[ad_1]

Buster Is Not Interested In Looking At AGNC’s Total Return

tverkhovinets/iStock via Getty Images

Over the last year, we have approached mortgage REIT trades with caution. It was our belief that the investing community had massively underestimated just how far the Federal Reserve would have to go to rein in inflation. With AGNC Investment Corp. (NASDAQ:AGNC) our strategy was to stay out, and herd the investing community towards its preferred shares. That has generally worked, as the preferred shares have delivered good income with far less volatility. One curious aspect here with AGNC has been the rather big difference between the headline “earnings” and the actual stock performance. We look at that today and provide some context for investors who are interested in this large yield.

Earnings?

It is not too uncommon these days to see REITs emphasizing non-GAAP numbers. After all, nobody uses earnings or EPS metrics for these. So when you see headlines like these, you assume that the $0.83 is the most relevant number.

Seeking Alpha

Now, there was no reporting issue here. AGNC actually does mention that same number in the actual linked press release and that is the same number that is used to compute EPS and P/E (highlighted on the right).

Which of course gets us to the question. How is AGNC going down when the massive 12% dividend is covered by more than 185%?

Q2-2022, The Actual Returns

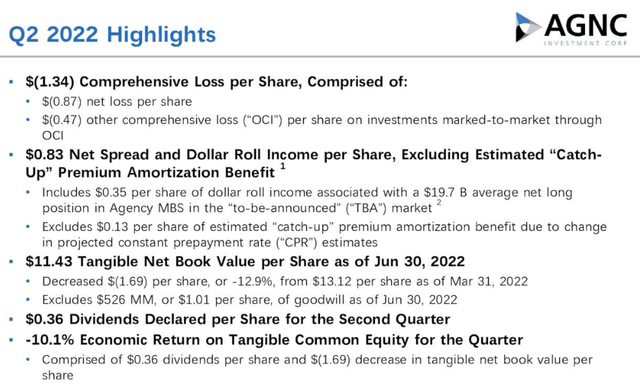

AGNC can help you understand that. Unlike the “I only want my dividends” crowd, the mortgage REIT itself is acutely aware of what returns are made up of. It presents both the comprehensive loss of ($1.34) and the total economic return of negative 10.1%.

AGNC Q2-2022 Presentation

AGNC’s net spread and dollar roll income, as impressive as it was, did not come close to offsetting the loss in tangible book value.

