[ad_1]

Olga Tsareva

The Canopy Growth (NASDAQ:CGC) dream in many ways started to wilt immediately on and after October 17, 2018, when recreational cannabis sales commenced in Canada. Profitability has since always remained elusive for the Smiths Falls, Ontario-based firm which was once the largest of its peers but has since lost the crown.

It’s easy to see why as Canada’s cannabis regulations continue to be too burdensome and strongly averse to creating a platform for the type of operational gearing that supports sustained profits for a large number of operators. The black market has proved resilient as a result with 43% of cannabis users opting to source their weed from illicit elements. The dream was of a global and fast-expanding total addressable market that would give legs to the $4 billion Constellation Brands (STZ) investment. My inaugural article on Canopy; Dots On A Map Don’t Yet Make An International Market, tried to spell out why this was optimistic.

Hence, at the cusp of 2023 and with the commons down 78% year-to-date, bulls are asking what the near future holds. Constellation Brands as of the end of its last reported quarter still retained its stake in Canopy and has remained upbeat on the prospects of cannabis throughout this year. The $43 billion dollar behemoth will be a key strategic partner for Canopy’s eventual US expansion if and when cannabis becomes legal under US federal law. This will especially come from its extensive distribution network and retail partnerships.

The Future Into View

Constellation flagged Canopy’s long-term market opportunity and pending deals to fully acquire US-based Acreage Holdings (OTCQX:ACRDF), Wana Brands, and Jetty Extracts. Canopy recently quit cannabis retailing in Canada to restructure itself around a new subsidiary called Canopy USA. The intention is to gain access to a U.S. cannabis market that’s still pending federal legalization.

It’s hard to assess what exactly the global cannabis TAM will be with only a patchwork of countries legalizing cannabis for medical or recreational use. The dream of a breed of agile Canadian operators that would challenge large pharma and big alcoholic beverage firms has faded into obscurity as regulations proved too burdensome.

Canopy Growth

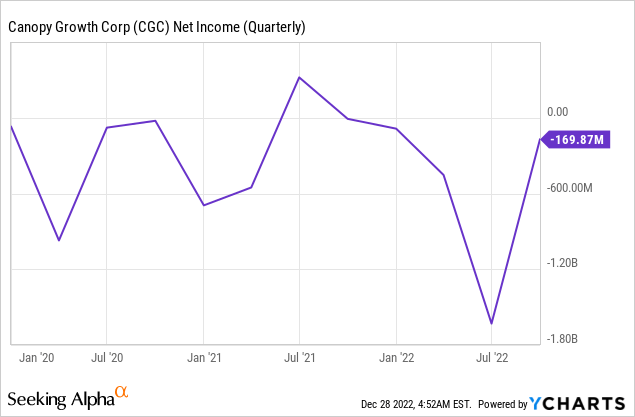

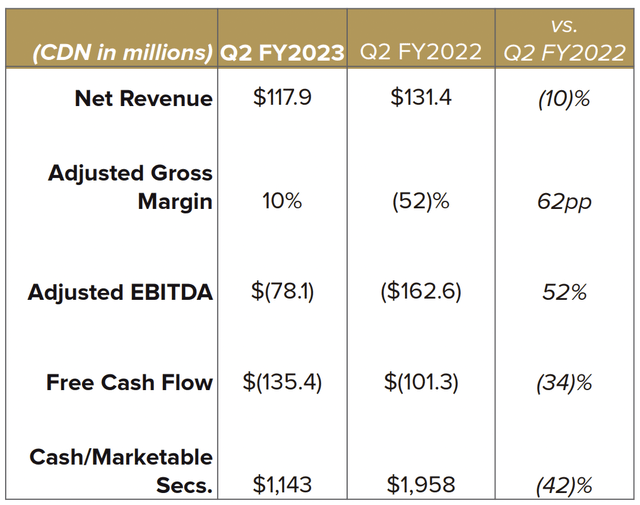

Canopy last reported earnings for its fiscal 2022 second quarter ending September 30. This saw three core takeaways for bulls and bears, the latter of which still retains a 15% short interest in the common shares. Firstly, net revenue declined by 10% year-over-year to reach C$117.9 million. Whilst this was a beat of C$4.77 million on consensus estimates, Canadian cannabis revenue fell by a significant 27% year-over-year to C$52.3 million.

