[ad_1]

Sergei Dubrovskii/E+ via Getty Images

With weaker prices for natural gas and NGLs, my free cash flow projections for Antero Resources (NYSE:AR) until the end of 2023 have been reduced by a bit over $1.5 billion compared to September. The natural gas strip for 2023 has gone down from $6.05 to $4.90, and Antero only has a small amount of hedges for 2023.

Antero is still projected to generate a fair amount of positive cash flow (including over $2 billion in 2023) at current strip, and it can also repurchase shares at a lower price now. I have not changed my long-term (after 2023) outlook on natural gas prices, which remains at $4.00 to $4.50. The reduction in 2H 2022 and 2023 cash flow does trim Antero’s estimated value to around $36 to $37 per share at long-term $4.00 gas though, and $45 to $46 per share at long-term $4.50 gas.

Decline In Commodity Prices

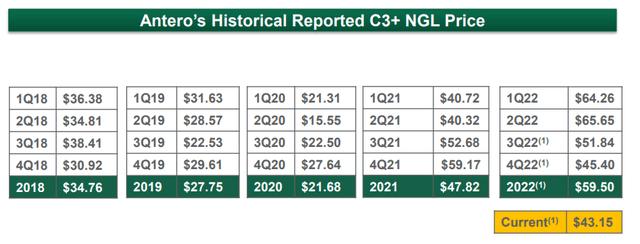

Prices for C3+ NGLs have fallen considerably since the first half of 2022. The current price of $43.15 per barrel is down -34% compared to Q2 2022, although it is still higher than recent years (up to Q2 2021).

Antero’s Pricing For C3+ NGLs (anteroresources.com)

Natural gas prices have also declined by a nearly similar amount from Q2 2022 to now, while oil prices have held up better at -22%. Oil is only a minor factor in Antero’s results though, accounting for only 2% of its total production and around 5% of its revenues.

2H 2022 Outlook

The current strip for 2H 2022 has gone down to around $6.65 NYMEX gas now. December 2022 futures were around $8 around one month ago and around $10 two months ago, but now are trading at around $5.50.

Combined with the decline in prices for C3+ NGLs, this results in Antero now being projected to generate $3.264 billion in revenues after hedges (including the effect of dividends received from Antero Midstream and distributions to Martica) at current strip.

Antero’s hedges now have around $849 million in estimated negative value for the second half of 2022. Although this is still highly negative, the 2H 2022 hedges have improved in value by close to $300 million due to the sharp decline in natural gas strip prices for Q4 2022.

| Type | Barrels/Mcf | $ Per Barrel/Mcf | $ Million |

| Natural Gas | 404,800,000 | $7.05 | $2,854 |

| Ethane | 10,672,000 | $19.00 | $203 |

| C3+ NGLs | 21,160,000 | $45.00 | $952 |

| Oil | 2,024,000 | $82.00 | $166 |

| Hedge Value | -$849 | ||

| Distributions To Martica | -$80 | ||

| Antero Midstream Dividends | $63 | ||

| Total | $3,264 |

Antero is now projected to generate $1.22 billion in positive cash flow in the second half of 2022.

| Expenses | $ Million |

| Cash Production Expense | $1,500 |

| Marketing Expense | $49 |

| Cash G&A | $67 |

| Cash Interest | $48 |

| Capital Expenditures | $380 |

| Total Expenditures | $2,044 |

Effect On Share Count

I’ve been assuming that Antero uses its 2H 2022 cash flow to repurchase shares and pay off its revolver balance. It is now estimated to end 2022 with 304 million shares, including the effect of converting its convertible notes into common shares.

The pace of Antero’s share repurchase program may be affected by it generating less free cash flow now that commodity prices have gone down. However, Antero is now also able to repurchase shares at a lower price since its share price is also down around 10% since a month ago.

2023 Outlook

Antero is now projected to generate $6.357 billion in revenues after hedges in 2023 at current strip (high-$70s WTI oil and $4.90 NYMEX gas). Since it is mostly unhedged for 2023, movements in commodity prices directly affect its projected cash flow.

| Type | Barrels/Mcf | $ Per Barrel/Mcf | $ Million |

| Natural Gas | 784,750,000 | $5.20 | $4,081 |

| Ethane | 27,010,000 | $13.00 | $351 |

| C3+ NGLs | 41,975,000 | $40.00 | $1,679 |

| Oil | 4,015,000 | $70.00 | $281 |

| Distributions To Martica | -$120 | ||

| Antero Midstream Dividends | $125 | ||

| Hedge Value | -$40 | ||

| Total | $6,357 |

Antero is now projected to generate $2.247 billion in positive cash flow in 2023 at current strip prices before the effect of cash taxes, which could reduce its projected cash flow to a bit over $2 billion.

| Expenses | $ Million |

| Cash Production and Marketing Expense | $2,950 |

| Cash G&A | $137 |

| Cash Interest | $73 |

| Capital Expenditures | $850 |

| Total Expenditures | $4,010 |

Valuation And Conclusion

Antero’s estimated value is now $36 to $37 per share with long-term (after 2023) $70 WTI oil and $4 NYMEX gas. This increases to around $45 to $46 per share at long-term $75 WTI oil and $4.50 NYMEX gas. I have not changed my long-term expectations around natural gas prices, but the reduction in near-term cash flow does negatively impact Antero’s projected cash flow (to the end of 2023) and thus trims its value a bit.

Declines in the prices of natural gas and NGLs reduces Antero’s projected cash flow at strip prices. It is still projected to generate over $2 billion in positive cash flow in 2023 though at current strip.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.