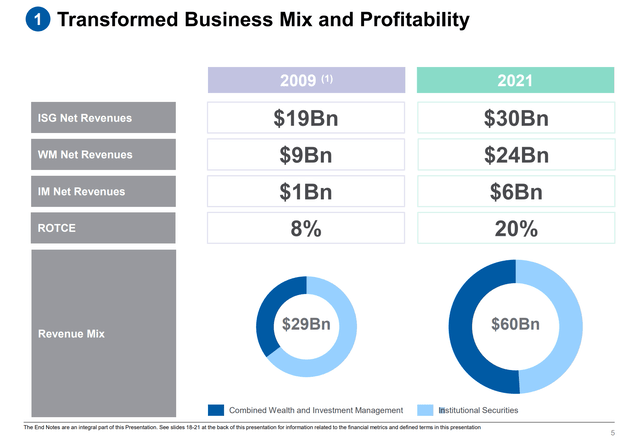

As of 2021, Morgan Stanley’s international securities division, which also includes investment banking, accounted for about 50% of the company’s total revenue exposure, wealth management accounted for about 40% and asset management for approximately 10%. From a geographical perspective, about 55% of total sales are generated in the Americas and about 23% in Asia and Europe.

Morgan Stanley Investor Presentation

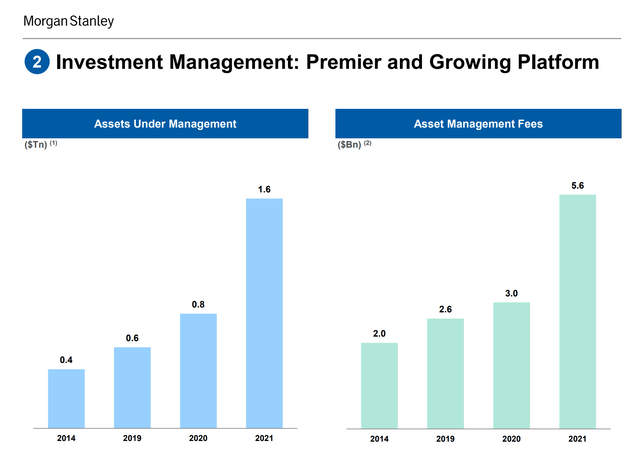

Ever since CEO James Gorman has taken over the lead at the bank, Morgan Stanley has boosted its Wealth and Asset Management businesses. Most notably, from 2014 to 2021 Morgan Stanley’s asset under management increased at 7-year CAGR of 21%, jumping from 400 billion to $1.6 trillion.

Morgan Stanley Investor Presentation

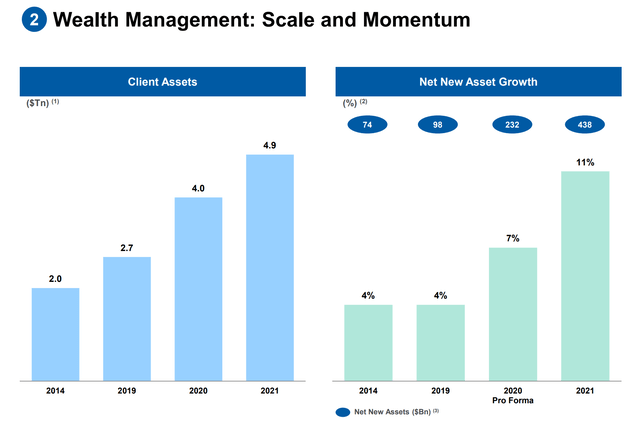

Respectively, client assets of the bank’s Wealth Management arm increased at a 13.5% CAGR, from $2 trillion to $4.9 trillion.

