[ad_1]

Here’s a look at the “smart-money” movement I’ve been seeing lately, and what I’m looking to do about it in my trading in the week ahead.

This week, I’ll be covering:

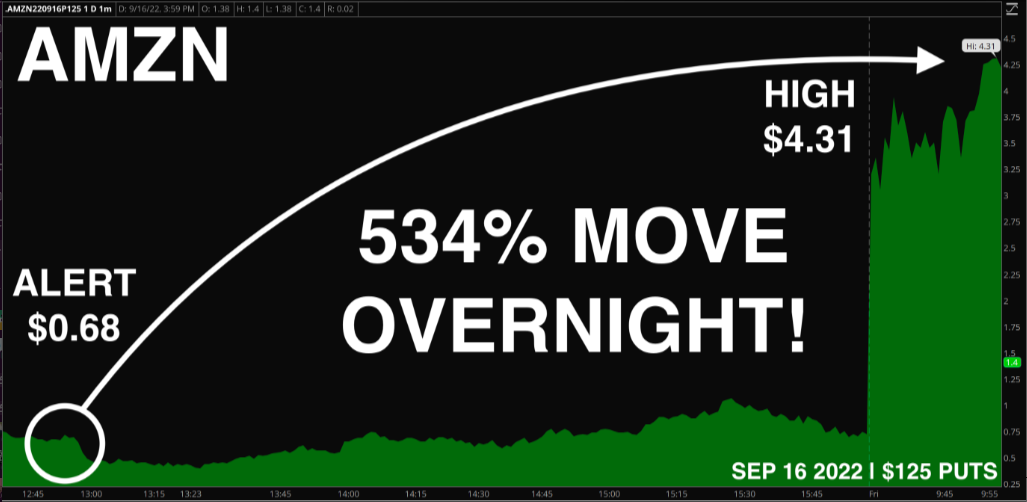

- AMZN – From 0.68 To 4.31!

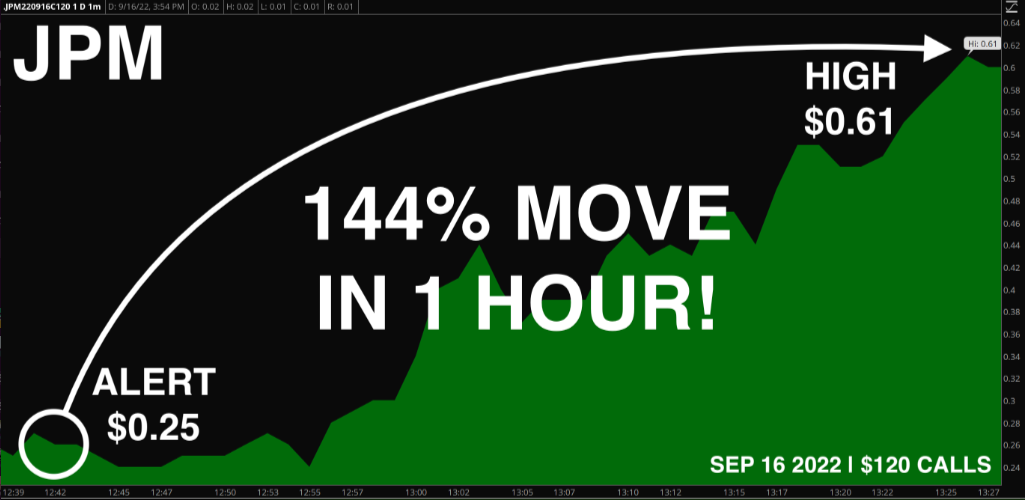

- JPM – From 0.25 To 0.61!

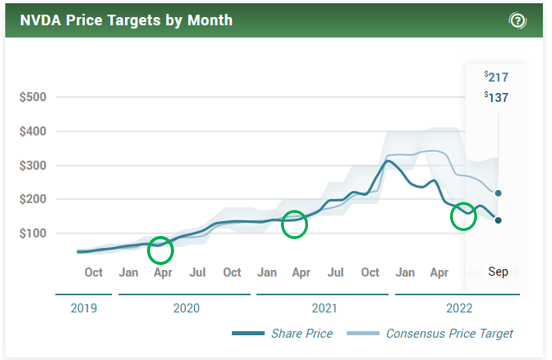

- NVDA – BIG Reversal From BIG Levels On BIG Buying

You Don’t Stand A Chance! Or Do You?

Friends, RagingBull’s CEO, Jeff Bishop, and I have been trying to tell you this for YEARS, and now the evidence has never been clearer.

