[ad_1]

What’s goin’ on everybody?

You know that popular saying, “Eat what you like, as long as it’s in moderation” that the health experts are always blabbering about?

Well, the same can be said about trading short-dated options.

Friends, short-dated options are explosive, and they can be a lot of fun to trade.

At the same time, though, they can be risky.

Not surprisingly, the explosive nature of these “junk food” options trades has made them quite popular in 2022.

Why is that, you ask?

Because, in bear markets, daily price ranges grow larger.

And with a Federal Reserve that has become so data-dependent, the frequency of large daily moves has also grown.

I mean, even Bloomberg is talking about the growing popularity of this strategy.

You know what I say?

I say better late than never, Bloomberg, because I have been educating retail traders on how to identify and manage short-dated options trades FOR YEARS.

In fact, along with my right hand man, the Options Master Ethan Harms, I have built my LottoX trading service into what is now one of RagingBull’s TOP services.

Week after week I have been showing you examples of the MASSIVE short-dated options moves we’ve been teaching LottoX members how to find here.

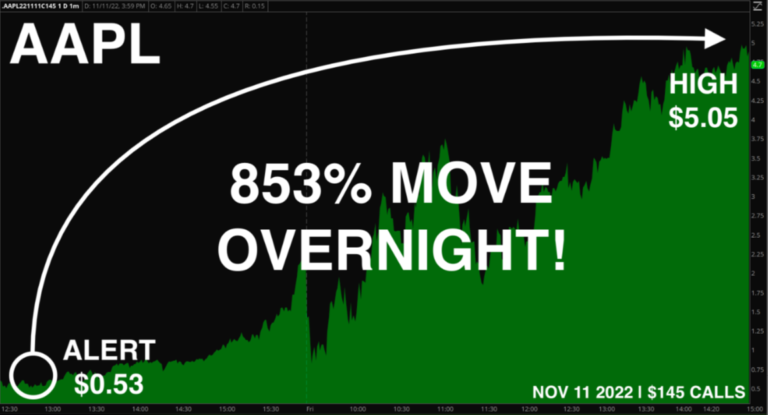

You know, moves like this:

Just like any successful plan, our approach is regimented, but simple to follow:

- It all starts on Monday when Ethan and I start monitoring the macro landscape for sectors that are ready to move.

- By Tuesday, we’re laser-focused on our CUSTOM “Smart Money” scanners for clues on where the BIG Whale-like volume is moving.

- When Wednesday arrives, we’re examining the options chains to find the BEST volatility setups possible to light a match under things.

- Finally, our decades of combined experience all comes together in a carefully curated list of a handful of options ideas with THE BEST potential to explode…and it’s all delivered LIVE at 12:30 a.m. ET every Thursday.

Right now, I’m going to let you in on a little secret…

NVDA, which has options that are MASSIVELY popular to trade, has SUPER low implied volatility right now.

Not only that, but as the Implied Volatility at the bottom of this next chart shows, that volatility has bottom and is on the rise again.

Now, that might not mean a lot to an uninformed trader, but in the hands of a trained 0-DTE (Zero Days to Expiration) trader that information is worth its weight in gold.

If you want to find out why, I am offering an incredible 44% discount for access to my next LIVE trading session at 12:30 pm ET tomorrow.

Friends, I get why Bloomberg says this is risky trading.

That’s because, just like anything else in life, anyone that ventures into it without the proper training is bound to learn the hard way

Wouldn’t you rather learn what this world is all about in the comfort of a community of fellow retail traders, trained by good old Uncle Ben?

Let’s all have a great weekend and until next time!

[ad_2]

Image and article originally from ragingbull.com. Read the original article here.