[ad_1]

Early July strength arrived on cue. Stock rallied smartly

off the June lows until bumping into resistance today near the 50 DMAs and

recently broken support levels around S&P 3900. NASDAQ led the charge up

9.3% since the June 16 low through the close on Friday, July 8.

We have been honoring our stops all year long sidestepping

much of the carnage, which has put the majority of our portfolio in cash. We

are in no rush to jump back in. Our indicators are still flashing caution signs.

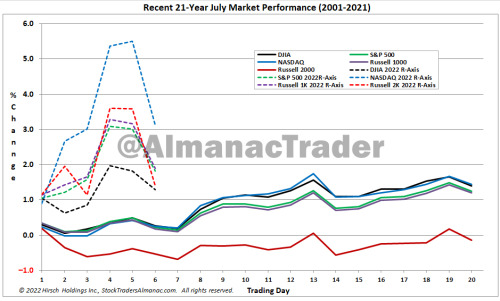

Seasonally we are in the worst months of the year and July is

weaker in midterm years. Fundamentals are shaky, Atlanta Fed’s GDPNow latest Q2

estimate is -1.2%. Technically this looks like an oversold bounce with old

support levels transformed into resistance and pre-pandemic levels in play. Inflation

is still surging, and the Fed is still hiking. Consumer sentiment and market sentiment

are still trending lower.

Our outlook is for continued weakness, volatility and likely

lower lows. Cash is our main position for now. You don’t have to always be buying

or selling positions. Cash gives you time to think. But we expect the Fed to be

wrapping up this aggressive tightening cycle in September ahead of the midterms

right on time for the midterm bottom and the “Sweet Spot” of the 4-year cycle.

So be sure to tune in tomorrow for my deep dive into summer

seasonals in search of the midterm bottom. https://online.moneyshow.com/2022/july/accredited-virtual-expo/speakers/ed8d429050d5486abc818182ac141048/jeffrey-hirsch/?scode=057060

[ad_2]

Image and article originally from jeffhirsch.tumblr.com. Read the original article here.