[ad_1]

Funtay

It has been nearly half a year since our latest coverage of British American Tobacco (NYSE:BTI) stock, and we thought it would be productive to share our latest valuation update. In our previous article, we claimed that British American Tobacco’s stock could surge by more than 12% in the space of the year. Needless to say, our prediction is yet to come to fruition, as the stock has drawn down by more than 5% ever since our bullish call on the security. However, we affirm our bullish stance on the stock today with a $46.50 price target, which could lead to more than 17% in price gains.

Operational Update

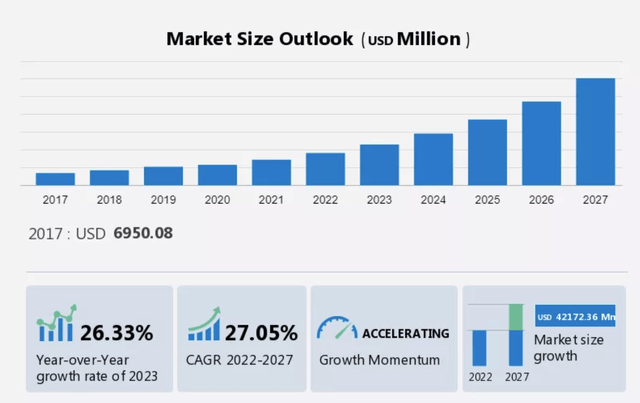

British American Tobacco’s management released its H2 transcript in early December, revealing that it anticipates the group’s revenue to surge by between 2% and 4% in full-year 2022 amid rising demand for the company’s e-cigarettes and oral nicotine products. Despite British American Tobacco’s involvement in an industry that some might see as archaic (cigarettes & tobacco), its non-combustible products make up nearly 15% of the company’s sales at a compound annual growth rate of 31%. In addition, “new categories” grew holistically at 45% as per H1 2022.

However, will the company’s new products’ hyper-growth rates phase out a potentially slowing traditional cigarette market?

The company will take time to pivot from its existing business model. However, the signs are that its acquisitions provide high sales/total asset value, illustrating the company’s ability to seek strategic acquisitions that would reignite its long-term growth trajectory.

Heat-not-burn Tobacco Market CAGR (Technavio)

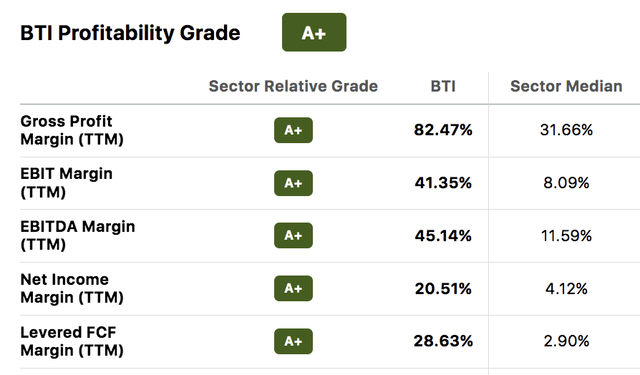

Despite the firm’s planned pivot, its core cigarette business still delivers robust results. We are optimistic about its core business unit for two reasons. The first is that it led the company into a dominant market position, allowing it to reach economies of scale and achieve tremendous profitability margins.

The second reason we appreciate the company’s core business is that it allows its new business units to scale much faster through economies of scope and cross-unit synergies. British American Tobacco’s newly horizontally integrated business model gives it leverage to engage in cross-sales, cross-division skill sharing, and shared facility cost cutting. Thus, it is unlikely that the firm’s new segments would’ve grown as quickly had it not been for the existence of its core cigarette business.

Valuation

Model Output

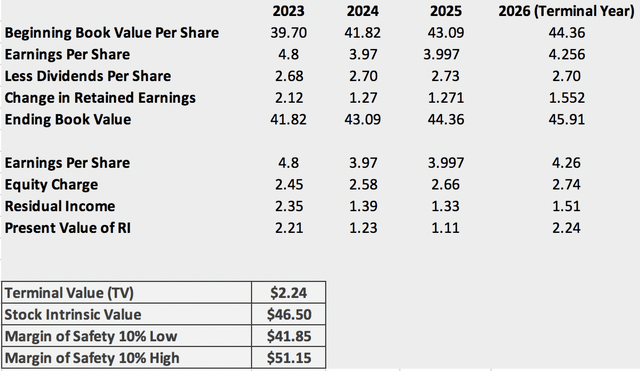

Our multistage residual income valuation model indicates that British American Tobacco is undervalued by approximately 17%. In fact, our model suggests that British American Tobacco is undervalued, even when incorporating a margin of safety of 10%.

