[ad_1]

Eoneren

Tax Loss Selling Strategy

This is the fourth entry in my tax loss selling basket. I explained portions of the rationale for the strategy in the previous three articles (here, here & here).

However for those who haven’t read the earlier articles, here’s a quick synopsis:

- Investors who have net realized capital gains in the year can offset these by selling losers before December 28th (there’s a two-day settlement period thus sales on the 29th or later will count for 2023).

- Stocks that are down on the year and preferably at multi-year lows are good candidates for such selling.

- Because of the year-end deadline, investors who sell can become quite indiscriminate and this can create quick price plunges.

- Wash sale rules mean any investor who might want to get back into these names after realizing losses must wait 30 days. For this reason I give the strategy through the middle of March to work, and no matter what the results, I sell the stock by that date. (If the stock bounces before then, I try to scale out of my position.)

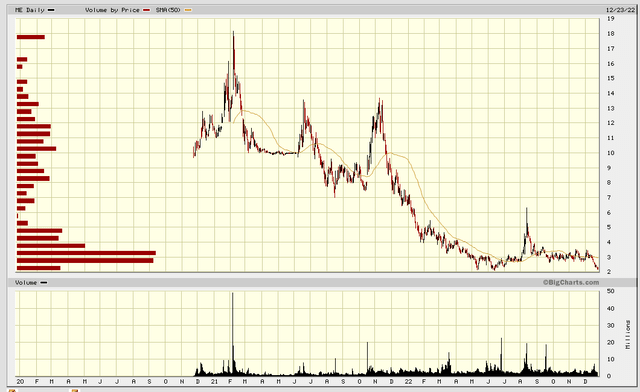

Today’s candidate, 23andMe (NASDAQ:ME), fits the stock price trading pattern to a tee. The chart since the company became public shows that any investor is holding at a loss:

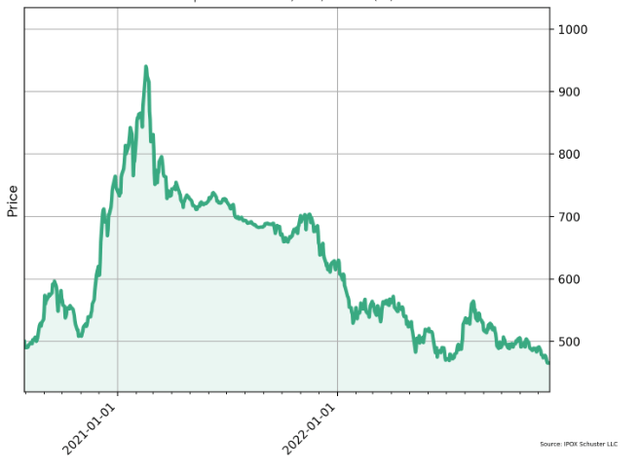

The reason for the stock dropping essentially since its IPO traces back to the market euphoria at the time of the initial public offering. In other words it’s not company specific, its reflective of general market action. For example, many SPAC’s have had similar performance as shown by the IPOX SPAC index:

Moreover, the exaggerated price drop in ME’s stock price over the past 6 or 7 trading sessions, without any negative news out on the company, suggests likely tax loss sellers. See six-month chart below.

23andMe

23andMe is a direct-to-consumer genetics information company which delivers personalized health data to individuals. It performs genome sequencing for individuals, and based on its crowd-sourced database, helps individuals identify possible health risks from their own genetic information.

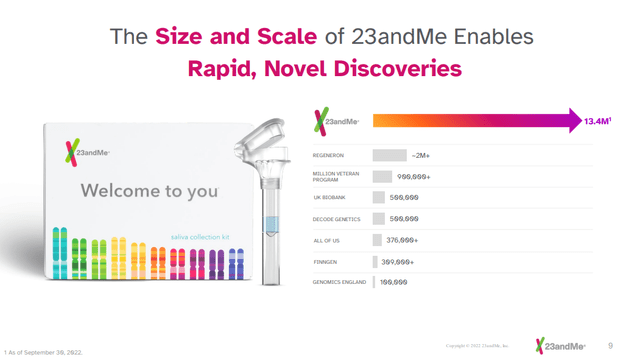

Individuals can opt into the crowd-sharing database, and by the company’s estimates, about 80% of people choose to do so. This means that ME has a larger database than most other genomics companies — a database that can be further monetized:

