[ad_1]

Justin Paget

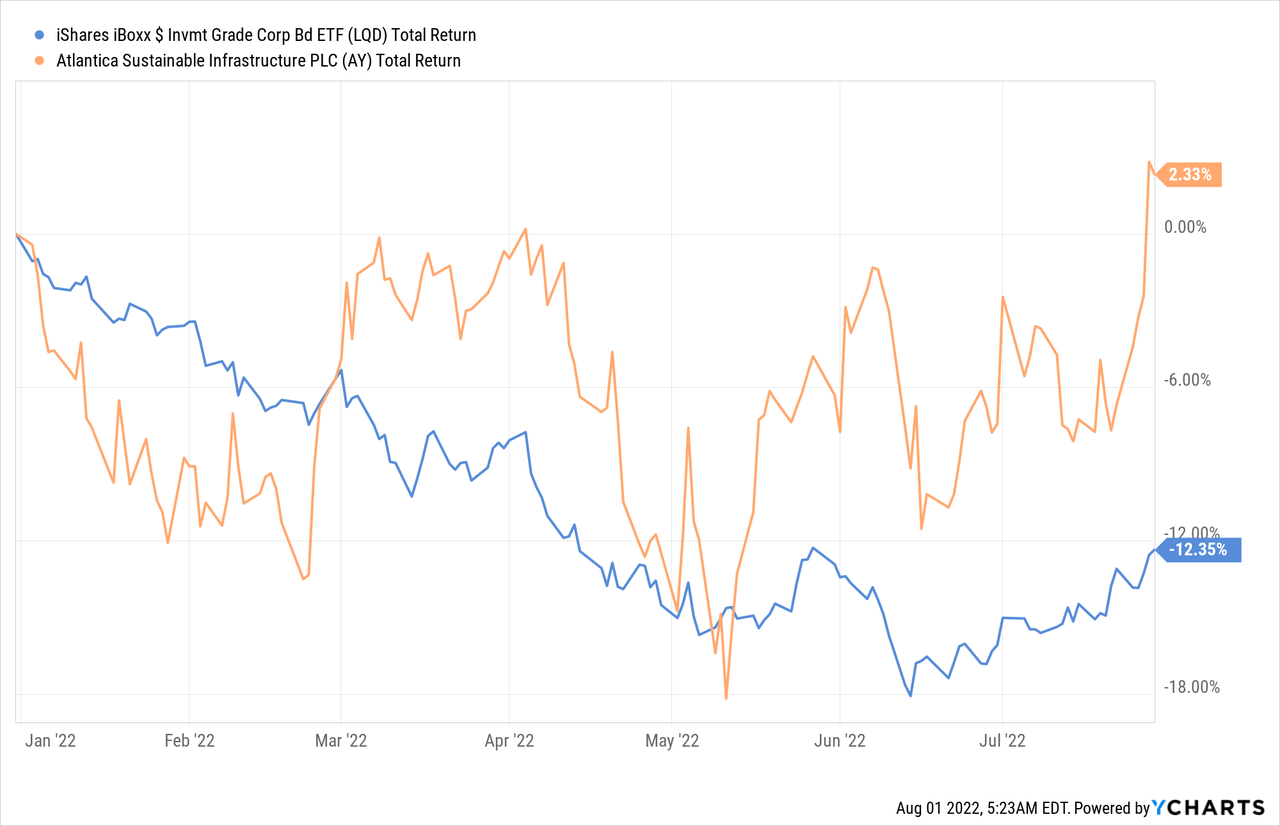

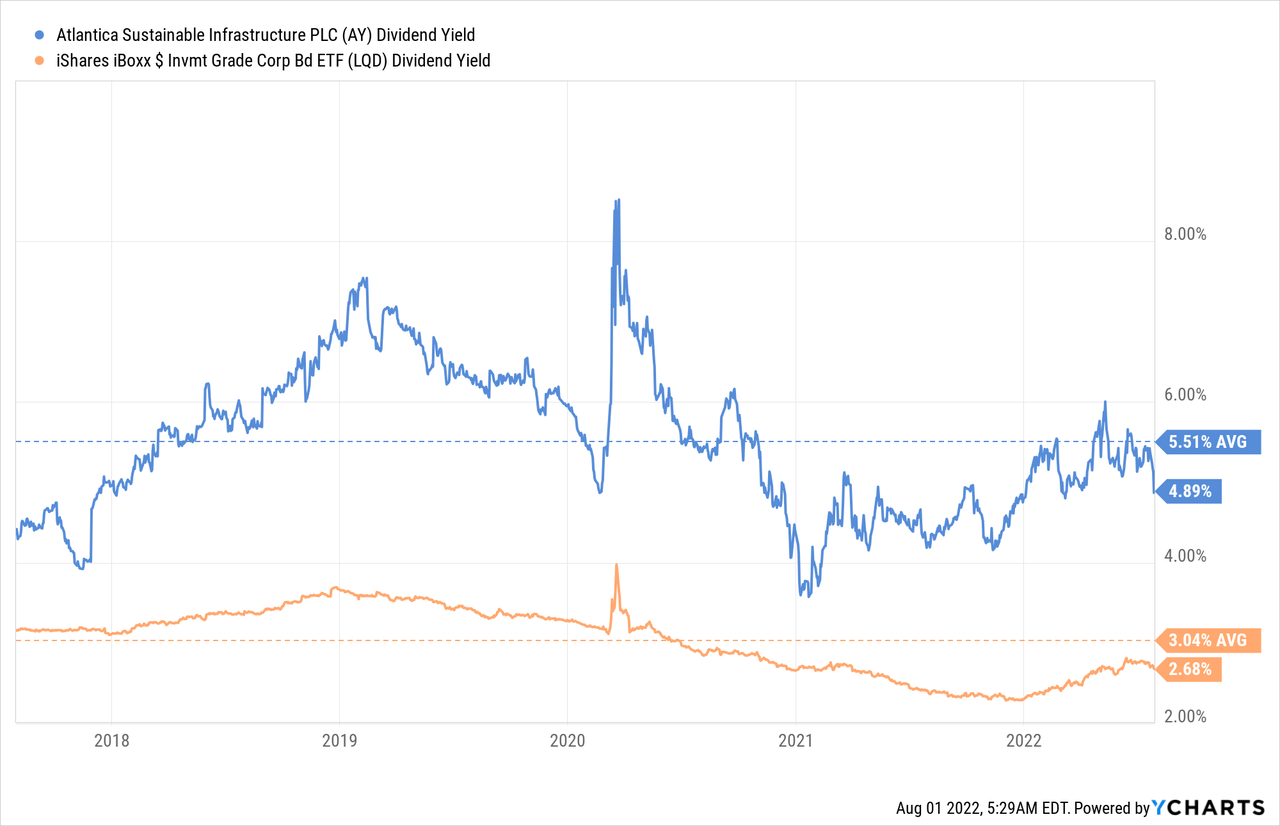

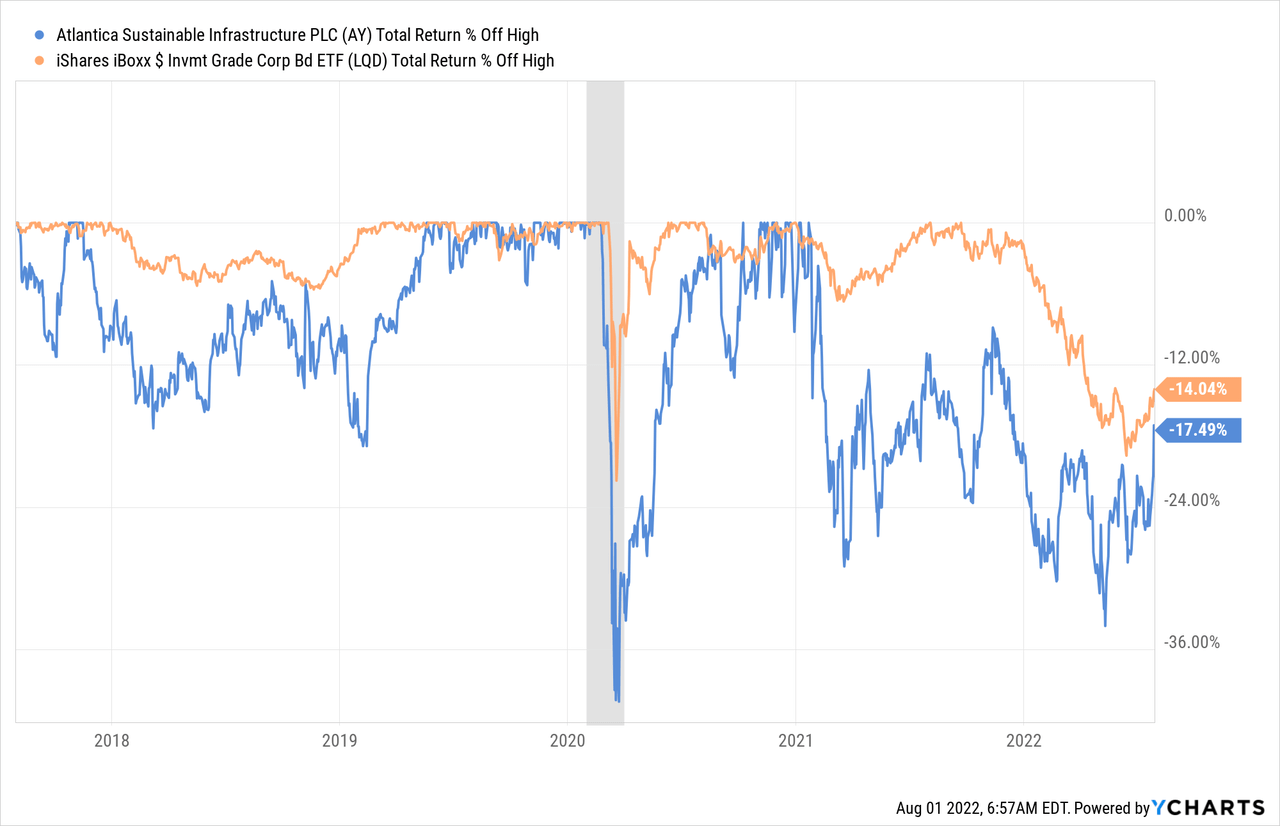

We believe that in the current inflationary environment real assets have an enormous advantage compared to credit investments. That is one reason we believe that for the foreseeable future YieldCo’s like Atlantica Sustainable Infrastructure (NASDAQ:AY) will outperform corporate debt funds or ETFs like the iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD). Year to date Atlantica has delivered a small positive total return of ~2.3%, compared to a loss of ~12% for LQD. One thing we can say in LQD’s favor is that it was less volatile, but we’d rather have a positive return with high volatility than a negative return with low volatility.

