[ad_1]

Friends, you can’t say I didn’t warn you that Tuesday’s CPI report had the potential to unleash extreme price movement.

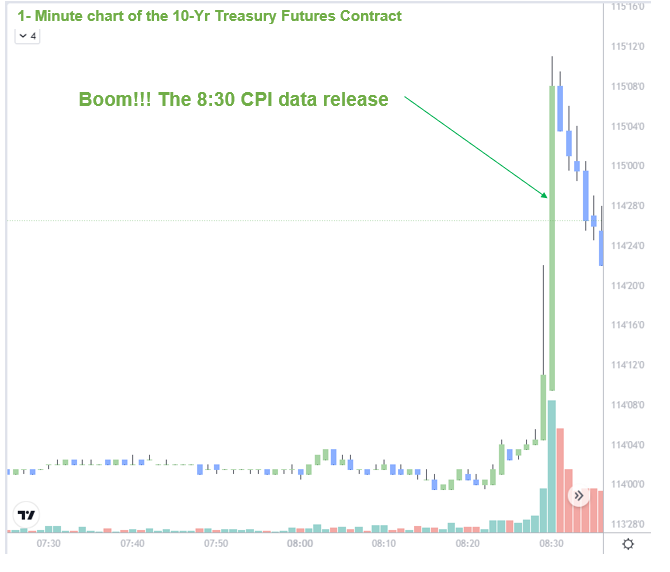

After November’s reading on core inflation (CPI) was reported to have only increased 6.0% (expectations were for a 6.1% increase) over the same time last year (YoY), US equity futures exploded higher on Tuesday morning.

The market has been hyper focused on high inflation of late.

Therefore, the pre-market algos were quick to read the lower than expected reading as an indication that the Fed may move to loosen its grip on rate hikes sooner than expected.

Friends, I do the type of research I did here for you last week so that there are no surprises.

You know what else shouldn’t come as a surprise?

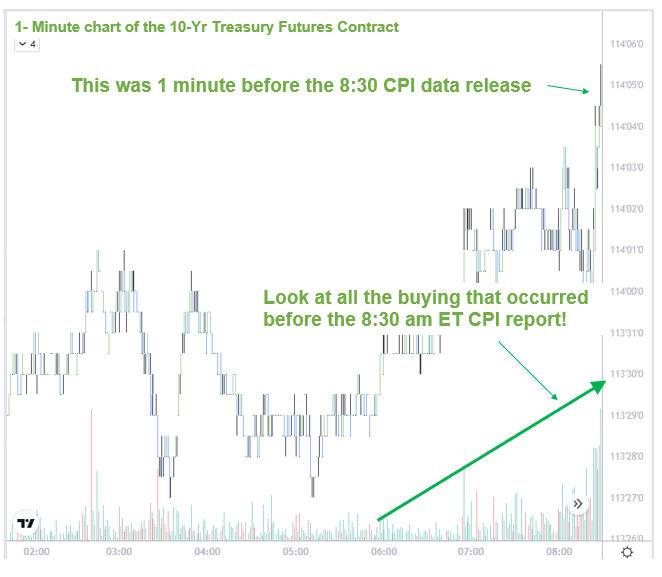

The fact that the bond market knew what Tuesday’s CPI report was going to reveal a FULL day before.

Here, look for yourself:

In case you missed it, here’s what happened after the CPI data dropped on the market one minute later:

If you weren’t already aware, the bond market is widely considered to be the smartest of the 4 major market segments (stocks, bonds, commodities and currencies).

Now, I am not saying that the bond market always knows what’s coming.

But the massive teams of mathematicians and quants that make the key decisions certainly give the institutions they work for an advantage over you and me.

You know what I say to that?

Bring it on!

I learned A LOT of important lessons early on in my trading career.

Perhaps two of the most important lessons were:

- There will ALWAYS be cheaters in the market, and it’s usually the Fat Cats that are guilty

- Keep a close eye on what these Fat Cats are doing

Because it is so important, we spend thousands of dollars each year to maintain the “Smart Money” tools that can uncover some of the BIG trades that these insiders are making.

Recently, I combined ALL of the tools, knowledge & techniques I have acquired over the years into a SINGLE, COMPREHENSIVE SERVICE!

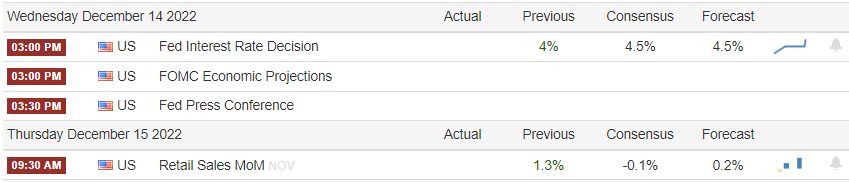

With the HUGELY anticipated next Fed rate decision due out in just a few hours AND Retail Sales data on deck tomorrow…

you can be DARN sure that I am spending today filtering through my Unusual Options Activity and Dark Pool scanners for insights to get out to my members via IMMEDIATE and ACTIONABLE alerts!

What’s the bond market telling me now, you ask?

You’ll have to go here to find out.

Let’s have a great rest of the week and until next time!

[ad_2]

Image and article originally from ragingbull.com. Read the original article here.