[ad_1]

Moussa81

Investing in speculative stocks can be a daunting task, especially if you’re just buying on price action alone and don’t really understand what the underlying company does. For some investors, it’s about trying to hit a home run every time, but in reality, a winning strategy should be to hit singles and doubles with companies that have scale and tried and true business models.

In other words, while you can’t get it right every time, the goal should be to not go too wrong. This is a winning strategy that experienced investors like Charlie Munger adopts.

This brings me to Black Hills Corporation (NYSE:BKH), which is a dividend stalwart that remains attractively valued with a respectable yield. In this article, I highlight what makes BKH a worthy buy at present for sleep well at night returns, so let’s get started.

Why BKH?

Black Hills Corp. is an electric and gas utility company based in Rapid City, South Dakota. At present, it serves 1.3 million customers across eight states across Arkansas and the North Central region of the U.S., from Iowa to Wyoming. In the trailing 12 months, BKH generated $2.2 billion in total revenue.

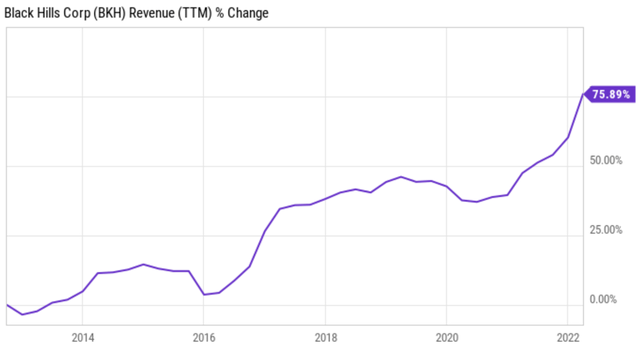

As one would expect from a well-run utility company, BKH has a solid track record of growing its revenue, by 76% over the past decade. As shown below, this growth has been rather steady and surely, giving investors sleep well at night attributes no matter how the macroeconomy is doing.

BKH continues this growth trajectory, with first half EPS growing by an impressive 21% YoY to $2.33, from $1.93 in the first half of last year. This was driven primarily by new rates and riders, along with a one-time benefit related to winter storm URI cost recovery at its gas utilities, partially offset by higher operating expenses.

The recent heat wave in July across BKH’s service territories has highlighted the indispensable need for reliable and ready electric capacity. This is reflected by the fact that for the ninth consecutive summer, BKH’s Wyoming Electric system marked a new all-time demand peak and the South Dakota Electric system surpassed its all-time peak from last summer, driven by ongoing customer growth in their service territories.

Also encouraging, BKH is making meaningful progress towards its clean energy plan in Colorado, with a path to a 90% reduction in greenhouse gas emissions by 2030, using 2005 as a baseline. The proposed plan includes adding 400 megawatts of renewable wind and solar resources and 50 megawatts of battery storage between 2025 and 2030.

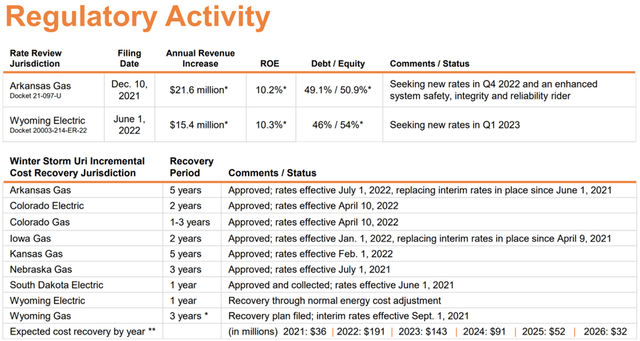

Looking forward, rate case filings should help BKH stay ahead of inflationary concerns. As shown below, BKH has seen a number of rate increase approvals this year, and currently has 2 pending in Arkansas and Wyoming, with ROE of 10.2% and 10.3%, respectively.

BKH Regulatory Activity (Black Hills Corp.)

Also, interestingly enough, BKH is an indirect participant in blockchain technology and crypto currency mining, as its service territories are relatively lower cost compared to the rest of the country. This is reflected by a recently established service agreement with a well-established crypto-miner, as outlined during the recent earnings call:

We were also successful with another innovative customer solution during the quarter. Our team completed its first agreement for service under our blockchain tariff in Wyoming with a well-established crypto miner that is investing in long-term operations in Cheyenne.

We anticipate our customer will begin taking delivery of up to 45 megawatts of energy by year-end, with an option to expand service up to 75 megawatts. The energy for this customer will be sourced through the energy markets and delivered through our reliable infrastructure, which will benefit our other Cheyenne utility customers.

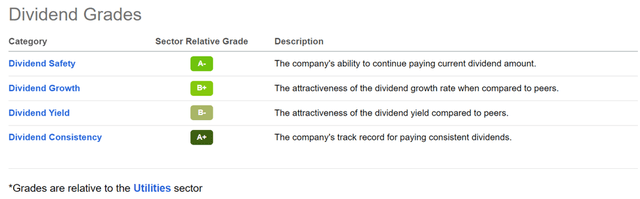

Meanwhile, BKH maintains a solid BBB+ rated balance sheet. It also has a sterling reputation for paying a reliable and growing dividend, with 50 years of consecutive growth under its belt. It currently pays a 3.2% dividend yield that’s well covered by a 57% payout ratio, and has a 5-year CAGR of 6.3%. As shown below, BKH scores A and B grades for Dividend safety, growth, yield, and consistency relative to the utilities sector.

BKH Dividend Grades (Seeking Alpha)

Admittedly, BKH doesn’t scream cheap at the current price of $74.40 with a forward P/E of 18.2, sitting just below its normal P/E of 18.4 over the past decade. However, I believe it’s well worth the price considering the quality of the enterprise and its strong track record of growth.

Sell side analysts expect to see 9.1% EPS growth this year, and have a consensus Buy rating with an average price target of $82.14. This translates to a respectable potential one-year 14% total return including dividends.

Investor Takeaway

All things considered, I believe BKH is a high-quality electric and gas utility that’s well worth considering for long-term growth and income at the current price. With an impressive track record of reliable growth, a strong focus on clean energy initiatives, and a solid balance sheet, I believe the company is well positioned to continue delivering strong and reliable results for shareholders in the years ahead.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.