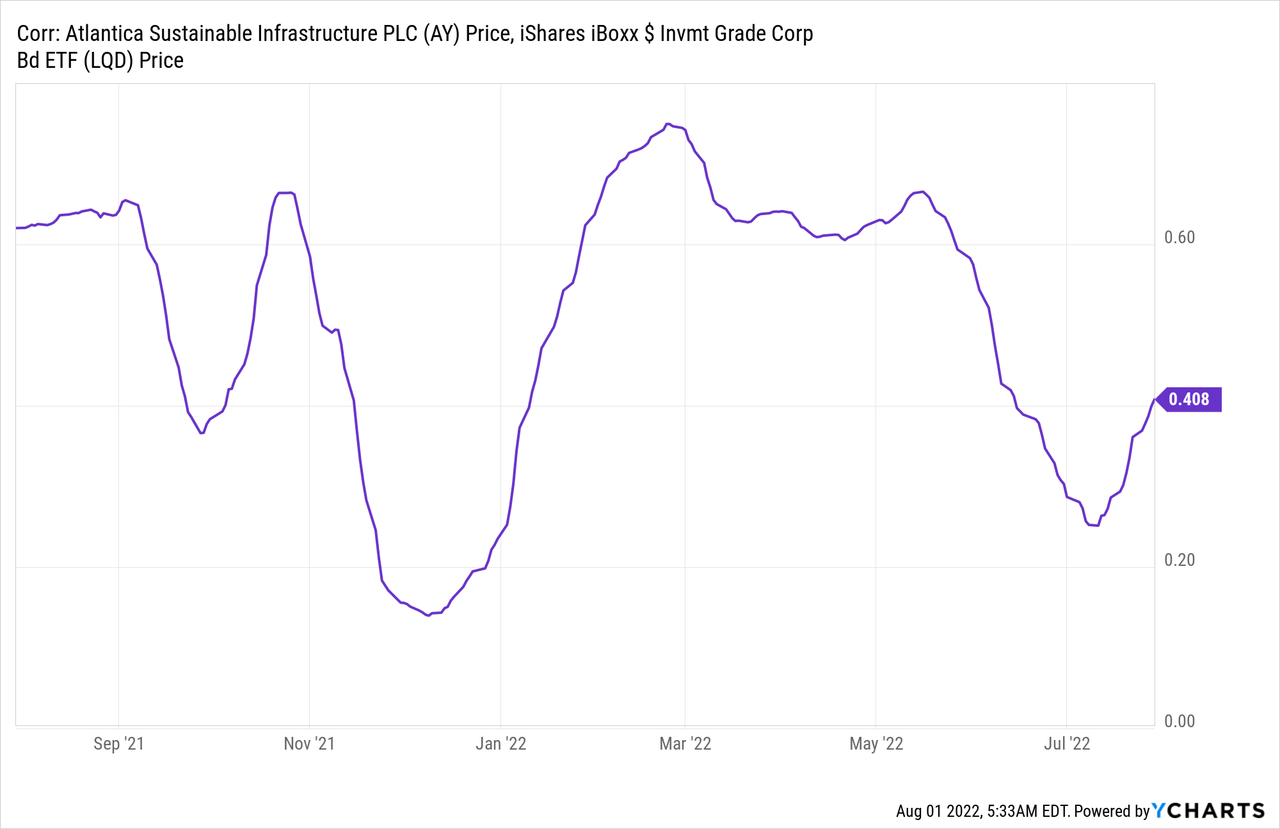

Since the dividend is the biggest attraction to invest in a company like Atlantica Sustainable Infrastructure, it is no surprise that it is highly correlated to corporate bond funds and ETFs. During the last year there were times where the correlation between Atlantica and LQD exceeded 0.6, which is remarkably high. One way to think about this is that, just like with a debt fund or ETF, interest rates will play an important role in determining the share price.

Financials

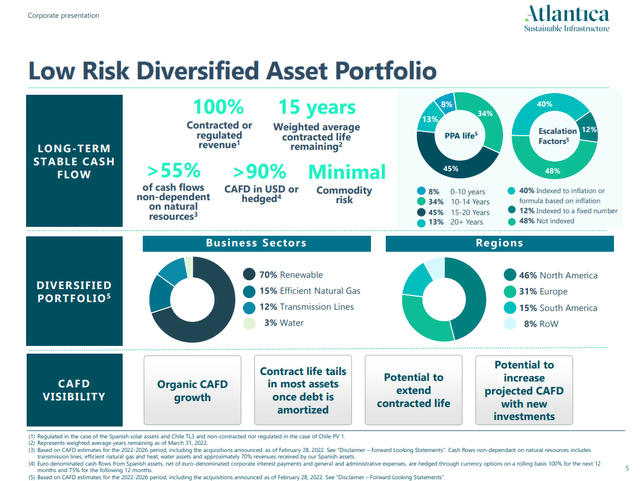

In order to be a good YieldCo the company should be managed in a very prudent manner. That is the case with Atlantica, which has long duration contracts and currency hedges to stabilize cash available for distribution. It also has a good portfolio diversification in terms of types of assets and regions. All of this gives the dividend a lot of safety, and while it might not be as safe as that of a corporate bond ETF, we believe it is still pretty reliable.

Atlantica Sustainable Infrastructure Investor Presentation

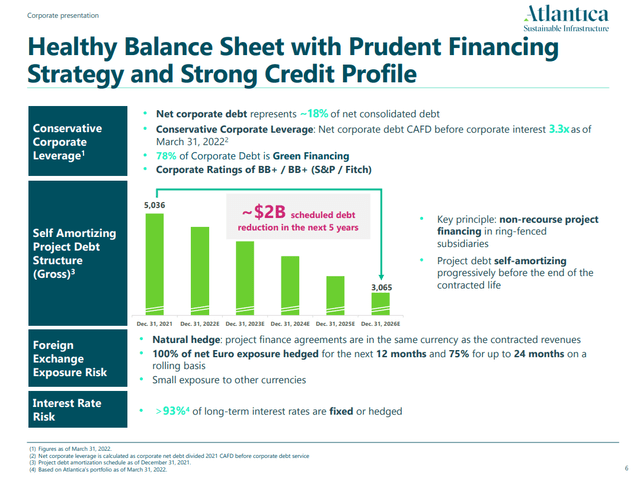

Balance Sheet

Atlantica’s balance sheet remains strong and its leverage is at a reasonable level. This is reflected in S&P Global and Fitch credit ratings of BB+. Importantly in this rising interest rate environment, most of its long-term debt is fixed or hedged.