Multistage Residual Income Model (Author’s Calculations)

Model Inputs

Let’s run through the model’s input variables to garner a better understanding of how an intrinsic value of $46.50 was derived.

- The stock’s price was divided by its price-to-book ratio to define a benchmark book value per share.

- Seeking Alpha’s database was utilized to plug in earnings-per-share estimates. However, the terminal year’s earnings-per-share value is a normalized average of preceding years.

- The model’s dividends per share were also obtained from Seeking Alpha’s database. However, the estimates for 2024/25 weren’t available; thus, historical growth rates were used. Again, a normalized value was utilized for the model’s terminal year.

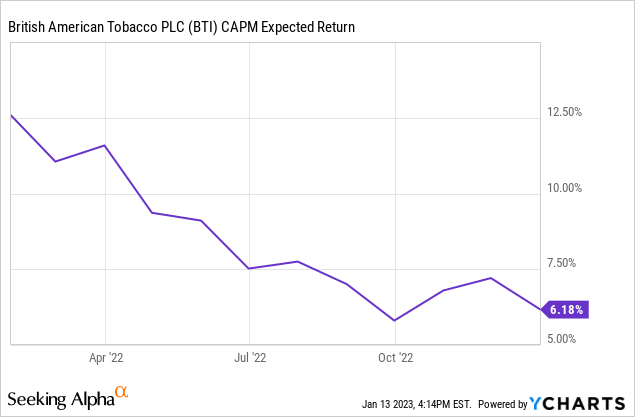

- The equity charge percentage was acquired from the stock’s CAPM (expected return). Subsequently, the percentage was multiplied by the beginning book value to estimate an equity charge.

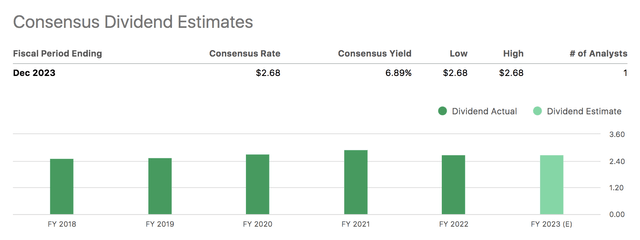

Dividends

According to the company’s latest transcripts, it remains dedicated to its 65% dividend payout ratio target. Thus, instilling immense belief in us as shareholders that we will be able to reap lucrative carry returns for years to come.

Furthermore, the stock’s lucrative 6.98% dividend yield is secured by a dividend coverage ratio of 1.78x and cash per share of 1.92x. Keep in mind that British American Tobacco is a noncyclical enterprise. Therefore, its dividend consistency is better than most. In addition, moderating inflation growth could reduce the company’s input costs in the coming years while its market position could allow it to sustain pricing power over its customers, consequently providing further support to its dividend profile.

Risks To Consider

The primary risk we see with British American Tobacco is style-based. If the market pivots into a more risk-on mood during 2023, it is likely that lower beta stocks, such as British American Tobacco, will fall out of favor.

An opposite scenario could also have an adverse effect. For example, sustained high-interest rates and a deepening risk-off market could add allure to bonds, which could make low-risk stocks’ risk premiums to be uninviting to market participants.

A final risk to consider is the company’s perspective restructurings. British American Tobacco is clearly in the midst of a pivot, and restructuring charges from acquisitions, divestments, balance sheet reorganizations, and recapitalization could stack up. Thus, leaving its investors unwilling to absorb the chaos.

Final Word

Despite its relative underperformance during the past half-year, we remain bullish on British American Tobacco and believe a price target of $46.50 is highly realistic. In addition, the stock’s dividend profile could be sustained amid moderating inflation and pricing power over its customers.

The company is in a clear pivot with non-combustibles growing exponentially. Although restructuring charges could stack up, the economies of scope gained from multiple business segments might outweigh any adversity.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.