[ad_1]

PhonlamaiPhoto/iStock via Getty Images

Investment Thesis

Cameco (NYSE:NYSE:CCJ) is well positioned for the change in the prevailing view from countless countries and government bodies toward nuclear energy.

The one key detraction from this name is that this business is for now only marginally profitable. This makes CCJ’s share price very volatile. And volatile stocks should trade at a lower multiple, to compensate investors for that heartache.

And even though the stock is up slightly since my bullish recommendation, I believe that substantially more is on the cards for shareholders.

Author’s rating history

This is the one-line summary. Even though there has been an uptick in its share price over the past month, I don’t believe that CCJ is in any way pricing in the monumental change of policy in the past several weeks.

Recent Developments, Snapshots From Across the Globe

Things are now getting serious around the world as the energy crisis creates knock-on impacts on the economies of many countries.

From Japan’s recent about turn to UK’s new Prime Minister Liz Truss’s nuclear discussions, the move to use uranium as a key energy source is now seen as a viable option.

Further, in the US, the Diablo Canyon has been proposed to be extended beyond 2025.

Simply put, the tide is turning towards the use of nuclear energy. What was at one point considered a fringe energy source, is now very much a key part of the energy conversation.

In fact, recently the EU has changed its opinion on nuclear by calling for incorporating nuclear energy as part of its green taxonomy.

All these different government agencies from around the world are now embracing a substantial change in how they view nuclear energy. And this is not an accident.

This is a culmination of different factors – from high oil prices to the realization that the technology requirements to reliably source energy from renewables is still a long way away. Simply put, there’s a mismatch between what many wished for and the actual underlying reality.

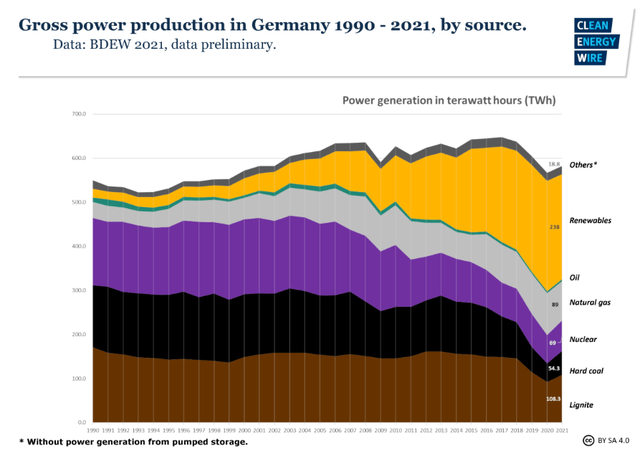

Even in the most advanced countries such as Germany, only 50% of the energy comes from renewables. That means that approximately 40% comes from fossil fuels, see above.

And if countries seek to become carbon neutral by 2030, these countries will rely on higher energy sources that emit low or no carbon, such as nuclear energy.

That being said, while a lot of these changes have come about in the past several, there hasn’t yet been a significant uptick in the price of uranium producers. And this is quite surprising.

Typically markets move quickly on the back of newsflow. And even though investors have generally accepted that we are in an energy crisis, with demand for oil staying relatively high, natural gas prices staying even higher on a relative basis, and coal the only one significant outperformer, the price of uranium has remained relatively unchanged.

Hence, the opportunity for investors right now.

CCJ Stock Valuation – 7x Sales

On the one hand, there’s no question that paying 7x sales appears to be a stretched multiple for a company that is both producing a cyclical commodity as well as a company that’s only slightly profitable.

Thus, for now, investors are asked to take a leap of faith that 2023 will see a significant uptick in revenues.

Given CCJ’s high fixed cost basis, that means that on the back of a substantial increase in revenues, that will lead to a pronounced improvement in its operating profit margins, so that its stock could ultimately report sustainably 10% operating margins.

Indeed, recall that CCJ hasn’t reported higher than 10% operating margins seen since 2010 to 2013.

The Bottom Line

Uranium prices are going to rapidly move higher as demand for this key energy source is rapidly increasing. And Cameco is well positioned to benefit.

The one blemish in the bull case is that CCJ today is only ephemerally profitable.

However, if there’s going to be a significant ramp-up in the demand for uranium around the world, note that uranium production globally runs at approximately 130 million pounds, while demand around the world in 2023 could now go beyond 180 million pounds.

This supply-demand imbalance is likely to see a significant uptick in uranium prices, thereby benefitting CCJ.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.