[ad_1]

Poulssen

After having analyzed NN Group NV (OTCPK:NNGPF), today we decide to follow up with Aegon (NYSE:AEG). In April 2022, in our initiation of coverage, we emphasized how:

NN was looking safer from a solvency ratio perspective, but from a shareholder remuneration policy perspective and considering long-term earnings power, Aegon is not only cheaper but more vigorous of a pick in this sector, and for that reason, it’s our Dutch insurance pick.

Source: Mare Evidence Lab’s previous publication

However, today, we believe that the above statement is reversed. On a potential capital appreciation, according to our internal estimates on a twelve-month basis, Aegon is safer from a solvency ratio perspective and has a 16% upside, while NN offers a 46% capital appreciation opportunity with a lower capital requirements. Here at the Lab, this year, we already covered the company twice:

- Aegon Will Again Outperform The Market – Q1 results comment

- Aegon: Looking Into Its Q2 Results

Our buy case recap was based on: 1) a portfolio reshaping which is still in progress (Aegon’s Turkish business unit was sold in 2022 as well as its Hungarian division), 2) a higher free cash flow generation that was over €2.0 billion until 2023, 3) ongoing debt reduction, 4) immaterial exposure to Russia and Ukraine, and more importantly, 5) the Wilton RE’s reinsurance deal, which was increasing Aegon profitability thanks to a better margin of safety on the United States mortality. Including dividends, the company is up by almost 7% since our second buy rating compared to an average S&P 500 return of 0.92%. However, we are still far away from our target price. Today, we would like to comment on the latest company development with our main key takeaways:

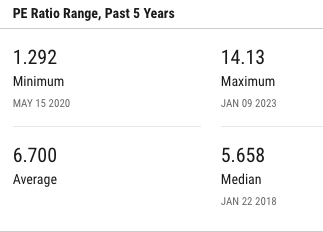

Related to our point 1), Aegon decided to merge its operations with ASR in a deal worth approximately €4.9 billion. This achievement will help to accelerate the company’s strategic transformation and will definitely unlock shareholders’ value. Speaking of numbers, ASR will acquire not only Aegon’s Dutch banking unit but also its insurance segment in exchange for €2.5 billion and 29.9% shares in the newly combined entity. Looking at the acquisition multiple, we can note that ASR valued Aegon’s business with an operating capital generation of almost €450 million for 2023 numbers and with a multiple (P/OCC) of 11x, while on a reverse basis, the estimated 2023 P/E was at almost 9x with a significant premium compared to Aegon’s P/E past 5 years average, which was standing at 6.7x.

Aegon’s P/E last 5Y

Source: YCharts

Regarding the cash proceeds, the company will reduce its leverage by €700 million and also intends to increase the shareholders’ remuneration policy. In detail, in 2023, the dividend per share will be reviewed upwards from €0.25 to €0.30 with an estimated forward dividend yield higher than 6% at the current stock price. According to our internal estimates, ASR will also raise its dividend per share by 12% to arrive at €2.7, and thanks to the synergies, the new combined company is forecasting a mid-to-high single-digit dividend growth until 2025. ASR Nederland N.V. (OTC:ASRRF, OTC:ARNNY) has a strong track record in delivering synergies, numbers in hand, the company has guided potential run rate savings per annum at an estimate of €185 million until 2025 to arrive at an OCC of €1.3 billion in that year. Here at the Lab, we believe that pre-tax synergies are a bit conservative; however, we prefer this cautious approach.

Aegon’s free cash flow reduction will be approximately €250 million per year and we are also including a one-off cost of €40 million in 2022 numbers; however, this will be partially offset by the ASR dividend, which will be approximately €160 million. There is a €90 million discrepancy but we should price in debt reduction and interest rate saving. We also need to factor in the fact that Aegon will receive €2.5 billion in cash, €700 million will be used to reduce the company’s €5.8 billion gross financial leverage and we estimated M&A optionality and a 2023 buyback announcement. The next catalyst might be the Extraordinary General Meeting scheduled for January 17th. For the above reasons, and considering also ASR valuation, we confirm our buy target price of €5.7 per share. The company will receive €2.5 billion in cash up front, which is more than 25% of the current market capitalization, 29.9% of a better combined entity, and will still have the possibility to strengthen Aegon Asset Management division, which will manage some ASR new funds.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.