[ad_1]

Darren415

This article was first released to Systematic Income subscribers and free trials on Jan. 7.

Welcome to another installment of our BDC Market Weekly Review, where we discuss market activity in the Business Development Company (“BDC”) sector from both the bottom-up – highlighting individual news and events – as well as the top-down – providing an overview of the broader market.

We also try to add some historical context as well as relevant themes that look to be driving the market or that investors ought to be mindful of. This update covers the period through the first week of January.

Be sure to check out our other Weeklies – covering the Closed-End Fund (“CEF”) as well as the preferreds/baby bond markets for perspectives across the broader income space. Also, have a look at our primer of the BDC sector, with a focus on how it compares to credit CEFs.

Market Action

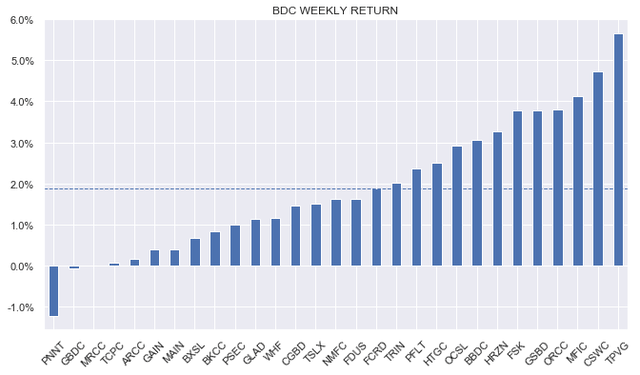

The BDC sector had a great first week of the year, with a nearly 2% total return as all but two names finished in the green.

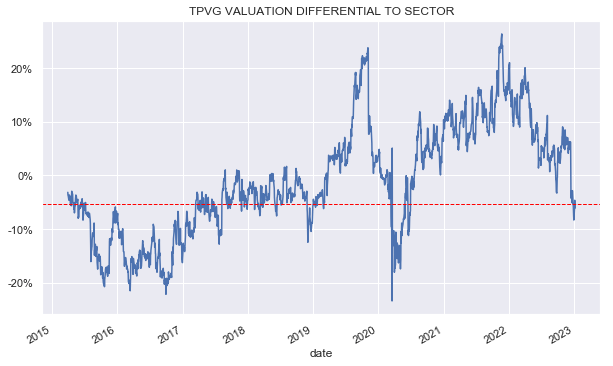

TriplePoint Venture Growth BDC (TPVG) outperformed after its valuation fell to a nearly double-digit discount versus the sector average – where it used to trade around 2017-2019. The stock remains well off its ridiculous 30% valuation premium vs. the sector in late 2022. At current levels, it is much more fairly valued.

Systematic Income

As we highlighted in a recent weekly, TPVG had a bankruptcy in one of its larger holdings which caused the price to deflate sharply. However, the valuation deflated by much more than the value of the holding, setting up a good chance for a reversal. TPVG continues to face an unfavorable environment with a low level of sponsor activity, making upside gains less likely from its venture-focused equity holdings than in the past.

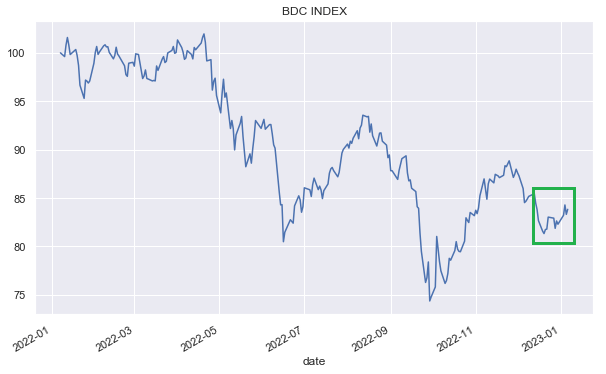

The sector drawdown that began in December appears to have been arrested so far. BDCs have retraced around half of their most recent drawdown.

Systematic Income

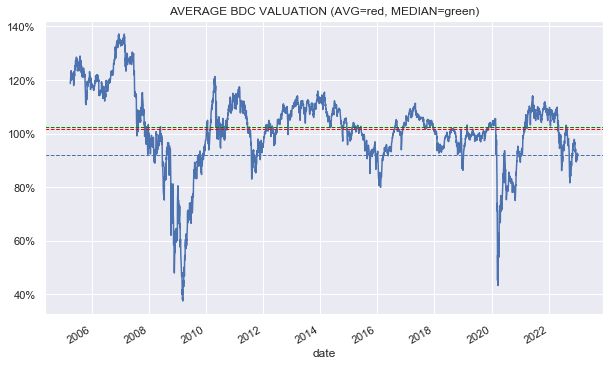

Average sector valuation has moved to 92%, which looks to be in the fair-value region to us, down from a 97% recent peak which we highlighted earlier as being on the expensive side.

Systematic Income

Market Themes

BDC Capital Southwest (CSWC) reported raising $104m in gross equity proceeds via a public offering as well as its ATM program. That’s quite a punchy number. The portfolio has $1.1bn of assets so a 9% increase in one quarter is quite something.

