[ad_1]

PonyWang

Many people are rightfully confused about the direction of the economy, as economists and CEOs are giving mixed messages. On the one hand, Bank of America’s (BAC) CEO, Brian Moynihan recently said that nothing will slow the U.S. consumer from spending money, while JPMorgan Chase’s (JPM) CEO Jamie Dimon is telling everyone to brace for an “economic hurricane”.

It’s no wonder then, that stocks have been volatile over the past couple of months. What’s good for value investors, however, is that market uncertainty has presented a number of opportunities to layer into quality stocks that have been beaten down.

This brings me to Carrier Global (NYSE:CARR), which, as seen below, has fallen by 27% since the start of the year. In this article, I highlight why CARR may be an attractive opportunity for strong long-term total returns from here, so let’s get started

Why CARR?

Carrier Global is a leading manufacturer of heating, air conditioning, ventilation, refrigeration, and fire and security products. Its HVAC business serves both residential and commercial markets, and its refrigeration segments serves the essential food transportation segment that’s integral to the cold storage supply chain. Carrier was originally spun off from United Technologies, giving it free reign to chart its own course, and in the trailing 12 months, generated $20.6 billion in total revenue.

Carrier’s advantages include its strong global reach, with products in 160 countries, as well as its diversified product portfolio and end-markets. In terms of its competitive advantages, Carrier has over 100 years of experience in the industry, which has allowed it to develop a strong brand name and reputation for quality.

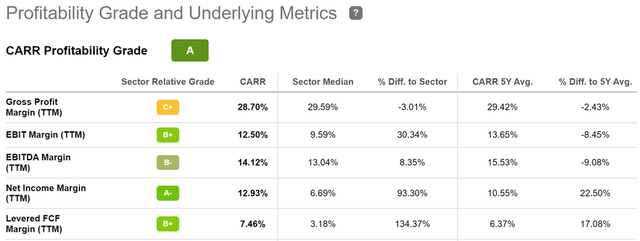

Moreover, Carrier also benefits from its aftermarket business, which provides replacement parts and services and accounts for around 30% of total revenue. This business is much more profitable than new equipment sales, as it has higher gross margins, and also provides Carrier with a more predictable and visible revenue stream. As shown below, Carrier scores an A grade for profitability, with a sector leading 12.9% net income margin, sitting well above the 6.7% sector median.

CARR Profitability (Seeking Alpha)

Meanwhile, Carrier has demonstrated respectable fundamentals, with organic sales up 10% YoY during the first quarter (total sales down 1% driven by the Chubb divestiture). This was driven by strengths in the HVAC segment in North American residential, light commercial, and building controls, which were all up by 20% YoY. Also encouraging Refrigeration sales were up 1% despite a difficult comparable with record sales during the same 2021 period.

Looking forward to Q2 results and beyond, I would expect for Carrier to post strong results, considering the recent record-breaking heat wave in Europe, as well as above normal temperatures across much of the U.S. As such, this should drive heightened demand for Carrier’s ventilation and air conditioning products. Risks to Carrier, however, include wage and cost inflation and increased competition, which could pressure its margins in the near-term.

Nonetheless, Carrier has a strong long-term outlook considering its largely pure-play focus, and focuses on service attachments and energy efficiency. This was highlighted by Morningstar in its recent analyst report:

Two of Carrier’s higher-profile growth initiatives include increasing its service attachment rate and becoming the leader in the applied HVAC market within five years. We think Carrier will successfully increase its service revenue, and while we believe it can gain market share in the applied HVAC segment, we expect tough competition from Johnson Controls and Trane Technologies.

We think Carrier’s HVAC segment (its largest segment at approximately 60% of sales) has the strongest long-term growth potential due to its commercial HVAC market exposure. We project the commercial HVAC market will grow above GDP due to increased demand for energy-efficient and indoor air quality solutions.

Residential HVAC demand remained robust in 2021, but we have a cautious outlook. On the one hand, we expect housing starts will remain elevated over the next five years (returning to 1.6 million units annually by 2025 after slower, but above historical average construction activity in 2023-24) and regulation changes (for example, refrigerants and energy efficiency standards) should be a tailwind. On the other hand, we believe the replacement cycle is maturing.

Meanwhile, CARR maintains a solid BBB rated balance sheet, and pays a 1.6% dividend yield that’s well supported by a low 23% payout ratio. While the yield is low, management has recently stated their intent on utilizing capital for either acquisitions or share repurchases, while aiming for a 30% payout ratio in 2023, thereby signaling a material dividend bump between now and then.

I see value in the stock after the market drubbing over the past few months, at the current price of $38.50 with a forward PE of 16.9. Sell side analysts forecast EPS growth in the low to mid-teens for much of next year, and have a consensus Buy rating with an average price target of $44.70. This translates to a potential one-year 18% total return including dividends.

Investor Takeaway

In summary, Carrier is a high-quality industrial with a strong market position, great profitability, and is set to benefit from heightened demand for its HVAC products. While the dividend yield is low at this time, a rise in the payout ratio next year could result in a meaningful bump. The recent selloff presents an attractive entry point for long-term investors.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.