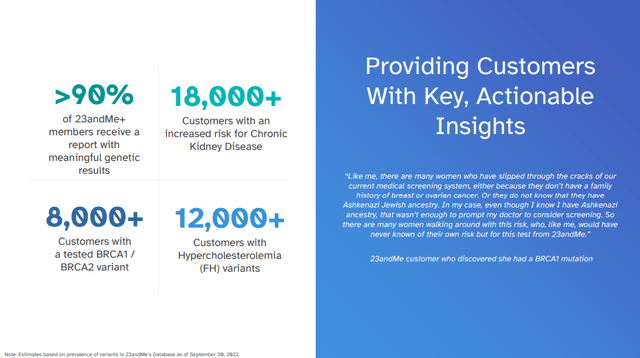

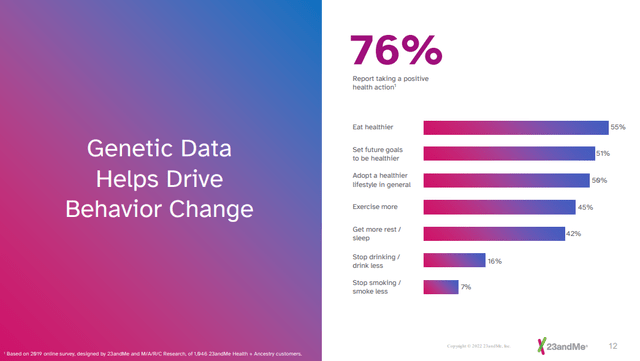

Most patients get actionable information from their tests:

And are able to make lifestyle changes according to the information they receive.

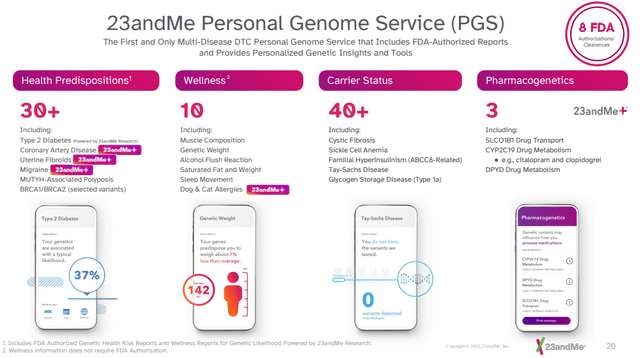

The core of ME’s platform is it testing and reporting. This includes 8 reports that are FDA authorized.

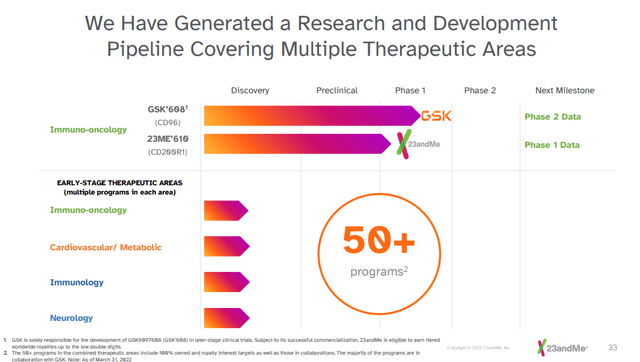

And the best way to leverage the large and growing database is to use the information to develop targeted therapies. ME already has two candidates in clinical studies; the most advanced is partnered with GSK. This area has the potential to exponentially grow ME’s longer-term revenues and thereby forms the heart of ME’s value proposition. But we’re early in the game here, so it will take time to learn how well the company can execute on this strategy.

Valuation

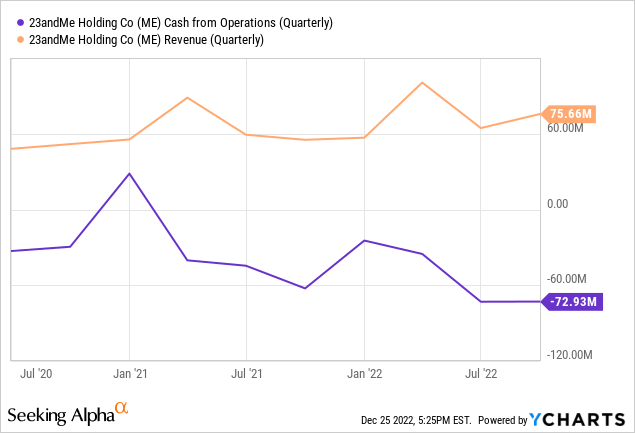

ME has been burning cash at a high rate (about $70M per quarter) without meaningfully increasing revenues.

