[ad_1]

maybefalse/iStock Unreleased via Getty Images

By Alex Rosen

Strategy

The iShares MSCI All Country Asia ex-Japan ETF (NASDAQ:AAXJ) tracks an index composed of Asian equities, excluding Japan. The fund focuses on mid and large cap companies in Asia. The fund does not have a stated sector lean, but it is heavily invested in IT, Financials and Consumer Discretionary (e-commerce).

Proprietary ETF Grades

-

Offense/Defense: Offense

-

Segment: Non U.S. Equity

-

Sub-Segment: Asia

- Risk (vs. S&P 500): Average

Proprietary Technical Ratings*

-

Short-Term (next 3 months): B

-

Long-Term (next 12 months): A

* Our assessment of reward potential vs. risk taken

(Rating Scale: A=Excellent, B=Good, C=Fair D=Weak, F=Poor)

Holding Analysis

AAXJ is heavily weighted towards four countries/territories, with Hong Kong leading the way at 36%, followed by India at 17%, Taiwan at 16% and South Korea at 13%. From a sector standpoint, IT, Financials and E commerce lead the way, accounting for 54% of the fund’s total holdings. Officially, the fund is evenly divided between emerging and developed markets, but that is contingent upon what definition of emerging markets is used.

Individually, the largest holdings are Taiwan Semiconductor (TSM) at 6.5%, Tencent (OTCPK:TCEHY) at 5%, Samsung (OTCPK:SSNLF) at 4% and Alibaba (BABA) at 3.6%.

Strengths

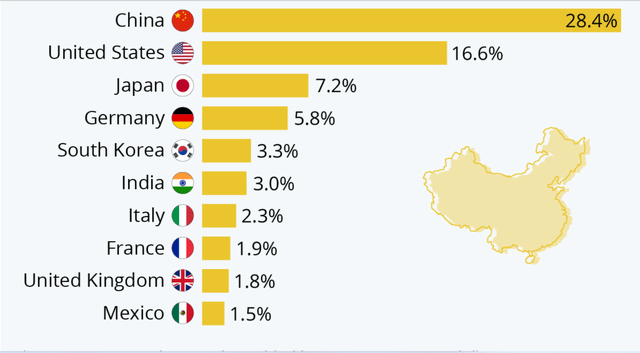

60% of the world lives in Asia. Four of the world’s top ten economies by total GDP are situated there, and four of the six largest manufacturing countries are there. In short, Asia is the economic engine of the world. Just looking at the AAXJ holdings list will show a who’s who of global companies.

Asia leads the way in manufacturing and it’s not close (World Economic Forum)

China and India have long been known to be the next superpowers. South Korea has quietly or not so quietly become an economic powerhouse with such companies as Samsung, LG, Kia, Hyundai (OTCPK:HYMLF), and SK being global market makers. Taiwan, despite its political status, has built a semiconductor shield around itself to protect from foreign intervention.

AAXJ excludes Japan. This is a good thing. Among the major economies of Asia, Japan is the one with the dimmest future. Japan’s aging society, high cost of living and restrictive immigration policies make it hard to see them sustain their position as a global economic leader.

Weaknesses

Even the most liberal of the Asian giants have highly restrictive policies that prevent transparency and truth in reporting. Hong Kong has gone through a series of political shakeups, and it remains to be seen how independent, if at all, they will be from the People’s Republic of China (PRC). Has anyone seen Jack Ma recently? Taiwan is in a similar situation to Hong Kong in that they live in the shadow of the PRC, wondering daily if they will suffer the same fate as Ukraine.

The South Korean Chaebols (South Korean Companies are run more like family fiefdoms than actual publicly traded companies and are called Chaebols, which in Korean means wealthy clan) are rife with scandals with more than half the leaders having been convicted of crimes from embezzling to fraud to racketeering.

At this rate, India looks like a golden boy, but it has its scandals and corruption, too.

Beyond the macro issues, AAXJ also has the issue of being an extremely broad fund holding over 1000 individual stocks, making it very unwieldy.

Opportunities

Asia is the land of opportunity. Rich with human capital, illiberal democracies dictating economic development, and abundant natural resources (except Japan), it is poised to be the global driver of the 21st century economy. Without firing a single shot, China has moved to challenge the U.S. for global superpower. China’s soft power extends across the entire planet and now beyond the planet. There is no question that Asia is either currently, or in the near future will be, the commercial center of the world.

Threats

Is Asia a house of cards? Is the growth and development all based on an unstable foundation? Will a flagrant disregard for human rights combined with global climate change and a lack of real innovation lead to a massive collapse in Asia? All of these are possible. For all of its economic might, Asia still significantly lags behind the U.S. and Europe in actual innovation. The U.S. has Amazon (AMZN), China built Alibaba, Apple (AAPL) = Samsung, Exxon Mobil (XOM) = Reliance [RELI]; the list goes on. Asian development is reliant on foreign innovation.

China’s centrally planned economy and threats of war with Taiwan leave investors wondering what the future really is. India, for all its potential, is still struggling to get on track, and South Korea shares a border with a country whose only claim to legitimacy is that it has nuclear weapons and keeps reminding the world it can use them.

Conclusions

ETF Quality Opinion

AAXJ has a very solid model. Invest in mid and large cap Asian companies excluding Japan. It’s a straightforward model with little regard for sector weighting. It’s a bet on Asia and the technical analysts like Asia. What’s not to like? It has all the ingredients necessary to succeed, and while it has suffered the same downturn the rest of the market saw in 2022, it has rebounded nicely with the reappointment of Xi Jinping as supreme leader of China.

ETF Investment Opinion

AAXJ has weathered the market downturn reasonably well and is poised to capture Asia’s rebound, especially if the rest of the world slides into a recession. As a result, we rate AAXJ a Hold, but that could very quickly become a buy if the conditions remain and tensions in Taiwan abate.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.