[ad_1]

porcorex

Buying solid companies when the chips are down can be a winning strategy, especially when they pay a high dividend yield that’s well-protected by cash flows. Such was the case with many pharmaceutical companies last year, when the sector fell out of favor with investors, giving value hunters great opportunities to layer in.

Such I find the case to be with office REITs at the moment, as I recently covered Kilroy Realty (KRC). This brings me to City Office REIT (NYSE:CIO), which appears to be even more undervalued while sporting a higher dividend yield. This article highlights why CIO is a solid choice for value and income investors alike, so let’s get started.

Why CIO?

City Office REIT is a self-managed REIT that specializes in owning and leasing Class A and B Office properties in secondary markets. Rather than focusing on highly competitive prime markets, CIO follows a differentiated strategy by focusing on what it calls “18-hour” cities. These cities have vibrant and growing populations, yet are not as congested as the Tier-1 cities.

This strategy is beneficial as CIO encounters less competition for deals in these markets, thereby resulting in higher cap rates. This strategy, combined with market undervaluation with high dividend yield has resulted in strong total returns for CIO. As shown below, CIO’s total return since 2014 is second only to Alexandria Real Estate Equities (ARE) in the office property sector, while growing its FFO per share at the same time.

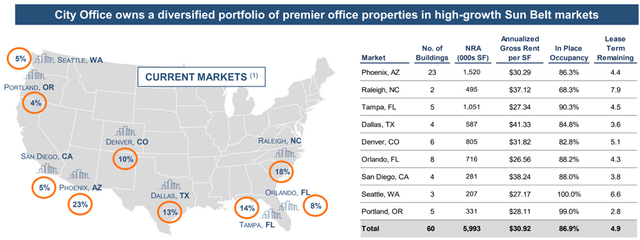

At present, CIO owns 60 buildings covering nearly 6 million square feet. As shown below, CIO’s regions trend towards warmer climates, including the Sunbelt region.

CIO Region Mix (Investor Presentation)

Meanwhile, CIO enjoys an overall healthy occupancy rate of 86.9%, which was impacted by the newly constructed Bloc 83 property in Raleigh, North Carolina that’s completing its initial lease-up phase and has signed leases that have not yet taken occupancy. Excluding this property, occupancy was 88.6% at the end of the second quarter.

It’s worth noting that CIO does come with its share of headwinds in this operating environment, as same-store cash NOI declined by 7.1% during the second quarter, due to lower year-on-year occupancy and free rent periods associated with new leases. Moreover, employee reservations around return to office at many companies adds uncertainty as to when occupancy will fully normalize.

However, I see reasons to be optimistic over the long run as hybrid work arrangements continue to require office space in the vibrant markets in which CIO participates. This is reflected by the 15.8% population growth rate that CIO’s Top-5 markets are expected to see this decade, comparing favorably to 5.5% growth in gateway markets, and 4.7% in the U.S. overall.

Moreover, CIO maintains a strong balance sheet with a net debt to EBITDA ratio of 5.8x, and pays a well covered 7% dividend yield with a 50% payout ratio (based on Q2 Core FFO per share of $0.40).

I see value in the stock at the current price of $11.50 with a forward P/FFO of just 7.4x, sitting well below many of its larger office REIT peers. Management apparently thinks the stock is rather cheap, as the company repurchased 2.3 million shares so far this year at an average price of $13.11 and what management estimates to be a 7.9% implied cap rate. This means that at the current price, share repurchases result in an even more attractive implied cap rate of 9.0%.

Meanwhile, Sell side analysts have a consensus Buy rating on City Office REIT with an average price target of $15.17. This translates to a potential one-year 39% total return including dividends.

Investor Takeaway

In summary, I believe CIO is an undervalued office REIT that’s well positioned to benefit from the structural tailwinds in its 18-hour markets. It carries a strong balance sheet, healthy occupancy levels and pays a well-covered dividend yield. Moreover, it’s provided investors with a comparably higher total return than most of its peers. I see value in CIO’s beaten-down share price for potentially strong long-term growth and income.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.