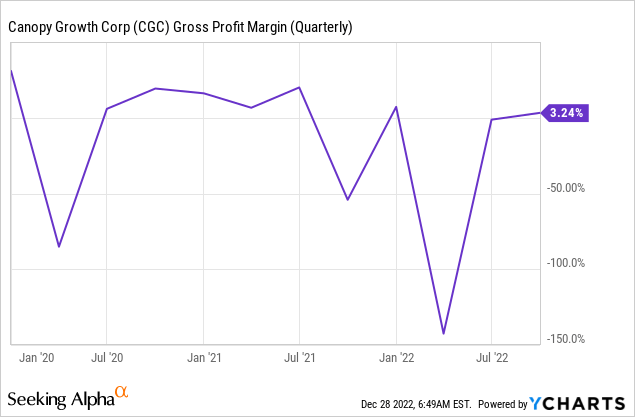

Secondly, adjusted gross margins turned positive.

This reversed a negative gross margin profile and came on the back of a reduction in excess and obsolete inventory charges in the Canadian recreational business. This overall meant core profitability improved but the company still generated negative free cash flow of C$135.4 million, up by 34% from the year-ago quarter.

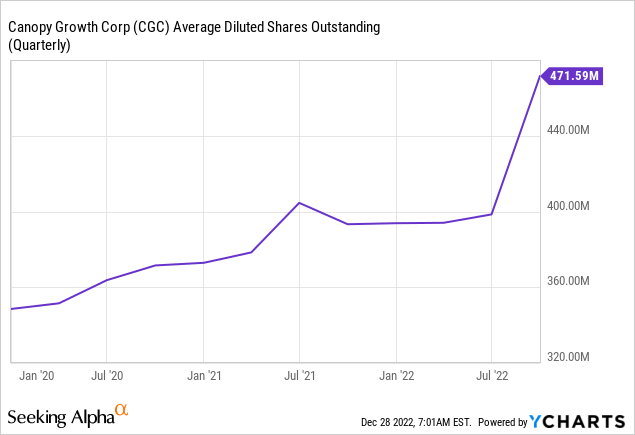

Consecutive quarters of cash burn exerted undue stress on the balance sheet and Canopy currently holds cash and equivalents of C$1.14 billion, down by C$229 million during the quarter. The company has leaned on dilution to plug previous gaps and close acquisitions, a position that is made harder by a falling share price and a fast reduction in the net cash position.

Pivoting To Kickstart Profitable Growth

It’s hard to believe now but Canopy once sported a valuation north of $20 billion. This was retrospectively an aberration in prudent security analysis borne by low interest rates and miscalculated global TAMs that drove an excessive amount of euphoria, hype, and FOMO.

The company’s profitable growth is required to reverse this trend and it starts with its US pivot. This is ramping up with Canopy USA recently converting a C$125 million loan into 24.6 million exchangeable TerrAscend shares (OTCQX:TRSSF). The transaction will increase Canopy’s stake to 18.2% from 12%. This could rise further to 23.4% if Canopy exercises its warrant option. This aggressive positioning to shift to the US market forms the only near-term salvo against the general uncertainty posed by the direction of global cannabis sales.

Whilst the Canadian government has launched a review of its Cannabis Act with the aim to ensure it aligns with its core objective of displacing the black market, the ship has sailed and Canopy Growth is out of retailing cannabis in the country. It seems to me that the Canadian cannabis market is the sick man of global cannabis sales even as the timeline for federal legalization in the US is still uncertain.

This has placed the future into view. Canopy Growth will likely be suspended in uncertainty for much of the new year. 2023 looks set to be more broadly characterised by macro-level risks coming to head. Is the current drawdown sustainable for the bears? This is hard to assess due to the volatile nature of the industry. The bears have the structural unprofitability of Canopy as a tailwind but the bulls have the longer-term dream.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.