[ad_1]

Tom Cooper

Back in early August, I warned investors that major dilution was likely coming for shareholders of AMC Entertainment (NYSE:AMC). The theater chain saw its balance sheet weaken further in Q2, with management unveiling a unique preferred stock dividend in an effort to improve sentiment. So far, the split into two trading classes has not gone well, meaning the potential dilution on one side could be very painful if the current trend continues.

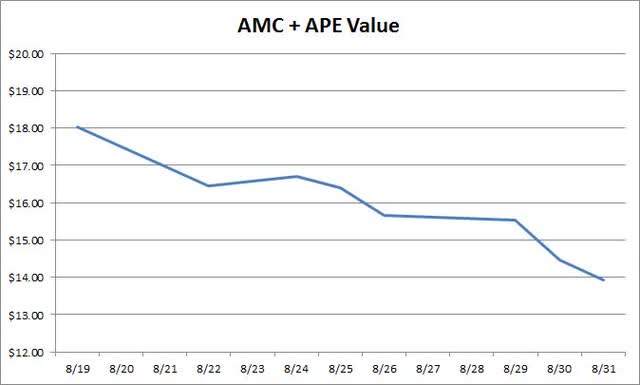

Aug. 19 was the last day when AMC shares traded as a singular ticker, closing at $18.02, as the AMC Preferred (APE) ticker started trading the following Monday. Since then, anyone holding has lost more than 22%, as the two combined tickers now fetch you less than $14 in total. As the chart below shows, we’ve seen a steady net decline that’s getting worse by the day now.

Combined Value of AMC + APE (Yahoo! Finance)

For those who were a little shaky on the situation here, AMC has a little under 517 million shares outstanding. However, the company has brushed up against its authorized limit for shares, so it can’t issue more shares to raise needed capital without getting shareholder approval. Last year, shareholders said no after they had already been diluted several times over since the pandemic started. This massive dilution saved AMC from going bankrupt.

AMC has an authorization in place for 50 million shares in preferred stock. The APE ticker represents a unit that equals 1/100th of a share, which means in total 5 billion units can eventually be authorized. Currently, there are 1 billion preferred units authorized, meaning 4 billion more would need to be eventually authorized by the board before they could be utilized. In the company’s FAQ document about the split, management said the board has no plans current to authorize the remaining 4 billion this year or next, but plans could change.

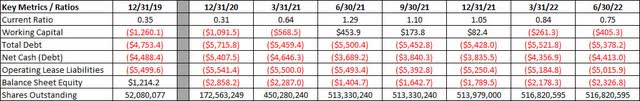

Shareholders of AMC received one preferred APE unit last week for each AMC share they owned, meaning there are about 517 million APE units outstanding. That means that AMC could theoretically sell another roughly 483 million units to raise capital without the board needing to authorize more units. As I detailed previously, the company’s balance sheet has continued to weaken, seen in the graphic below, so selling units might be a good idea. Dollar values below are in millions.

Key Financial Metrics (Company Filings)

Overall, the balance sheet is in its worst shape since Q1 2021, especially with working capital now being more than $405 million in the red and balance sheet equity at its most negative point since the end of 2020. Management previously talked about more cash burn coming in Q3 due to seasonality and some other factors, so the balance sheet is likely to look even worse at the end of September holding all else equal.

If we look at current box office numbers, Q3 domestic grosses are up almost 20% sequentially from Q2 levels through the first two months of the quarter. On a dollar basis, that represents about a $260 million increase. However, the domestic number was up almost $550 million after July. September is not expected to be a very strong month, and in June the domestic gross was almost $970 million. If current trends continue, we could see total AMC revenues decline by around $200 million sequentially. That would likely mean more net losses, which is why management has talked about potential cash burn in Q3.

The problem for AMC is that every decline in APE makes potential dilution even more significant. When APE rallied to a high of $10.50, AMC could have raised about $5 billion by selling those remaining 483 million authorized units. With APE now trading under $5, you’re probably looking at around $2.3 billion after fees. Don’t forget, management hasn’t announced its plan to sell more units yet, so if this ticker plunges when the news comes out, the potential raise could be well less if units fall to say $4 or even lower. With AMC having over $5 billion in net debt, APE holders will likely be dramatically diluted to fix the balance sheet unless the business shows significant improvement in the coming years.

In the end, it’s been a terrible start at AMC for its APE preferred units. Both tickers have fallen since the dividend went into effect, and investors of the preferred haven’t even faced any dilution yet. With a terrible balance sheet and more cash burn forecast for Q3, those holding the APE preferred are likely looking at more significant losses coming.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.