Atlantica Sustainable Infrastructure Investor Presentation

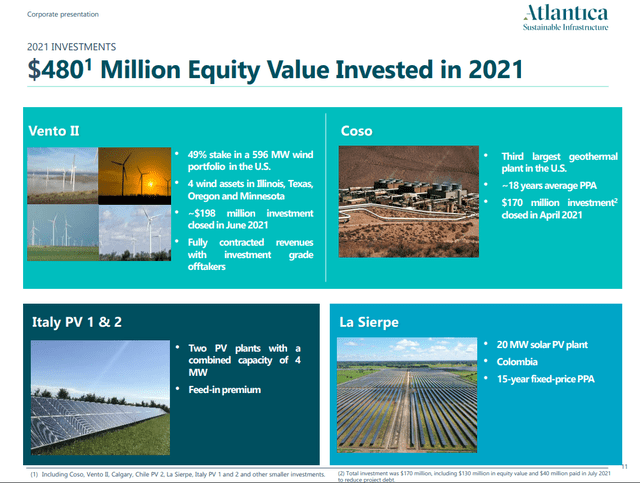

Growth

One of the key tailwinds that helps Atlantica and other YieldCo’s outperform fixed income is their ability to deliver real growth. In Atlantica’s case it made several attractive investments in 2021, one of our favorites being Coso, since it adds nice technology diversification as it is a geothermal project. Going forward the company has said that they intend to invest at least ~$300 per year. By investing in new projects, or current project improvements, cash available for distribution should keep climbing. For instance, in Q1 2022 CAFD per share grew +4%.

Atlantica Sustainable Infrastructure Investor Presentation

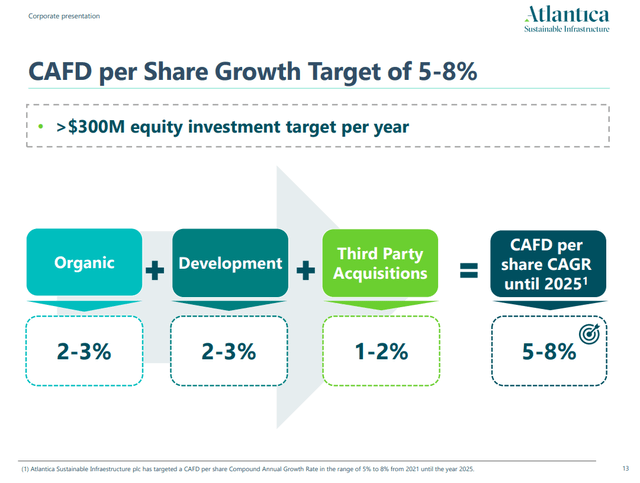

While +4% growth on top of a generous dividend is already not bad, the company is actually guiding to higher CAFD per share growth. The target is 5-8% CAFD per share growth, coming from a combination of organic growth, development projects, and third party acquisitions.

Atlantica Sustainable Infrastructure Investor Presentation

Valuation

We continue to find the valuation of Atlantica much more attractive than that of a corporate debt ETF like LQD. For starter it is yielding more than 200bps more, and there is significant potential for some capital appreciation thanks to the CAFD growth. In other words, it has a much higher dividend yield, the dividend should increase as CAFD grows, and it is more likely to deliver capital appreciation. That said, Atlantica is a higher risk investment, and not suitable for every type of investor.

Risks

Bond funds and ETFs still play an important role in portfolio diversification, and we are certainly not suggesting that investors should get rid of their LQD or other bond funds. While over the long-term we expect high-quality YieldCo’s like Atlantica to outperform corporate debt funds, this comes with increased risk. This can be seen in both the volatility, and the size of the draw-downs. For example, during the worse of the Covid crisis Atlantica went down almost twice as much as LQD.

Conclusion

We expect high-quality YieldCo’s such as Atlantica to continue outperforming corporate debt funds in the current inflationary environment, given that they have real assets and real growth. This likely outperformance comes at the price of increased risk, so each investor should judge what is right for them. At current prices, and given the more than 200 bps of yield that Atlantica offers over LQD, we would expect it to outperform for the foreseeable future, as long as there is no major market panic or crash. We therefore believe Atlantica Sustainable Infrastructure shares in the mid to low 30’s look attractive.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.