[ad_1]

Andrew Burton

Thesis

Leading asset manager BlackRock, Inc. (NYSE:BLK) stock has underperformed the SPDR S&P 500 ETF (SPY) in 2022. The asset manager’s stock posted a YTD total return (including dividends) of -22.4%, in contrast to the SPY’s -13.8%.

Therefore, even a leading manager like BlackRock isn’t immune to the most pronounced macro headwinds seen in H1’22. However, management also emphasized in its Q2 commentary that investors have not seen such challenges in decades, as CEO Larry Fink articulated:

The first half of 2022 brought on a combination of macro financial and economic challenges that investors haven’t seen in decades. Rising energy prices, disrupted supply chains and hawkish pivots of central banks to confront inflation have sparked the reassessment of growth, profitability, and risk across financial markets. (BlackRock FQ2’22 earnings call)

Despite that, we are confident that the “perfect storm” of headwinds has culminated in BLK’s long-term bottom in June. Consequently, it staged a remarkable summer rally toward its August highs before it got engulfed in the broad market pullback.

Therefore, we are confident that investors who missed the June lows are given another fantastic opportunity to add exposure to a highly profitable asset manager with wide competitive moats.

Accordingly, we rate BLK as a Buy.

Don’t Just Follow Positive Net Flows To Invest

BlackRock TTM total net flows (Company filings)

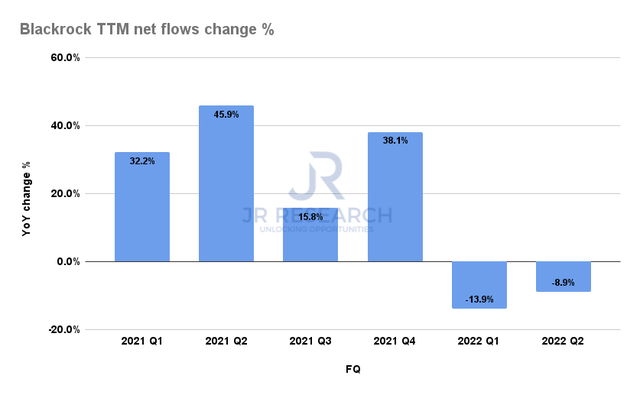

BlackRock posted positive net flows of $89.6B in Q2, demonstrating the resilience of its platform. However, it recorded a second consecutive decline in the growth of its TTM net flows in Q2, down 8.9%. Notwithstanding, it improved from Q1’s 13.9% fall, indicating that BlackRock’s TTM net flows could stabilize.

We encourage investors to use a contrarian lens when considering BlackRock’s TTM net flows growth chart. As seen above, BlackRock posted its highest net flows growth in Q2’21. However, that metric was also pretty close to the stalling of BLK’s momentum in its stock performance (which we will discuss subsequently) in 2021. Moreover, another surge in net flows growth was registered in Q4’21, which coincided with the November top in BLK. Hence, we believe that herd mentality, even among institutional investors, cannot be ruled out, as they chase growth and returns.

However, the perfect storm of headwinds in H1’22 also impacted the confidence of these institutional investors. Consequently, they also joined retail investors in repositioning their portfolios after experiencing significant battering in the bond and equity markets. Furthermore, a survey by BofA (BAC) in July indicated that portfolio managers raised cash to a 20Y high in June, coinciding with the broad market bottom.

Therefore, we believe investors should be delighted to see a decline in the growth of net flows in a high-quality asset manager like BlackRock. The market cyclicality and macro headwinds have created a dislocation, affording astute investors who gleaned June’s bottom to add more exposure. Despite the rally from June’s lows, we believe that BLK’s valuation remains reasonable.

BlackRock – Investors Should Expect Better Days Ahead

BlackRock revenue change % and adjusted EPS change % consensus estimates (S&P Cap IQ)

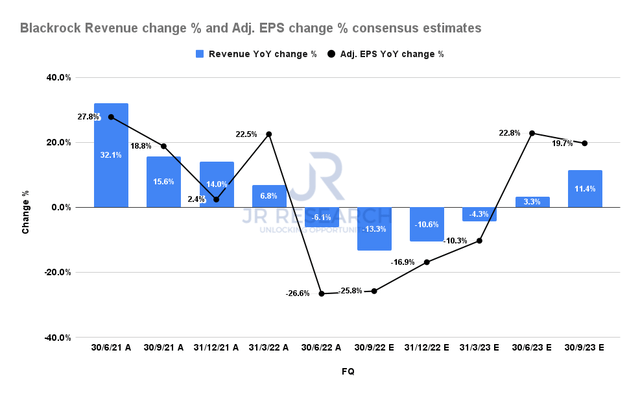

Given our confidence in June’s bottom, we are confident that the TTM growth in BlackRock’s net flows should improve further. Moreover, repositioning to higher-fee funds/ETFs should improve BlackRock’s revenue growth cadence as investors attempt to capitalize on the recent market bottom.