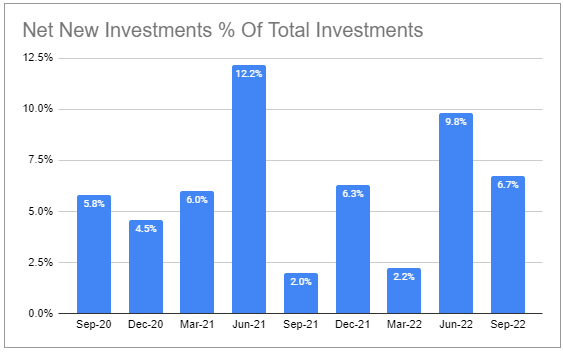

CSWC has been a serial equity issuer so this isn’t particularly new. What’s odd, apart from the size of the number itself, is that it was done in what has been a lackluster quarter for new investments. One would think that a period of wide credit spreads and less competition for lending would be a great time to put capital to work, but many BDCs have not been able to do this. This could be because sponsor activity is subdued because of a lower level of dealmaking. Or it could be because the borrowers are more cautious in investing and expanding.

CSWC has not had this problem – its net new investment activity has been very strong consistently. It has not had a negative net new investment quarter in a couple of years and likely longer which is very unusual in the sector. Some quarters its net new investment activity has reached a double-digit level which is almost unheard of in the sector.

Systematic Income BDC Tool

In any case, new equity issuance itself is not surprising. It achieves a number of things for BDCs. First, it provides an organic deleveraging without requiring the company to sell assets. This can be particularly helpful in a period of falling NAVs which mechanically increase leverage.

Two, it provides dry powder for new opportunities. Credit spreads remain fairly tight and the base case is for a further fall in corporate earnings which could lead to even better valuations this year.

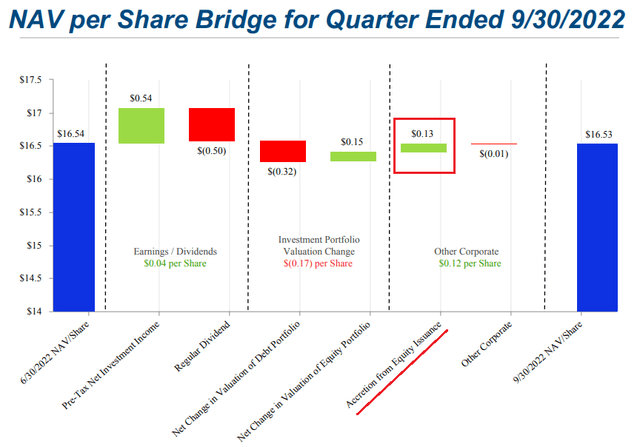

Third, for a company like CSWC, which tends to trade at a premium, it leads to NAV accretion, i.e., additional riskless NAV returns. This source of returns is not as high as it has been for CSWC – it sold shares at a 9% premium to NAV, however, it’s something. The chart below shows how the company accounts for this tailwind in its reporting.

Finally, it allows the company to collect more fees (once the assets are invested – BDCs typically don’t earn fees on cash) which is not a bad thing if you’re the manager.

The downside of equity issuance is it can put pressure on the price which annoys some investors but the dip is usually temporary, something we discussed in the context of Ares Capital (ARCC).

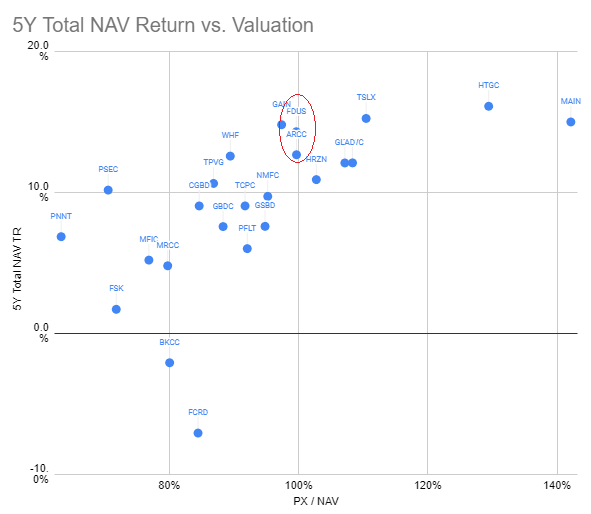

CSWC was one of the worst performers of 2022 as its overly high premium collapsed. It’s now trading at a 108% valuation which is still not cheap (ARCC and FDUS are both more appealing with both lower valuations and higher historic total NAV returns) but if it keeps moving lower it will be worth a look.

Stance And Takeaways

In the current market environment, we continue to tilt to BDCs with a secured loan focus, a higher-quality underlying profile and a margin-of-safety valuation. This includes names such as the Blackstone Secured Lending Fund (BXSL), trading at a 10.7% yield and an 87% valuation and Golub Capital BDC (GBDC), trading at a 10% yield and 88% valuation, among others.

The overall valuation/historic return picture looks like the following. All else equal, BDCs with higher total NAV returns (y-axis) and lower valuations (x-axis) look more attractive. Securities to keep an eye on in our view are the ones we mentioned above – Fidus Investment (FDUS) and Ares Capital Corp. – both strong and consistent performers – to add to in case of dips.

Systematic Income BDC Tool

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.