[ad_1]

Even though S&P 500 finished today with a fractional decline, our First Five Day (FFD) early warning system is positive. Over the first five trading days, S&P 500 gained 1.4%. In pre-presidential-election years, such as this year, our FFD has a respectable record with 13 full years following its direction in the last 18 years.

Last week our Santa Claus Rally was also positive, and with today’s positive FFD reading there are two possible outcomes remaining for our January Indicator Trifecta. Our January Barometer can either be positive or negative.

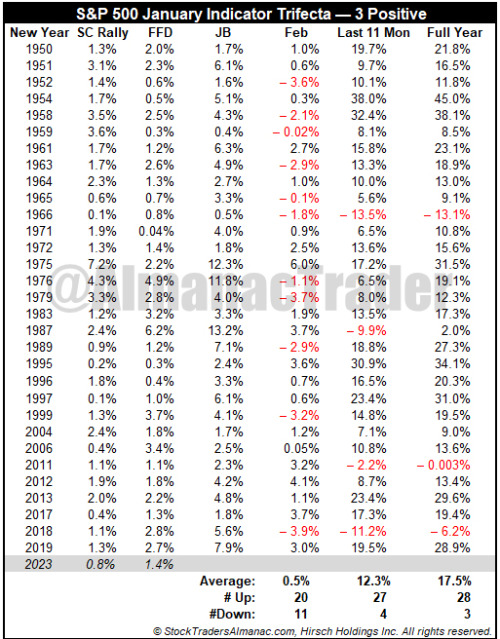

As depicted in the table above a positive January Barometer would further boost prospects for the last 11 months and the full year. When all three indicators were positive the next eleven months have been up 87.1% of the time with an average gain of 12.3% and the full year was positive 28 of 31 times (90.3% of the time) with an average gain of 17.5% in all years.

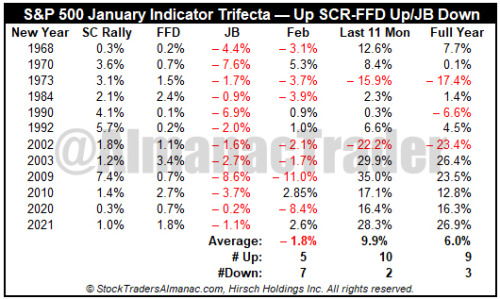

Following the previous twelve occurrences when the SCR and FFD were positive, and our January Barometer was negative S&P 500 advanced ten times over the remaining eleven months and nine times for the full year with average gains of 9.9% and 6.0% respectively.

The December Low Indicator (2023 STA, page 36) should also be watched with the line in the sand at the Dow’s December Closing Low of 32757.54 on 12/19/2022.

At this juncture our outlook for 2023 remains unchanged from our annual forecast. We do acknowledge the numerous headwinds that the market is currently facing, but we still contend that the market will continue to climb the proverbial “wall of worry” with choppy trading likely to persist until typical, pre-election year seasonal forces kick in later this year most likely after the Fed signals it will end increasing rates. This could happen as soon as their next meeting at the end of this month, but it may not happen until the Fed meets in March.

[ad_2]

Image and article originally from jeffhirsch.tumblr.com. Read the original article here.