[ad_1]

Bear market rally or new bull, the 2022 summer rally looks

like its run it’s course. With the summer rally pushing DJIA up 13.5% from the

June low with S&P up 17.2% and NASDAQ up 23.3% here’s what we are looking

at.

This impressive comeback rally pushed through technical

resistance at the June highs. But our indicators and cycles analysis suggest another

leg down that culminates in a lower low or retest of the lows at some point in

the weak seasonal period August-October ahead of the midterm election.

Last week’s inflation numbers were certainly encouraging.

But we would like to see further confirmation before moving into the bullish

camp. We are bullish for Q4 and 2023 but remain vigilant about the potential

for another leg down that either tests the June lows or makes a new low.

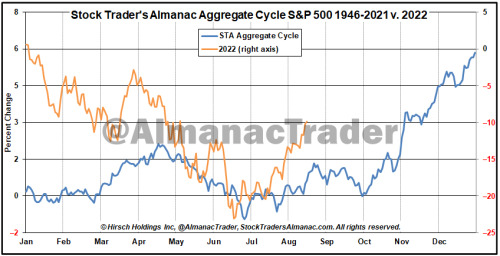

In preparation for the 2023 Stock Trader’s Almanac,

we developed this brand-new Stock Trader’s Almanac Aggregate Cycle index

(STAAC). STA Aggregate Cycle is a combination of the 1-Year Seasonal Pattern

for All Years, the 4-Year Presidential Election Cycle and the Decennial Cycle.

In the chart here STAAC is all years, midterm years and second years of decades

post-WWII from 1946-2021.

[ad_2]

Image and article originally from jeffhirsch.tumblr.com. Read the original article here.