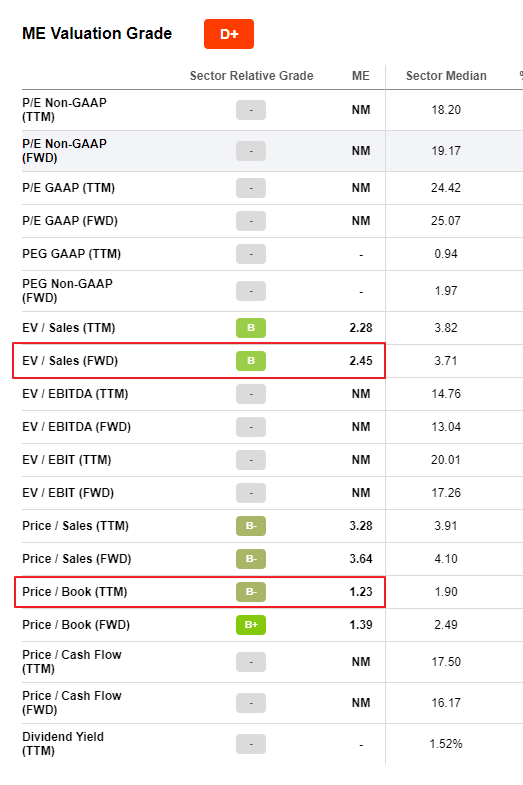

However, the stock is now so beaten down, that metrics like EV/Sales and price to book value have become somewhat attractive.

Seeking Alpha with author’s highlights

Cash Position

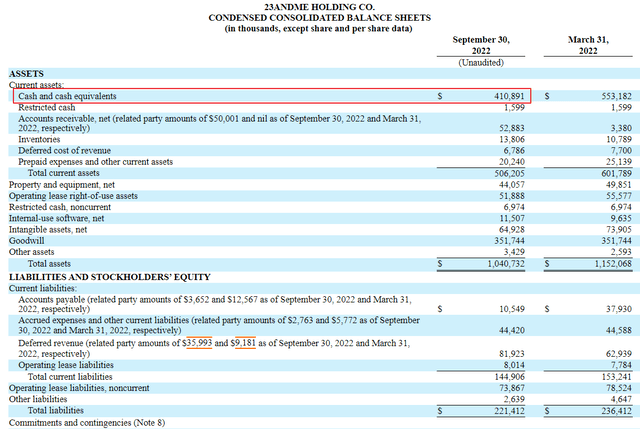

More importantly, given that in this strategy we’re only looking to hold the stock for a few months, ME has $410M in cash and cash equivalents on its balance sheet. This should be enough for almost six quarters of operation and thus should limit the risk of a forthcoming dilutive financing. Also, with 455M shares outstanding, this means the company has about $0.90 per share, so with the stock trading at $2.21 more than a third of that price is cash on hand. This provides some margin of safety in buying the stock at today’s prices.

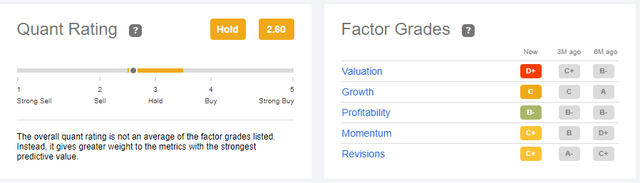

Quant Ratings

Seeking Alpha rates the stock a hold, with the worst factor grade for valuation and the best for profitability.

Risks

ME is burning cash quickly and hasn’t yet seen a meaningful trend of increasing revenues, so unless some of its other programs take off, or it is able to land partnership deals in the drug discovery space, long term it may not make it, or it may have to succumb to highly dilutive financings.

Shorter term however, this risk is somewhat mitigated by a healthy amount of cash on the balance sheet.

Trading Strategy

Given the precipitous drop in price over the past week, I’ve taken a full trading position in ME assuming that the selling is predominately driven by tax loss sellers. If the stock bounces as I anticipate, I will scale out of the position; and no matter what happens, I will be out by mid-March at the latest.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.