[ad_1]

MarsBars

Consumer price inflation has been the headline generator over the past year, and fears and uncertainty related to CPI has boiled over into fears of a recession, especially if the Federal Reserve goes overboard with rate hikes.

However, after all is said and done, cooler heads should prevail, and investors will realize that real estate is among the best asset classes to own in an inflationary environment.

This brings me to Brixmor Property Group (NYSE:BRX), which remains overlooked by the market despite its large size and strong metrics. In this article, I highlight why BRX is an undervalued gem for potentially strong investors returns.

Why BRX?

Brixmor Property is one of the largest shopping center REITs in America, owning and operating a high-quality portfolio of 378 retail centers covering 67 million square feet. Its properties are well-located and spread throughout 116 communities, and are diversified across over 5,000 national, regional, and local tenants.

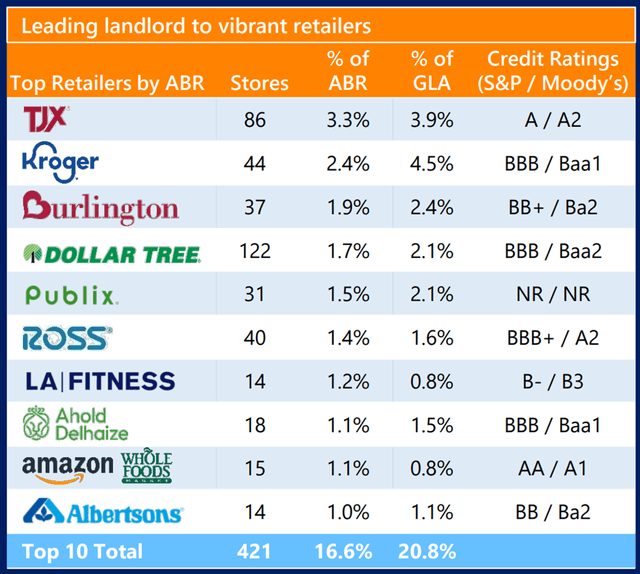

BRX’s open air shopping centers are generally well-located in high traffic areas. Over 70% of BRX’s centers are grocery anchored, making them essential to the communities they serve. As shown below, BRX’s top 10 tenant roster is comprised of a number of top grocer and retailer names, including TJX (TJX), Kroger (KR), Dollar Tree (DLTR), Publix, Ross Stores (ROST), and Whole Foods (AMZN).

BRX Top 10 Tenants (Investor Presentation)

Meanwhile, BRX’s portfolio operating metrics are strong, with an overall 93% leased rate during the third quarter. This includes anchor occupancy of 95% and small shop occupancy of 89% (a record high), representing a 110 basis point sequential improvement. Generally, small shop occupancy of 85% is considered to be a healthy level.

Moreover, BRX is seeing respectable same property NOI growth of 3.6% driven by strong demand from existing and new tenants. This is reflected by 1.7 million square feet of new and renewal leases, with a blended rent spread of 14%, including a very strong rent spread of 32% on new leases, representing a record for the company.

Management is also actively recycling capital, completing $29 million of dispositions in the last reported quarter and stabilized $46 million of reinvestment projects at an attractive average incremental NOI yield of 8%. Also encouraging, BRX has $400 million in remaining development pipeline that’s expected to generate an even higher average incremental NOI yield of 9%.

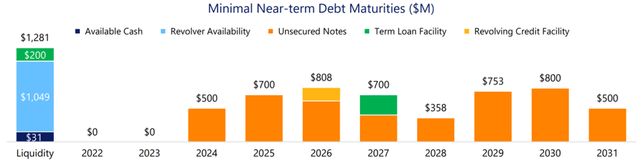

BRX also maintains an overall healthy BBB- credit rating with positive outlook from S&P, sitting it up for a potential upgrade to BBB. I also carries an overall safe net debt to adjusted EBITDA ratio of 6.4x and has strong fixed charge coverage ratio of 4.1x. 100% of BRX’s annual base rent is unencumbered by mortgages and 96% of BRX’s debt is fixed rate with a low weighted average interest rate of 3.7%.

As shown below, BRX has $1.3 billion worth of liquidity and its debt maturities are well staggered, with no maturities until 2024.

BRX Debt Maturity Schedule (Investor Presentation)

This sets up BRX to take advantage of opportunities down the road, as management anticipates higher leveraged private market owners to be forced to sell when their debt maturities hit in the coming quarters. This was highlighted during the last conference call:

From an investment standpoint, we continued our pause on acquisitions. Keeping our power drives, we believe there will be compelling opportunities in the coming quarters as private less well capitalized landlords struggle with upcoming debt maturities and cash flow constraints. With that said, even in this more challenging capital markets environment, we’ve continued to find some liquidity to sell smaller non-core assets at opportunistic values with over $110 million in sales transactions completed during and subsequent to the end of the quarter.

Notably, BRX raised its dividend by 8.3% recently, and the new quarterly rate of $0.26 is very well protected by a 53% payout ratio, based on Q3 FFO per share of $0.49. Lastly, I find BRX to be appealing at the current price of $23 with a forward P/FFO of 11.8.

BRX appears to be undervalued considering the very strong tenant demand that it’s seeing and the incremental growth that it could see from its development pipeline. I believe it would be reasonable for BRX to trade at a P/FFO of at least 13x, translating to potential for total returns in the mid-teens.

Investor Takeaway

BRX is an underfollowed and undervalued large shopping center REIT that’s demonstrating strong tenant demand. Its portfolio operating metrics are strong, with record small shop occupancy, and it has a meaningful development pipeline with attractive incremental NOI potential.

Lastly, BRX pays a very well covered dividend, setting it up for continued dividend raises. As such, investors may want to consider BRX as a good way to hedge against inflation and earn potentially strong long-term returns.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.