Ken Griffin, the Founder of Citadel Securities, spoke to CNBC recently, where he exposed the truth about how he and his firm have rigged the game against retail traders.

This is MUST SEE viewing!

I mean, how stupid does this guy think we are?

At one point he says, “This is part of the march of progress forward.”

But then he immediately follows it up by saying, “understanding that many dynamics of how humans behave can, in a sense, be taken advantage of by technology.”

I feel vindicated because I have been warning you for years about this.

At the same time, however, I am disgusted that this is taking place because of how it hurts SO MANY small traders like YOU.

In a nutshell, what these quant strategies do is to wait for key points in the market where human traders tend to overreact, then they perform some shady liquidity tricks to spark a human reaction that allows the machines to swoop in to take your shares.

This is precisely why I have made “smart money” indicators the CORE of my strategies, so that I know when these BIG Wall Street players are making a commitment in the market.

That said, I remind you…YOU DON’T STAND A CHANCE IN THIS MARKET without tools like mine to help guide the way.

If you haven’t heard already, I introduced an INNOVATIVE new Smart Money product called Terminator Trades recently.

The introduction of this product was so popular, however, that I had to shut down registration so that I can be sure I’m giving all members the attention they deserve during my LIVE sessions.

But DON’T WORRY!

We are currently ramping up our backend operations so that we can start taking on new members again VERY SOON!

In the meantime, there is still an opportunity for you to get access to my favorite idea generation tools that I use every day to track smart money moves in the market.

Friends, this past week’s LottoX 0-DTE session was epic, YET AGAIN!!!

I mean, there were so many big movers on our ideas list that there’s too many to show here today.

Without further ado, here is just a little taste of what Ethan and I dished up this past week.

Back on 9/15/22 Ethan and I alerted my LottoX Members to:

AMZN Short

Contract: $125 Puts

Here’s what we said, “Ethan sees a lot of volume here, and that this big name could break down into tomorrow. These are trading around $.68.

And sure enough, the contract saw explosive price movement, with the contract jumping as much as +534% OVERNIGHT!

Next there was…

JPM Long

Contract: $120 Calls

Here’s what we said, “Ethan’s seeing financial names showing strength, and thinks JPM could keep moving up. These are trading around $.25.”

BOOM! The contract exploded as much as 144% IN LESS THAN 24 HOURS!

Now, BOTH of these throwbacks came from Thursday’s LottoX Live session. If you aren’t a member yet, consider saving on a year of access today. CLICK HERE TO JOIN LottoX.

Okay, that’s enough looking back… Because as much as I hope these helped you find some winning trade ideas, I want to talk about what’s cooking now in the Fat Cat Kitchen…

NVDA is back near BIG support!

Nvidia was a market DARLING during its post-pandemic, stimulus-induced surge that lasted from March 2020 to November 2021, because of the future investors saw for its chips in key areas like autonomous machines.

In its most recent earnings report, Nvidia saw large gains in its Data Center and Automotive segments, where the company’s high-end, AI capable chips have strong potential to expand market share.

Of particular interest to investors was the fact that the company’s automotive business was up 45% y/y and 59% q/q, showing not just gains, but accelerating gains.

Technically, the stock has suffered the same fate that MANY high growth stocks have during the recent rising interest rate environment, retracing roughly 75% of its post-pandemic surge recently.

But is all of that negative sentiment now priced in?

With the stock price now sitting at the low-end of analyst estimates, it’s VERY possible.

I can tell you one thing, if that’s the case, THESE ARE THE LEVELS where a bottom needs to form.

NVDA is now testing the rising 200-week moving average again.

I say “again” because this is a long-term smoothing line that the stock has rescinded positively to EVERY SINGLE TIME it has been tested since 2015.

Not only that, but the RSI and Accumulation/Distribution studies at the bottom of this next chart also show that large investors have been accumulating shares during the latest sell-off, as downside momentum has begun to show signs of slowing.

These positive volume and momentum divergences, when coupled with support from the 200-WMA, are the sort of MACRO items I like to see when looking for stocks that can bottom.

What I am REALLY excited about as a SIGNAL that the timing of a short-term rally is imminent is that NVDA registered an EOD opening sweeper 4 mins before the close in to shorter dated 9/23 $133 CALLS on my “smart money” scanner on Friday.

Friends, that’s a premium of $682K!

Now, I’ve already got my game plan for how I am playing NVDA this week.

If you don’t want to wait for next week’s “Hustle” to find out how things went, you can get actionable ideas delivered to you here.

Let’s have a great rest of the week and until next time!

[ad_2]

Image and article originally from ragingbull.com. Read the original article here.