Therefore, we deduce that the consensus estimates (bullish) are credible, as they suggest that BlackRock’s revenue and adjusted EPS growth should recover through FY23. Even though BlackRock’s operating performance could still experience potential near-term downside from the market’s volatility, we urge investors to look ahead.

BLK’s Valuation Remains Reasonable

BLK NTM normalized PE multiples valuation trend (Koyfin)

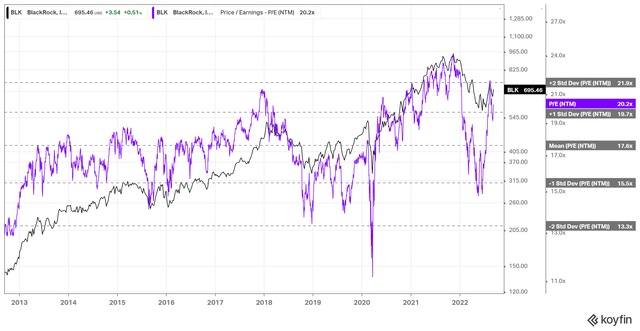

BLK’s NTM normalized P/E fell to the one standard deviation zone below its 10Y mean at its June lows. Barring a full-blown recession, we believe BLK found robust support as buying momentum returned to propel it toward its August highs.

Notwithstanding, its NTM EPS estimates remain under pressure, as BlackRock is expected to resume positive EPS growth only from Q2’23. As a result, it also impacted its near-term P/E ratio, as seen above.

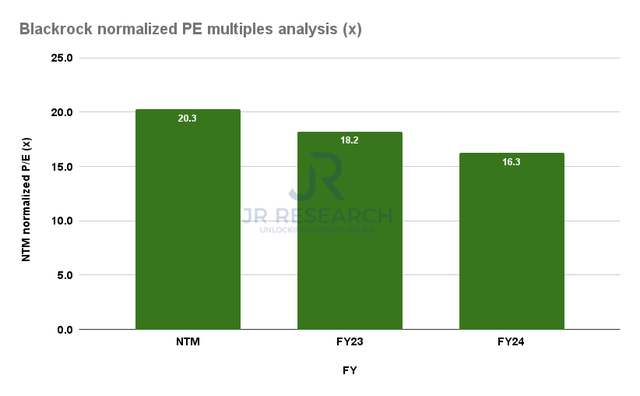

BlackRock normalized forward PE analysis (S&P Cap IQ)

As seen in its forward P/E multiples analysis, with the expected recovery in its profitability, BLK’s valuation is also projected to improve markedly. Notably, its FY23 normalized P/E of 18.2 is close to its 10Y mean of 17.6x. Therefore, we believe that BLK’s valuation remains reasonable, even though not significantly undervalued.

Is BLK A Buy, Sell, Or Hold?

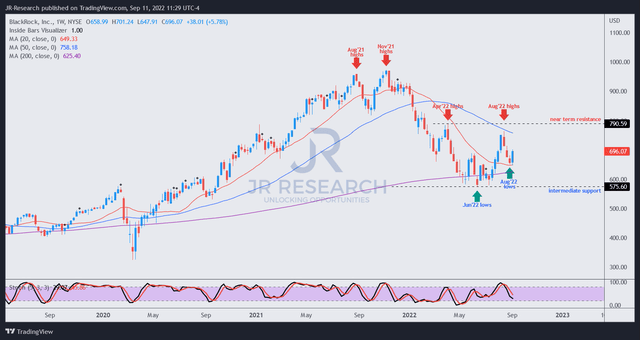

BLK price chart (weekly) (TradingView)

As seen above, BLK staged its 2021 highs in August and November, close to the periods where it registered the highest growth in its net flows.

We believe BLK’s June lows seem robust, as we don’t expect a full-blown recession, which could batter its valuation further. Despite that, BLK remains 20% above its June lows despite the recent pullback from its August highs. Hence, we deduce a fair amount of near-term upside has been reflected. As a result, investors should layer in their exposure if they decide to add at the current levels.

Notwithstanding, we noted robust support at BLK’s August lows. Furthermore, it appears that BLK might be able to regain control of its 20-week moving average (red line), which could help recover its medium-term bullish bias decisively.

Accordingly, we rate BLK as a Buy.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.