[ad_1]

Lemon_tm

Over the last year, global equity markets have been very volatile and many investors fled into Safe havens. Safe havens are investments that are expected to hold their value or even increase in value during times of economic uncertainty or market volatility. These types of investments are sought after by investors as a way to protect their wealth and minimize potential losses. These investments may not offer the potential for high returns. Still, they can provide investors with a sense of stability and security, which we saw in action over the last year, where Consumer Staples outperformed and closed the year positive.

In this article, I’ll review if Coca-Cola (NYSE:KO), one of the most prominent Consumer staples, still provides investors with a good safe haven compared to US bonds.

US Bonds as a lucrative alternative?

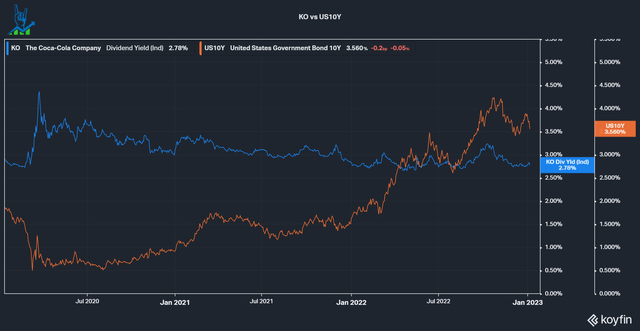

The classic example of a safe haven is the US 10-year treasury (US10Y), which has risen sharply in the last year, rising from just 0.56% in July 2020 to over 3.5% today. Until April of 2022, the decision was evident, with the low treasury yield, but after that, the treasuries have consistently stayed above KO’s yield, currently 78 basis points below the bond. This opens the question if it is still lucrative to hold Coca-Cola shares as a safe haven or if it would be prudent to own treasuries instead. We’ll look at KO’s business and growth prospects to find this out. After all, a treasury has a set yield once you buy it and it can’t increase the yield as companies can with dividend raises.

Revenue and earnings growth

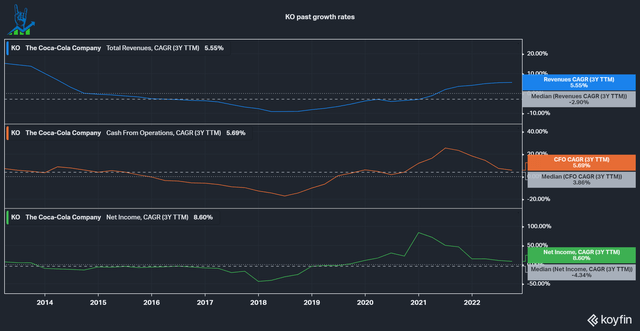

Over the past decade, we can see that KO’s growth in revenue, earnings and cashflows has been bumpy and lackluster. The company had a negative median 3-year revenue and net income CAGR over the last decade, while cashflows were only slightly positive at a 3.86% median 3-year CAGR. We can also see that in the previous years, the numbers are improving, so let’s see what analysts expect for KO in the following years.

Based on Seeking Alpha’s earnings estimates page, we get the following expectations for the next five years:

| Revenue estimate (billions) | EPS estimate | |

|---|---|---|

| Dec 22 | 44.77 | 2.49 |

| Dec 23 | 44.02 | 2.54 |

| Dec 24 | 46.33 | 2.75 |

| Dec 25 | 48.87 | 2.93 |

| Dec 26 | 49.34 | 3.26 |

| 5 Year CAGR | 2% | 6.18% |

Analysts expect the company’s growth to accelerate for the next five years, a positive sign for investors. Let’s see how this could translate into dividend growth and how safe KO’s dividend is.

