[ad_1]

courtneyk

Decent jobs gain, but fall in temporary help employment hints at a turn

The US economy added 223k jobs in December, a little above the 203k consensus, but there was a net 28k of downward revisions to the past two months, meaning we are broadly in line with what was anticipated. The details show the jobs growth was led by the service sector, with education and health gaining 78k, leisure/hospitality 67k and trade and transport gaining 27k. Meanwhile, construction saw employment rise 28k with manufacturing up 8k.

However, we are starting to see falls in some key areas, most notably temporary help, which posted the fifth consecutive monthly fall. This is an important signal as these workers are always the first to be fired in a downturn (as they are the easiest to fire) and are likely to indicate broadening weakness in coming months. Business services fell for the second consecutive month while information services also saw employment fall.

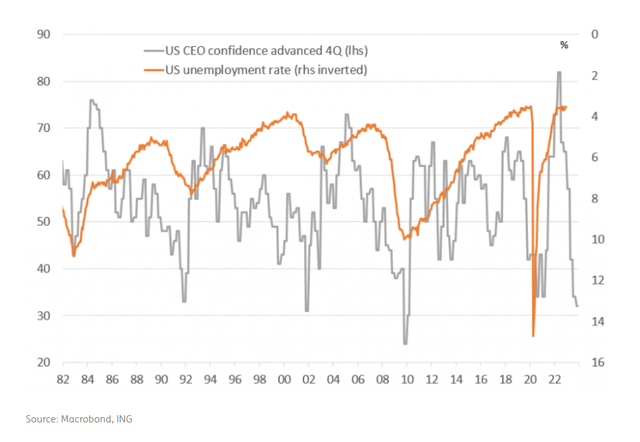

US unemployment and CEO confidence – more pain ahead

Unemployment indicates strength, wages… less so…

Elsewhere, we have had quite a lot of revisions within the household survey, which is used to calculate the unemployment rate. It is now reported at 3.5% versus the 3.7% consensus. This is down from a downwardly revised 3.6% in November (initially reported as 3.7%). While a great number, remember that the low unemployment rate masks the fact that more that a third of the working age population are not engaged at all (participation rate is just 62.3%).

Then there are the wage numbers. Again there are major revisions, but this time they make the situation look a lot weaker. The annual rate of wage inflation (average hourly earnings) is now ‘just’ 4.6% whereas, the market had been looking for 5%. Last month’s 0.6% month-on-month initial print has been revised down to 0.4% while December’s MoM rate came in at 0.3% versus 0.4% expected. So we have a weaker trend materialising it seems.

Fed focus moves to next week’s CPI

As such, the report is a fairly mixed bag. Payrolls are broadly in line with expectations, the unemployment rate indicates strength, but wages indicate softening inflationary pressures. Consequently, the focus switches to next Thursday’s CPI report. Markets are currently split between whether the Fed will raise rates by 25bp or 50bp at the February Federal Open Market Committee meeting. Given the softer wage situation, if we get another softish core CPI print (0.3% MoM or below) the case for a 25bp hike at the February FOMC versus 50bp is likely to build.

More pain ahead for the jobs market

That’s the near-term story. Looking further ahead, we have to remember that labour data is a lagging indicator – the last thing to turn in a cycle. What we should be focusing on is the economic outlook and that is deteriorating as the Federal Reserve continues to hike interest rates in its battle with inflation. This week’s ISM report showed manufacturing orders contracting for four consecutive months while the Conference Board reports that CEO confidence is at its weakest since the Global Financial Crisis – even weaker than at the worst point in the pandemic. This suggests that businesses will increasingly adopt a defensive stance, which implies a greater focus on costs, including labour. So far, the job loss announcements have been concentrated in the tech sector and, more under the radar, the temporary help sector, but we expect that to change over the next twelve months.

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.