[ad_1]

Pgiam/iStock via Getty Images

Every month we seem to have to come back to the action in Cleveland-Cliffs Inc.’s (NYSE:CLF) stock. We have traded this successfully nearly a dozen times in the last year. We just can’t remember a stock like this, one that seems like it should be moving much higher, only to give us buying and selling opportunities seemingly month to month. Every time the stock gets some legs to around $20 it likes to pull back. And that gives us a chance you pounce again and again, offloading for gains. Eventually we would like to think that the stock gets well above $25 and stays there, as we move into a great time for real assets and commodities. But for now, we are looking padding short-term gains to help fuel our longer-term holdings. That said, steel and iron ore prices, as well as demand data, will drive a lot of the action in the stock both short and medium-term. Yet, we believe in the company and management long-term. Let us discuss.

Steel is cyclical

As we all know steel is a commodity and Cliffs for better or worse trades with the price of steel largely, as well as iron ore. The price of steel is rather cyclical, and some investors never touch it because long-term all of the stocks that operate in its production and distribution seem to offer lower returns than the broader market given how correlated the sector is to steel and iron ore pricing. It is also largely influenced by commercial and industrial demand. This latter point of course is tied to GDP strength though that link may be weakening.

Much of what we are seeing here in terms of steel pricing stems from the Federal Reserve’s unrelenting action to decrease inflation. This action has many investors concerned with a “possible recession.” Now technically we are in a recession, but we are not feeling it yet, other than at the gas pump, grocery stores, and housing. But with all of those items rocketing higher is it any surprise that the economy might slow? Steel pricing has fallen badly because of what could occur, not necessarily what will occur, but it does certainly seem like we are going to see a true slow down. Maybe not a crash, but a slowdown. The Fed is working to lower inflation, and does it not seem like we are doomed for a horrible economic slowdown, in our opinion.

So with that all said, we expected commodities to retract a bit. But this Cleveland-Cliffs is not the same stock from years ago as it has transformed itself beyond being a stock we trade for gain. Given the outlook for the company longer-term, the stock should move higher long-term.

Current valuation and price of steel during Q2

So while we have our opinions, the forward view is one that could see steel rebound, or hover sideways. But we think most of the technical damage is done for steel. That said, Cliffs recently reported earnings, and they were strong. The company missed a touch relative to earnings estimates but shares are valued at just 4x FWD EPS.

There were a few big positives in the release including management’s view of a “full-year 2022 average selling price expectation of $1,410 per net ton.” the company expects to generate massive levels of free cash flow in 2022. And yet, the stock is stuck. We just cannot remember a stock like this.

Top line strong

The numbers remain strong as Q2 2022 consolidated revenues were $6.34 billion, rising 26% from last year. For those keeping score this was a beat of $226 million vs. estimates. That is by and large good news. And yet, the stock has ebbed and flowed over the last few weeks. What is more, earnings power is strong.

Earnings power

On top of revenue growth, the company’s EBITDA and EPS remain strong, for the most part. Cliffs’ adjusted EBITDA of $1.1 billion in Q2 of 2022 was down sequentially though, it was also a touch lower from last year’s $1.4 billion. However, quarter to quarter can be volatile. Adjusted EBITDA was $2.6 billion through H1 2022 vs $1.9 billion through H1 2021. Cannot believe the action in this stock which is unreal. This adjusted EBITDA though H1 was three times higher than last year. It also brought the last 12 months of EBITDA to $6.2 billion. That is an all-time record for any 12-month period in Cliffs’ history. Cliffs earned $1.31 per share in Q2. Not too bad at all.

Cash flow is solid

We are also looking at a price to cash flow of less than 3x because cash flow is so strong. To be clear, Q2 saw the best free cash flow-driven debt reduction in company history and Cliffs generated $633 million in free cash flow. Winning. This cash generation in Q2 is more than double Q1, even after paying around $300 million of taxes.

Cleveland-cliffs august investor presentation

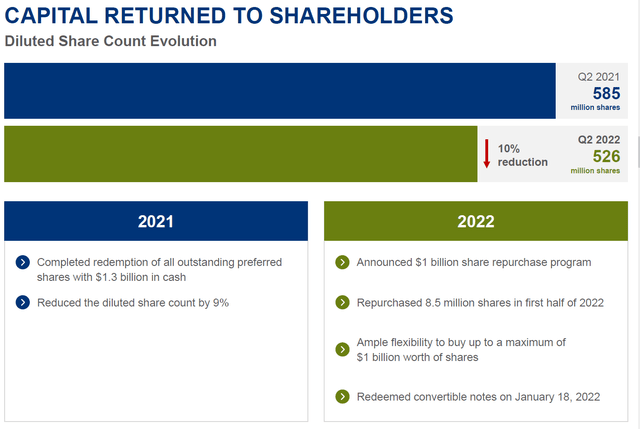

There has been a lot of capital returned to shareholders in some form or another and we expect this to continue.

The debt is coming down

The balance sheet is improving and again, Cliffs saw the company’s largest quarterly debt reduction ever, paying down hundreds of million in debt. There is still a lot of debt, but Cliffs chipped the debt down to about $4.6 billion while buying back 7.5 million shares in the quarter. Not only did they reduce the float they still have $2.3 billion of liquidity. The company is in good shape. Cliffs has done a great job here.

Closing thoughts

This is such an amazing trading stock that our faithful readers and especially our members have taken advantage of to make serious money. In our opinion there is great value here, especially as the stock moves lower and the company chips away at debt. Steel prices have come down on fear of recession. We think you let the market move lower, then add to this quality name. Traders know we can get out with an easy 10-20% gain, especially if we scale in down to the very strong $15 point. But all things considered, investors should be there too.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.