Dividend yield and growth prospects

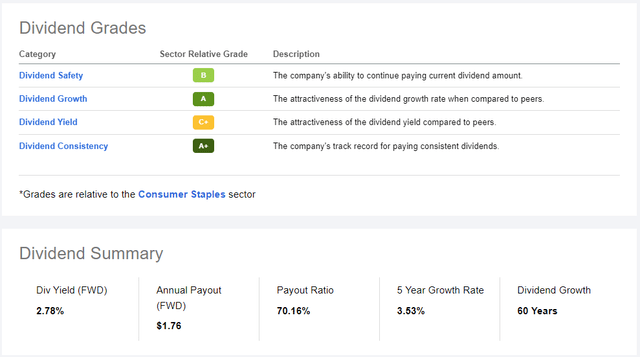

Let’s look at the Seeking Alpha Dividend Grades. We can see that KO scores well in most categories, especially Consistency with a 60-year record of dividend increases, making the company a dividend king. The most important question, in my opinion, is if KO can sustainably continue to increase it from now on or if the dividend is at risk, as I made a case for VF Corp’s dividend (VFC) in a recent article.

KO dividend grades and summary (Seeking Alpha)

Dividend safety

To determine the dividend’s safety, we can look at the payout ratio, both on an earnings and cash flow basis. The company has an excellent cash flow conversion and converts more than 100% of its net income into free cash flow. This is possible because the company leverages its great market position to get paid in advance. This can be seen in its cash conversion cycle of -181 days on average. With a cash payout ratio of 56% and an earnings payout ratio of 76%, we get a dividend that’s not at risk. The 5-year averages, on the other hand, were critical, with 91% and 181%, respectively. It showcases that the cash flows aren’t always stable. If KO doesn’t perform like analysts expect and earnings decline, the dividend could come at risk in the future. KO is dominant in the soft drink industry but highly relies on its leading brands.

Dividend growth prospects

To determine the dividend growth prospects, we can look at the past dividend growth rates and see if they can be matched or exceeded with the expected earnings growth. The table below shows that the dividend growth decelerated meaningfully over the last decade, almost halving from 5.6 to 3.2%. In line with the expected growth acceleration we discussed in a prior segment, analysts expect a reacceleration of growth in the next year but a similarly low growth rate of 3.3% for the next three years.

| Timeframe | Growth rate |

|---|---|

| Past three years | 3.23% |

| Past five years | 3.53% |

| Past ten years | 5.61% |

| Expected next year | 3.82% |

| Expected next three years | 3.3% |

At an expected Earnings growth of 6% over the next five years, this should continue to improve the payout ratio but doesn’t provide any significant growth in the dividend payments for investors. If we extrapolate the expected 3.3% annual dividend increases, KO’s yield (2.78% currently) will surpass the treasury’s (3.56%) after six years of increases.

Current Valuation

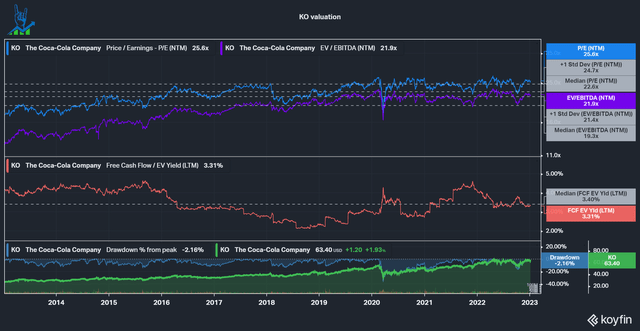

KO currently trades significantly below its 10-year median PE and EV/EBITDA multiples and slightly below its median FCF yield. Considering the massive slowing in dividend growth over the last decade and the switch from reduction to the expansion of shares outstanding (shares outstanding have increased 1.7% since 2018 versus a decrease of 5.5% from 2013 to 2018), I’d require a valuation below its median to justify a purchase.

Buy bonds instead of Coke as a safe haven

To conclude: At the current valuation and growth prospects, I do not see a significant enough possible upside in owning Coca-Cola as a safe haven instead of US 10-year Treasurys. The company has not shown stability in its earnings as I’d wish for a safe haven stock.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.