[ad_1]

Detailed description of Au Golden Lab Expert’s work.

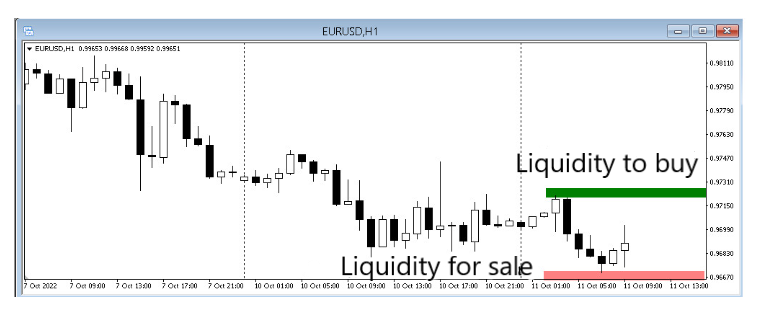

Au Golden Lab Expert tracks the tactics of the big players, who rely on large clusters of traders’ pending orders to obtain sufficient liquidity for their trades. If the big players try to, say, sell an abnormal volume of currency at the market price, they will get the next execution on the chart:

A part of the lots will be sold at 1.3150, the rest will be sold at 1.3140, possibly 1.3130, 1.3120 and even lower. The decrease in order execution price is due to the lack of currency at the current price level, which is why the big player “gains” volume at lower prices.

The challenge for a major player is to select the level of the trade where the greatest number of pending buy/sell orders are located so as not to worsen the entry price. Inside the day, buy liquidity is above the highs and sell liquidity is below the lows. Most stop losses and pending Buy Stop/Sell Stop orders are located in these areas.

What does a major player do, say, when he wants to buy (Buy) the EURUSD pair? He moves the current quote of the currency downwards to “take out the stops”. A number of stop orders will provide the liquidity needed to ensure that the price does not change much when entering the market. Before the price goes down, it is convenient to take out the sellers’ stops. Before price goes up, it is convenient to take out buyers’ stops.

The idea behind the ICT strategy is to enter after taking out stops and after breaking the structure, on the return to the level from the inside.

[ad_2]

Image and article originally from www.mql5.com. Read the original article here.