[ad_1]

MarsBars

Everything is relative, especially when it comes to stocks. This brings me to Agree Realty (NYSE:ADC), which I continue to like. It has a solid track record and a seasoned management team. However, amidst so many other bargains on the market today, I highlight whether if the stock is a buy or hold, and what alternatives I find appealing, so let’s get started.

Why ADC?

Agree Realty is a net lease REIT that’s been around for over half a century. Today, along with well recognized retail-focused peers Realty Income Corp. (O) and National Retail Properties (NNN), ADC has become one of the premier net lease REITs, with a portfolio of 1,707 properties, located in 48 states covering 36 million in gross leasable area.

Notably, ADC has one of the highest exposure to investment grade tenants in the net lease space, with 68% of its ABR (annual base rent) derived from this group. It also has substantial exposure to ground leases, which comprise 13% of its ABR. Ground leases are generally regarded as being safer than building leases. 88% of ADC’s ground lease ABR stems from investment grade tenants, and it comes with a long-weighted average remaining lease term of 11.4 years.

Meanwhile, ADC continues to exhibit strong portfolio metrics, with a very high 99.7% leased rate and reasonably long weighted average remaining lease term of 9 years. Importantly, ADC is also growing its bottom line, with FFO per share growing by 5.6% YoY during the third quarter. It also appears that management isn’t finding a shortage of deals, recently acquiring 98 properties diversified across 21 sectors in 29 different states, at an attractive weighted average initial cap rate of 6.2%.

This sits comfortably above ADC’s cost of capital, as it was able to issue $300 million worth of public bonds in August at a 4.8% interest rate. Additionally, ADC is able to effectively use equity as a source of capital, as it was able to raise cash from equity sales at around a 5% FFO yield. Including outstanding forward equity offerings, ADC’s balance sheet is very strong at just 3.1x net debt to recurring EBITDA. Notably, ADC also has a very strong fixed charge coverage ratio of 5.0x.

Assuming that ADC deploys the $382 million worth of anticipated net proceeds from forward equity offerings, its net debt to EBITDA ratio would still be at a very safe 4.0x.

Management has proven adept on capitalizing off market turmoil, as it nearly doubled the size of the company since 2020. What also makes ADC unique is its development capabilities, which serves as a differentiator when there aren’t enough attractive deals. Management is guiding for $1.65 billion at the midpoint in acquisitions for the full year, and highlighted its development capabilities in the current macroeconomic environment during the recent conference call:

Moving on to our development and partner capital solution and platforms, our team continues to uncover compelling opportunities, helping to build the company’s largest ever development pipeline. Our platform is uniquely situated to provide struggling merchant developers with the ability to walk in funding, while providing us with additional opportunities to drive superior risk adjusted returns. We continue to have dialogue with many of our retail partners to find solutions that fit their store growth strategies.

Importantly, ADC is a consistent dividend payer, having raised its dividend by 5.7% since last year. The dividend is also safely covered by a 73% payout ratio. ADC has maintained an above average 5-year dividend CAGR of 6.9% and has 9 years of consecutive growth.

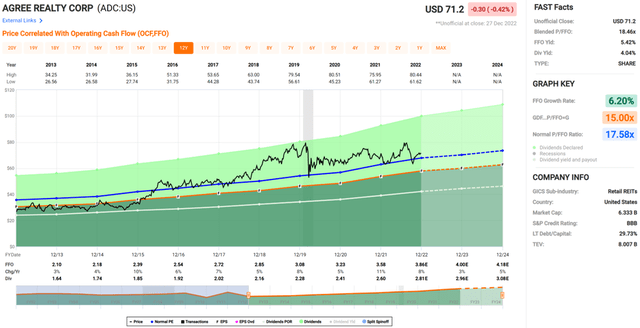

While ADC has a lot of things going for it, I don’t find its current price of $71 with forward P/FFO of 18.4 to be appealing. As shown below, ADC’s valuation currently sits above its normal P/FFO of 17.6 over the past decade.

Not only that, there are a number of cheaper qualitive alternatives on the market, with Realty Income Corp. trading at a P/FFO of 16.0, and fast-growing Essential Properties Trust (EPRT) trading hands at a P/FFO of 14.8. For those venturing outside of the net lease space, top 3 self-storage REIT CubeSmart (CUBE) just raised its dividend by 14% and trades at a P/FFO of 16.3.

Investor Takeaway

Agree Realty has a strong portfolio of ground and net leased assets. Its balance sheet is very healthy, and it has a long track record of dividend growth. Moreover, ADC’s management team has proven adept at capitalizing off market opportunities.

However, ADC’s current valuation appears to be too high relative to other high quality alternatives in the REIT space, and it’s worth waiting for a better entry point at or below the $65 range, which could come with market jitters during the anticipated rate hike at the next Fed meeting. As such, I view ADC as currently being a Hold.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.