[ad_1]

Justin Paget

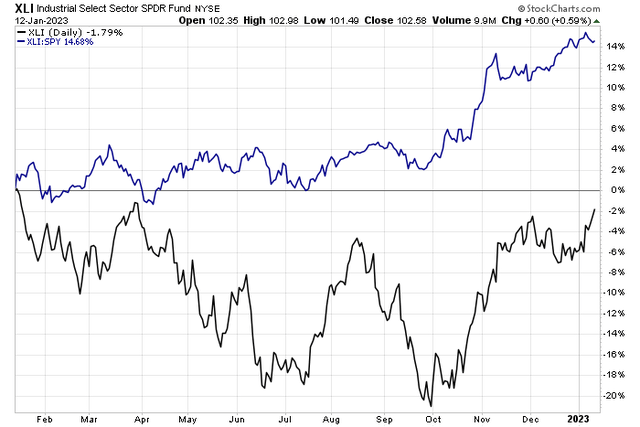

The Industrials sector ETF (XLI) continues to march higher. On a relative basis to the S&P 500, the ETF is up more than 14ppt in the last year. The absolute total return chart shows XLI nearing the unchanged mark after being down more than 20% from early January last year through the end of September. Is that a harbinger of the U.S. skirting a recession? That remains to be seen, but it’s definitely a chart the bulls like.

One stock is not quite as bullish, but are shares of Ameresco (NYSE:AMRC) a buy here after a big 2022 pullback? Let’s dig into this construction name.

Industrials Near 52-Week Highs

According to Bank of America Global Research, Ameresco is a U.S.-based provider of energy efficiency, infrastructure upgrades, energy security/resilience, and renewable energy solutions in North America and Europe. The company was founded in 2000 and is based in Framingham, MA, with operations principally in the U.S. (92% of ’20 revs), Canada (4% of revs), and the U.K. Operations include energy efficiency project installation plus LT O&M contracts as well as ownership and operation of renewable assets (solar, RNG, LFG, storage).

The Massachusetts-based $3.1 billion market cap Construction & Engineering industry company within the Industrials sector trades at a high 30.4 trailing 12-month GAAP price-to-earnings ratio and does not pay a dividend, according to The Wall Street Journal.

Back in November, Ameresco reported an earnings miss while topping revenue expectations. The stock traded higher in the days following that news as the firm reported upbeat guidance above the consensus forecast. The company has also been in investment mode with a recent acquisition of a 5MW wind farm in Ireland. Growth in energy assets could support further earnings upside, but risks stem from construction delays and a concentration of revenue generation sources.

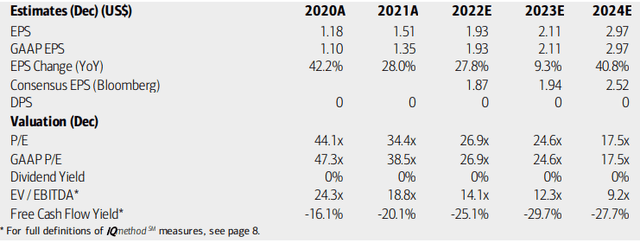

On valuation, analysts at BofA are bullish on the stock as the research firm views AMRC as underappreciated. As for earnings, BofA expects robust 28% 2022 EPS growth before a more moderate 9.3% advance rate this year. Per-share profits are then seen as surging another 41% in 2024. With heavy capex and negative free cash flow, there’s no dividend with AMRC, however.

BofA has a poor D valuation rating, but I notice that its forward operating PEG ratio is below the sector median at just 1.22. With a high price-to-sales ratio, though, it is not a cheap stock.

Ameresco: Earnings, Valuation, Free Cash Flow Forecasts

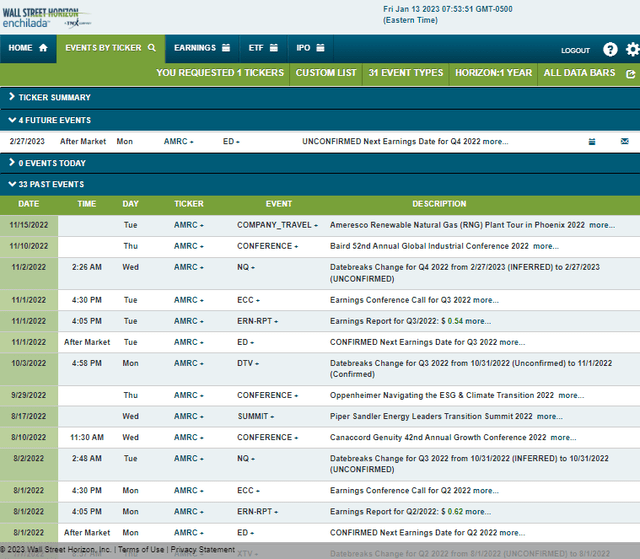

Looking ahead, corporate event data from Wall Street Horizon show an unconfirmed Q4 2022 earnings date of Monday, February 27 AMC. The calendar is light on volatility catalysts outside of the reporting date.

Corporate Event Calendar

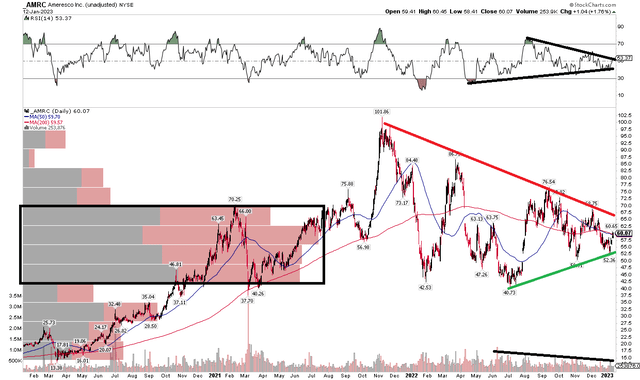

The Technical Take

With a valuation premium to its peers, what does the chart say? Notice in the graph below that AMRC is consolidating in a symmetrical triangle off its all-time high notched in November 2021 and after hitting a pullback low just above $40 this past July. I want to see how this consolidation plays out before getting long or short from a technical perspective. Also, take a look at the consolidation as well in the RSI momentum indicator at the top of the chart – a breakout or breakdown in momentum could be a harbinger of what future price action will be.

Also, there’s a heavy amount of volume by price in the $40 to $70 range, which suggests shares could be stuck here for a bit, but a move above $70 would be bullish while a drop under $40 could lead to a swift move down. Finally, volume is on the decline during this coil, which is to be expected – again, keep an eye out if big volume comes in on a significant price change. Overall, it is a holding pattern, and watch for a move out from this triangle.

AMRC: Consolidation, Waiting For The Big Move

The Bottom Line

I am a hold on AMRC as the valuation is high, but investors also earn solid EPS growth. The chart, meanwhile, is simply in consolidation mode as we wait for a bullish breakout or bearish breakdown.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.