[ad_1]

Trading in December is holiday-inspired and fueled by a

buying bias throughout the month. However, the first part of the month tends to

be weaker as tax-loss selling and yearend portfolio restructuring begins.

December is the number three S&P 500 and Dow Jones

Industrials month since 1950, averaging gains of 1.5% and 1.6% respectively.

It’s the second-best Russell 2000 (1979) month and fourth best for NASDAQ

(1971). It is also the third best month for Russell 1000 (1979).

In 2018, DJIA suffered its worst December performance since

1931 and its fourth worst December going all the way back to 1901. However, the

market rarely falls precipitously in December and a repeat of 2018 does not

seem highly likely this year.

When December is down it is usually a turning point in the

market—near a top or bottom. If the market has experienced fantastic gains

leading up to December, stocks can pullback in the first half of the month.

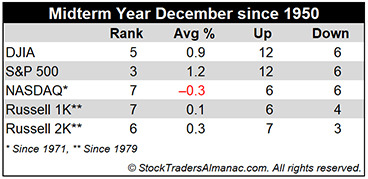

In the last eighteen midterm years, December’s rankings slip

modestly to #5 DJIA (0.9%), #3 S&P 500 (1.2%) and #7 NASDAQ (–0.3% since

1974). Small caps, measured by the Russell 2000, also tend to soften in midterm

Decembers. Since 1982, the Russell 2000 has lost ground just three times in ten

midterm years in December. The average small cap gain in all ten years is 0.3%.

Midterm December performance had been stronger prior to previously mentioned

December 2018.

[ad_2]

Image and article originally from jeffhirsch.tumblr.com. Read the original article here.