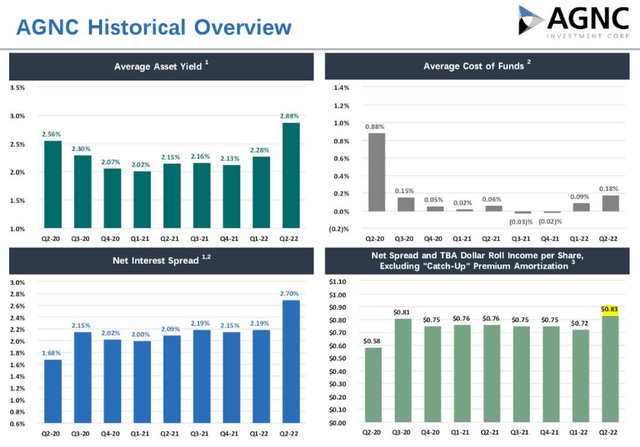

AGNC Q2-2022 Presentation

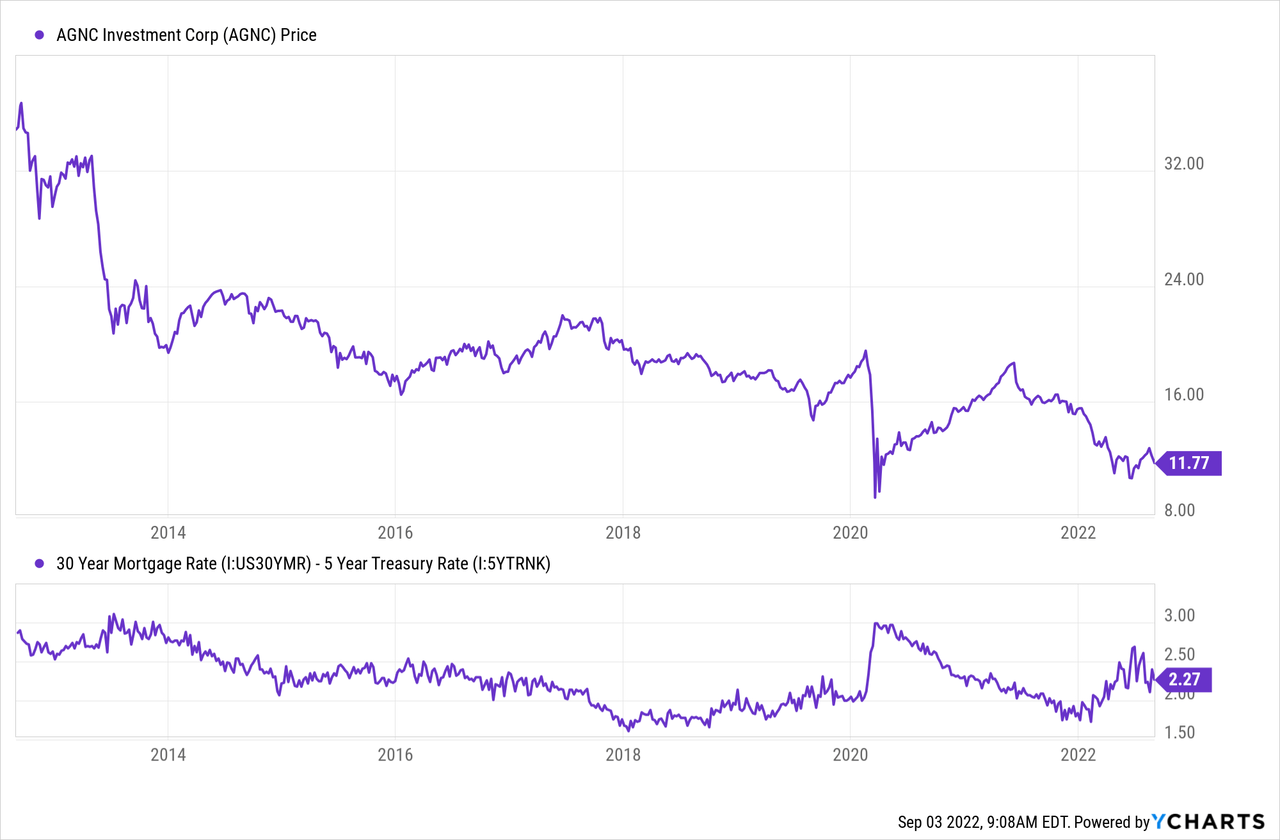

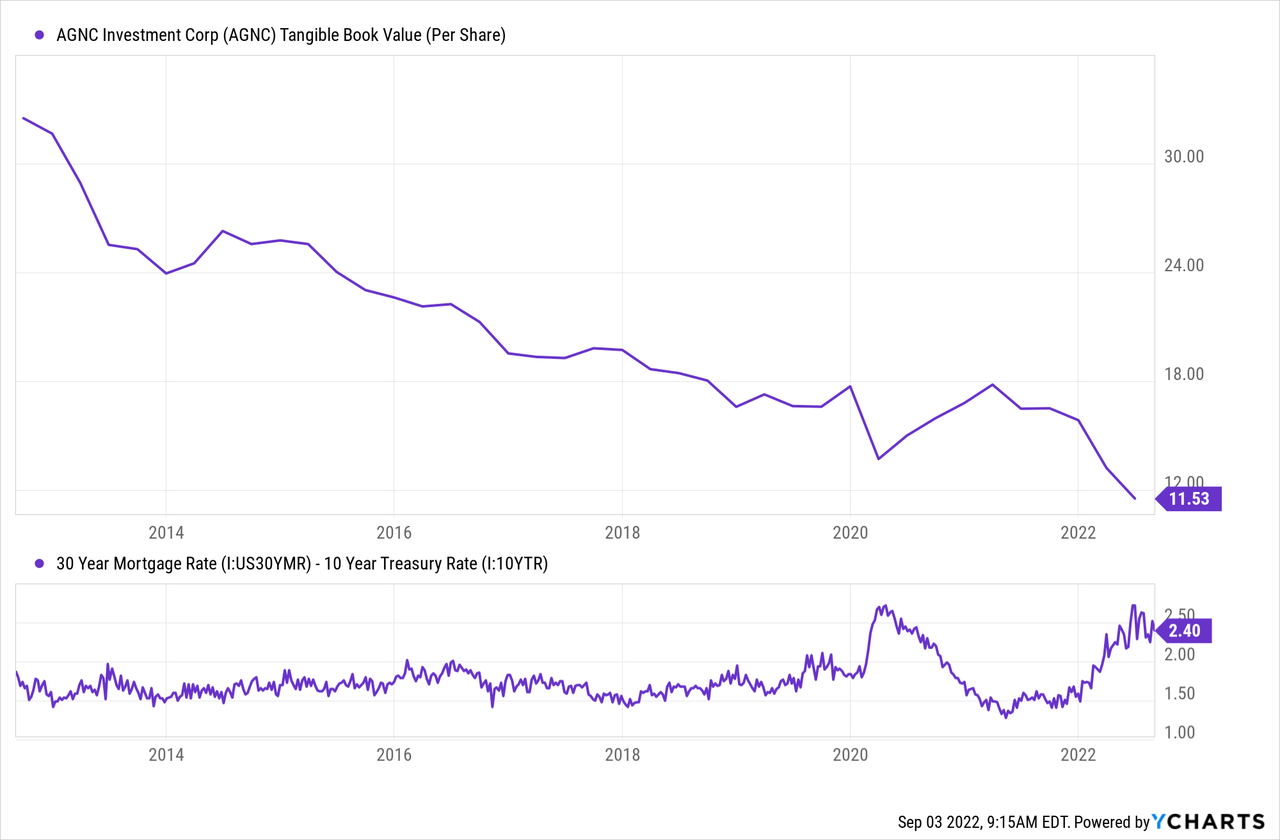

This is to be expected in an environment where mortgage backed securities or MBS, trade at widened spreads to Treasuries. Higher spreads equals more spread income and also more tangible book value destruction (outside of hedges). Mortgage REIT 101. What should be concerning for investors though is the permanent loss in value with each spike. Below we have plotted AGNC price and compared it to the 30 year mortgage rate-5 Year Treasury rate spread.

Now assume for a moment that you were not “all invested” here and were not burdened with sunk cost fallacy. What would you observe above?

Each Spike In The Spread Cause Permanent Destruction That Never Comes Back.

This is not the market just pricing things lower. AGNC’s tangible book has eroded pretty consistently and this tends to be faster during spread spikes.

