[ad_1]

akinbostanci

Introduction

For retirement accounts, it is important to find stable, income-producing businesses. Insurance companies tend to be great providers of these features. The Progressive Corporation (NYSE:PGR) is an insurance business I have looked at before and has shown great operational results and growth to boot. Over the past five years, the company has seen net premiums grow at low double-digit rates, with net income following. The company has always had an underwriting profit with a combined ratio below 100%. But at 23.5x P/E, 3.78x P/BV, and an uncertain dividend yield, I think there are better income investment options.

Financial History

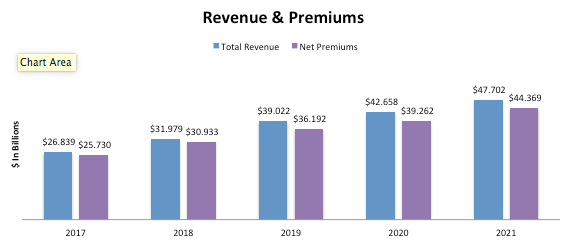

Progressive Revenue & Premiums (SEC.gov)

Progressive has seen steady growth in total revenue, powered by growing premiums. Total revenue over the last five years has grown at a rate of 12.19%. This is on the back of net premium growth of 11.51% per year. The other revenue contributors (investment income & realized gain or loss) vary each year depending on capital market sentiment. These two revenue sources are important, but are minuscule in comparison to premiums. That being said, the outcome of Progressive’s investment drastically affects earnings as there are few costs associated with this revenue.

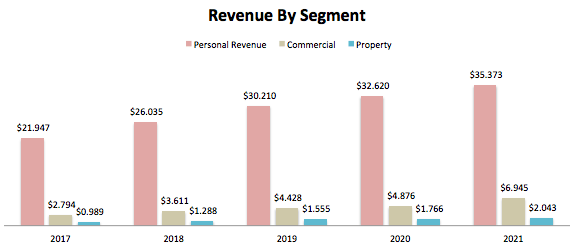

Progressive Revenue By Segment (SEC.gov)

But I digress, as the most important part of the business is generating customers and active policies. Looking above shows the segment breakdown of the business. Personal insurance is the largest segment making up 74% of total revenue. Personal insurance revenue has grown at a clip of 10% over the past five years. The Commercial and Property segments, while much smaller, have also grown at great rates of 19.97% and 15.62%, respectively. Overall, Progressive has posted a great growth story over the last half-decade.

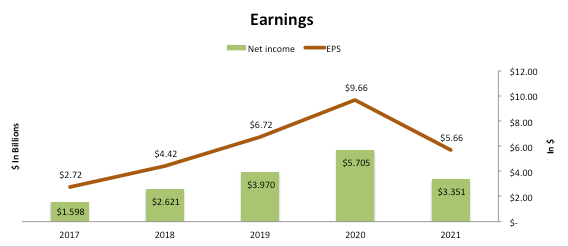

Progressive Net Income & EPS (SEC.gov)

But as mentioned before, the consistency of the top line doesn’t always translate downhill. Net income has seen more variability due to the results of underwriting and investments. Over the past five years, Progressive has seen some lackluster and superb investment results. For example, from 2017-2018, the company realized breakeven or losses on investments and had lower investment income. But in 2020, there was higher than normal investment income and realized gains. It all depends on the markets.

The other factor is underwriting, which has a more direct and influential impact on earnings. If the premiums are not underwritten at appropriate levels, claims will eat away that revenue.

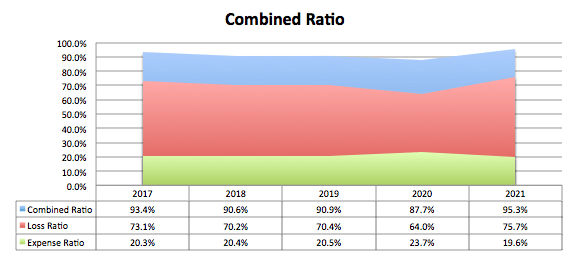

Progressive Combined Ratio (SEC.gov)

This is why it is important to look at the combined ratio. This ratio shows the percent of a dollar of premium that is spent on claims (losses) and expenses. A ratio below 100% means the business made money on the policies underwritten. Progressive has been very good at doing this, with the combined ratio below 100% every year for the past five. The reason 2020 saw such a boost in earnings was due to the lower loss ratio that year, as fewer people were driving during the pandemic.

But in 2021, the opposite was true, and the loss ratio jumped by 11.7%. Looking at catastrophe losses shows Hurricane Ida had an effect of 3% to the loss ratio, but the main cause was just a general increase in the movement of people after the pandemic. There was a 14% increase in auto accident frequency and a 9% increase in severity this year. To note is that Progressive has kept the expense ratio very steady, showing the company’s ability to control costs of marketing and customer acquisition. Taken altogether, the increase in the combined ratio is not what I want to see, but if it is sub-100 I am content with it.

This Year

Over the first quarter of 2022, Progressive has again struggled with the combined ratio and lower net income. While total revenue and net premiums grew by 3% and 13% each, net income declined by 79%. Part of the reason is that there was a realized loss of $445 million, but most of the issue was a combined ratio that increased 5.2% year-to-year. For the first quarter, the combined ratio was 94.5%, with a loss ratio of 75% and an expense ratio of 19.5%.

The loss ratio increased by 6.7%, while the expense ratio decreased by 1.5%. The gain in claim losses is attributable to changes in consumer habits after the pandemic and inflation. Catastrophe losses only attributed 1.2% to the combined ratio. Progressive has aimed for a combined ratio of 96% this year, which is still an underwriting profit. While I would like to see better margins, continued underwriting profits and solid premium growth are good.

Valuation & Dividend

Progressive Dividend & Payout Ratio (SEC.gov)

As of writing, Progressive trades around the $110 price level. At this price, the company trades at a forward P/E of 23.5x using the EPS estimate of $4.68. The company is also trading at a P/BV of 3.78x with a book value of $29.05. At these levels, it seems the insurer is a bit overvalued.

The company has been known to offer a nice dividend, but the way it is distributed is different. Progressive offers a 0.36% yield or 10 cents per quarter. But the company will usually add a substantially variable dividend at year-end. For example, in 2021, two variable dividends were paid out of $1.50 and $4.50, producing a fantastic yield. While this is great, it provides uncertainty to a dividend investment thesis for the stock. Taking this information as a whole, I do believe the stock is overvalued.

Conclusion

Progressive has been a very solid business over the last half-decade, with premium growth and consistently profitable underwriting. Each segment has seen growth in revenue along with either maintained or improving combined ratios. While the first quarter of 2022 is showing a less profitable year ahead, the company will be alright. While I like the business, I have a hard time paying 3.78x book value for an uncertain income yield.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.