Morgan Stanley Investor Presentation

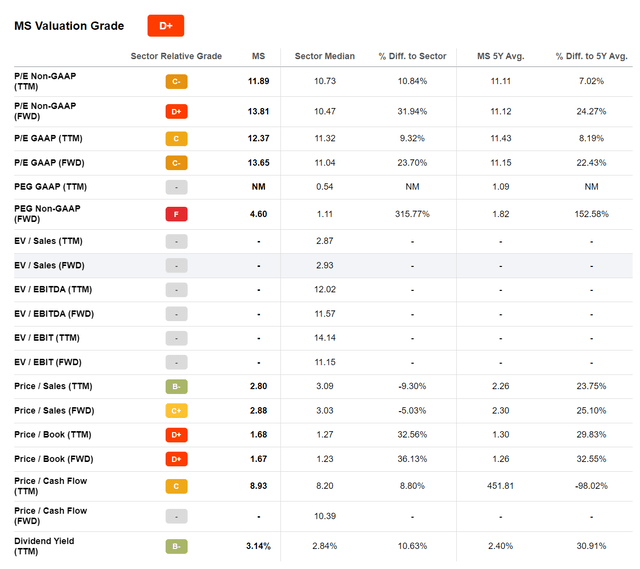

Valuation Lags Fundamentals

Morgan Stanley has a highly attractive financial profile. From 2014 to 2021 the banks revenues grew at a CAGR of more than 8%, from $40 billion to $59.8 billion. The company’s operating income grew at double this speed (16% CAGR): from $8.5 billion in 2014 to $23.5 billion in 2021.

Moreover, in 2022 Morgan Stanley has also proven that the company can deliver a strong performance when there is no ‘bull market’. In Q2 2022, Morgan Stanley generated total revenues of $13.1 billion (more/less in line with 2021), EPS of $1.39 and ROTCE of 13.8%.

I claim that Morgan Stanley’s valuation doesn’t match the bank’s fundamentals. Morgan Stanley is currently trading at a one-year forward P/E of x13.6 and a P/B of about x1.5. Arguably for any other industry than financials, when a company can grow at a similar pace like Morgan Stanley, be similarly capable of gaining market share, and be similarly profitably, the company’s stock would arguably trade at a x30 P/E.

Residual Earnings Valuation

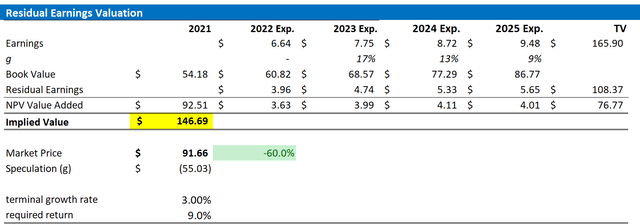

In my opinion, banks are prime candidates to be valued with a residual earnings (“RE”) valuation, given that the RE framework anchors on both the income statement and the balance sheet as well as accrual accounting. That said, I apply the following assumptions:

- To forecast EPS, I anchor on consensus analyst forecast as available on the Bloomberg Terminal ’till 2023. In my opinion, any estimate beyond 2023 is too speculative to include in a valuation framework – especially for banks.

- To estimate the cost of capital, I use the WACC framework. I model a three-year regression against the S&P 500 to find the stock’s beta. For the risk-free rate, I used the U.S. 10-year treasury yield as of August 12, 2022. My calculation indicates a fair required return of about 9%.

- To derive MS’s tax rate, I extrapolate the 3-year average effective tax-rate from 2019, 2020 and 2021.

- For the terminal growth rate, I apply 3% percentage points, approximately the nominal GDP growth, which I think is a fair assumption for a company that has a history of outperforming global GDP growth by x3.

Based on the above assumptions, my calculation returns a base-case target price for MS of $146.69/share, implying material upside of about 60%.

Analyst Consensus EPS; Author’s Calculations

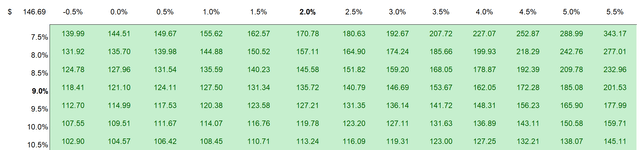

I understand that investors might have different assumptions with regards to MS’s required return and terminal business growth. Thus, I also enclose a sensitivity table to test varying assumptions. For reference, red-cells imply an overvaluation as compared to the current market price, and green-cells imply an undervaluation.

Analyst Consensus EPS; Author’s Calculations

Risks

While I believe that investments in banks are less risky than the market implies, the tail-risk exposure is still elevated and if materialized this might depreciate MS share-price significantly. For reference, take the great financial crisis as an example, which crippled many bank stocks including Morgan Stanley’s for multiple year. In any case, the latest FED stress test of the banking system concluded that Morgan Stanley has sufficient capital to absorb losses caused by a material shock to the banking system.

Conclusion

Without a doubt, Morgan Stanley is one of the best banks in the world. In the past few years, the company has delivered strong business growth and healthy profitability. Moreover, in 2022 Morgan Stanley has also proven that the company can maintain a strong performance even given a more challenging economic backdrop. Accordingly, I am confident to claim that Morgan Stanley’s x13.6 one-year forward PE points to an undervaluation. I argue MS should be worth $146.69/share.

My other articles about US banks:

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.