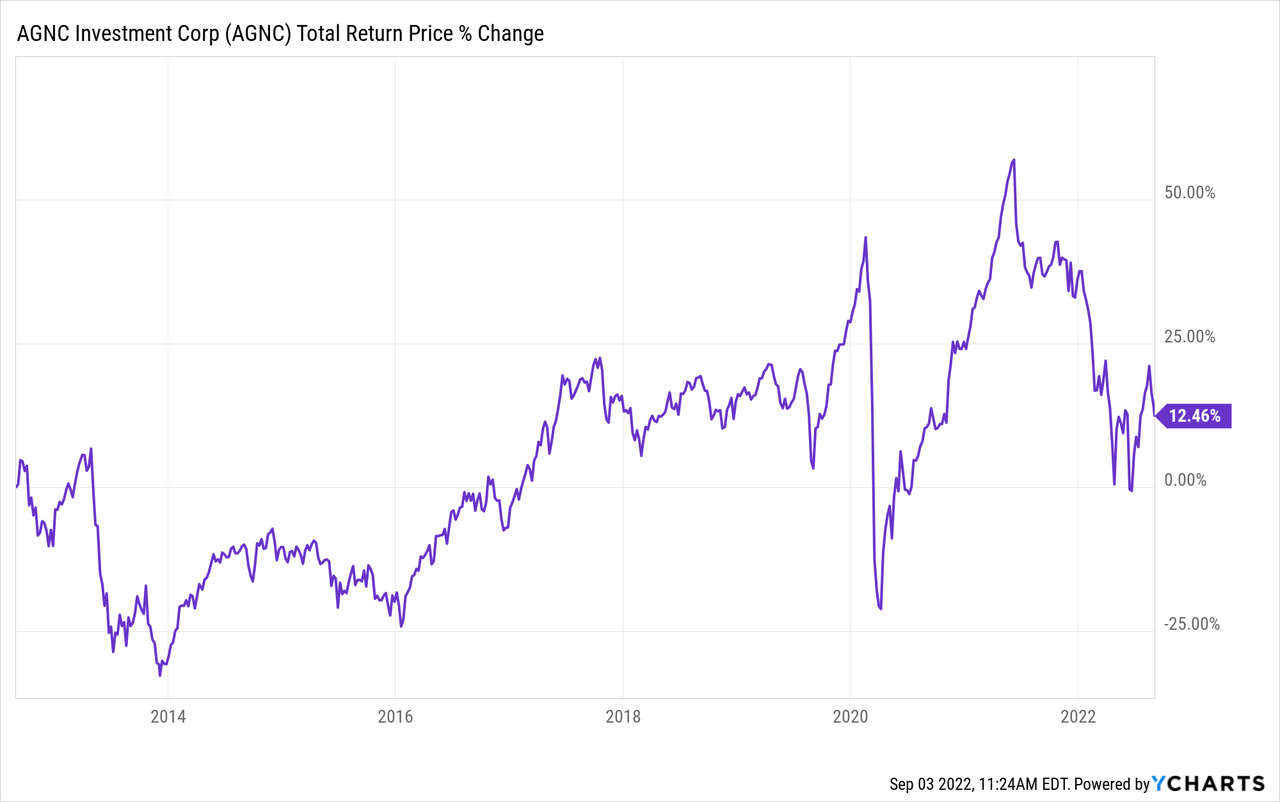

This is also why AGNC has delivered total returns over 12.42% over the last decade.

Outlook

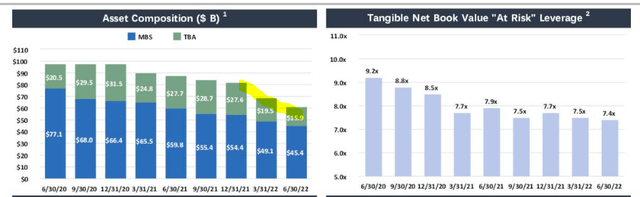

The billion dollar question here remains whether quantitative tightening has been priced in. Our belief is “no”. While one can argue that MBS rates are attractive, keep in mind that all income securities are becoming cheaper by the day. Cash parking funds which yielded almost 0% in 2021 are now setup to yield 4%. In that context MBS remain expensive relative to shorter duration securities. From a pure supply and demand point of view, supply from the Federal Reserve will be huge. We often get readers pointing out that the mortgage REITs will buy attractive spread securities. That statement flies in the face of what actually happens. Mortgage REITs deleverage and sell on the way down as that is the only way they can stay within their margin limits. AGNC sold off 25% of its assets in the last two quarters.

AGNC Q2-2022 Presentation

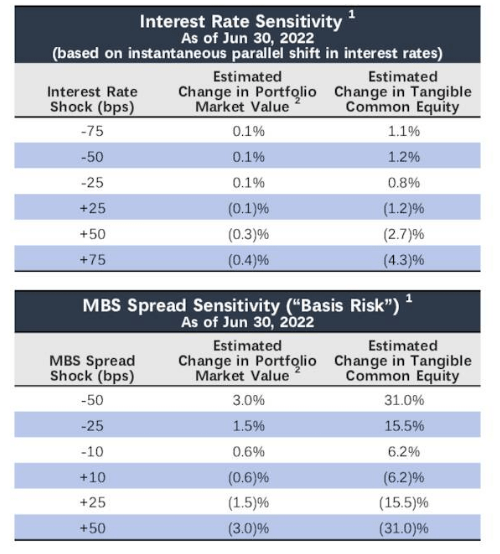

Had AGNC not sold, tangible net book value at risk would have spiked near 9.0X. Even now, MBS spread sensitivity is extremely high.

AGNC Q2-2022 Presentation

One key aspect that investors seem to not grasp is that AGNC cannot simply “hold on” if we get such a spike. They literally have to sell to protect their leverage ratios.

Verdict

We continue to rate the common shares of AGNC as a hold/neutral. The risks from a full spread blowout are not priced in and we would not be surprised to see further book value erosion into year-end. AGNC could also trade at a big discount to tangible book value and that could exacerbate losses for investors. As negative as our outlook may sound, keep in mind that AGNC is one of the best (third best in our opinion) mortgage REITs. So whatever happens here, your returns elsewhere will likely be worse.

If you like mortgage REITs, then your best risk-adjusted returns in AGNC may come via the preferred shares. We are updating our outlook here on the one we had stuck our neck out for.

AGNC 7.00% Series C Fix/Float Cumulative Redeemable Preferred (AGNCN) is the first one on our radar and will move to a floating yield very soon. The reset rate spread is strong and it starts floating in October 2022 at Libor +5.111%. Based on where the Fed Funds rate is headed, AGNCN may well yield over 8.75% by year end. When we covered it last, with the price on June 21 at $22.55, we actually put a Buy rating on this. However with the price appreciation, we are now back to Neutral/Hold on this.

While the rest of the AGNC preferred securities are safer than AGNC, we are actually avoiding all of them as they have actually become quite expensive compared to the fixed income picks we are finding these days.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.