[ad_1]

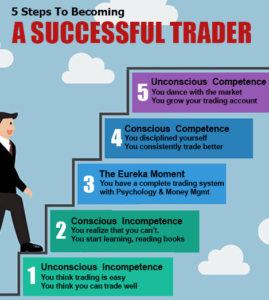

Wait a minute, Ray! You said “six” steps in the title; but, the picture says “five”. No mistake, there are six steps, but the last one is hidden. You have to read the end of the series to know it.

Let’s have a look at the first step: “unconscious incompetence”.

We all begin here. We have unrealistic expectations of what the market will give us and how easy it will be. If you are unlucky like me, your first trades will happen to hit a flow stage (where everything you do makes money!). My unrealistic expectations confirmed, I sold my legal practice and then proceeded to experience seven years of losses.

Why is it newbies come into this game thinking that they can make a mere 10% per month? Just today, I engaged in a series of WhatsApps with an acquaintance from Thailand.

“I want to set a target for my trading. Something like I want to get 10% a month for my trading in 2019.” He messages me.

“10% per month? I can’t help you. The best hedge fund, Renaissance Medallion, averages about 30% per annum. It’s the best in the world. Most good hedge funds will average 20% to 26% per annum.” I replied.

“30% per annum it’s great for me. Now for me, I cannot find entry for trading. I cannot see how market going on.…”

Amazing, he doesn’t have the basics – clearly does not have any sort of trading methodology and still believes he can emulate the best trader in the world!

Unfortunately, most newbies enter the world of trading with this mindset.

Anton Kreil has a 90-90-90 rule: 90% of newbies will lose 90% of the bank wrong within 90 days. I don’t know how accurate the stats are, but I would not be surprised if the rule turned out to be correct.

At this level, you either learn to move onto the next, or you blow out.

At Level 2, “conscious incompetence”, you realise you need help. You begin to read books and attend courses. Here you take one of two routes:

- You hold onto your unrealistic expectations seeking the Holy Grail. You are seeking to invest as little as possible in your education. You want a Harvard degree, but you want the degree at the price of a fourth-rate university.

- Alternatively, you dig deep and discover the reality for trading success. You direct your efforts in that direction. Despite your efforts, the probability is, in the beginning, you will focus on Method, and perhaps Money. Mind, you either dismiss or suppress and consider it irrelevant to your quest

Initially, you will continue to lose money. At some point, you will realise that a Harvard degree is unavailable at fourth rate prices. This is not an easy step.

Recently, I was reading a rant in one of the chat rooms. The writer was freely going to distribute the material that cost him USD 3000. To say he felt ripped off is putting it mildly.

Now, I know there are many charlatans in our game. But, we do have avenues for research, for example, the Forex Peace Army. Carry out your due diligence before parting with your hard-earned.

In any event, as I read the exchanges, it seemed like the aggrieved party was complaining that he couldn’t apply the material. It was not the Method did not have a positive expectancy.

Newbies need to know that there are methods out there that might not suit them but still have a positive expectancy. The reason for their inability to apply them is: the method does not suit the personality. Unless the trader comes to this realisation, he will eventually opt out of the game.

The newbie that took the other route, a deep dive into reality, comes out the other side at Level 3, “the Eureka Moment”.

You realise you need Method X Money X Mind.

Your research has lead you to a method that suits your personality. If you are a mechanical trader, you understand that you will suffer periods of consecutive sustained losses. If you are a discretionary rule-based trader, you have overcome the problem of complexity. You have created a set of rules that you can apply to your trading.

You have worked out the answers to the four Money questions:

- percentage of capital to risk per trade

- position sizing

- portfolio risk

- when to add profits to and deduct losses from your capital.

Finally, you have obtained insight into the probability mindset that is essential to trading success. You maintain both equity and psych journals because you know they are the foundation for your improvement. Yo are primed for success.

(More tomorrow)

[ad_2]

Image and article originally from www.tradingsuccess.com. Read the original article here.