[ad_1]

undefined undefined

Thesis

Compass Diversified (NYSE:CODI) is a stock that could make sense in your portfolio. The company at the current price presents a unique opportunity to buy a stock with strong fundamentals at a discount, with predictable yields as well. We believe that the company can be a great way for investors to collect dividend income during times of economic uncertainty.

Company Overview

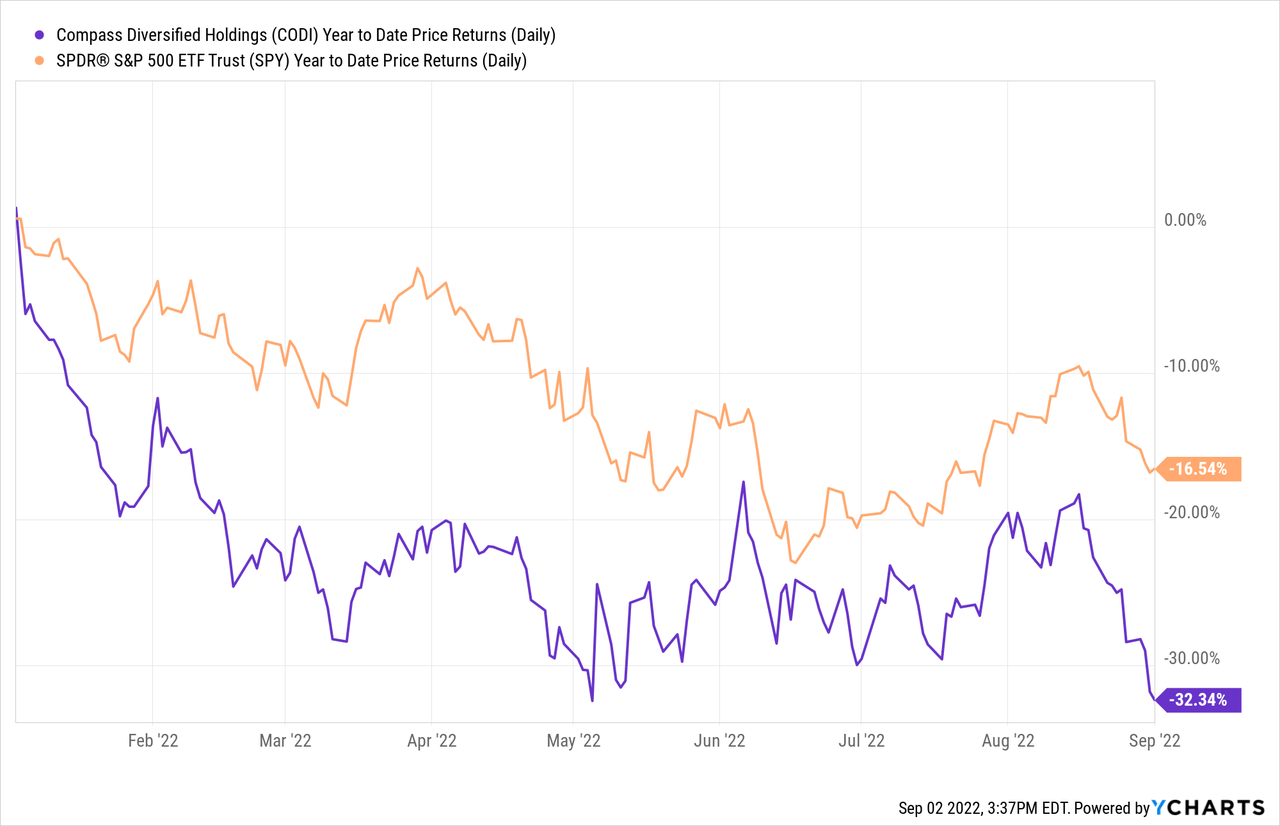

Compass Diversified is publicly-traded holding company that invests in middle-market businesses. The company currently has 11 assets in its portfolio, which amounts to a value of $3.1 billion. Compass Diversified maintains controlling interests in these assets (or subsidiaries) and works to maximize its value by increasing cash flow generation. The company invests in both equity and debt side of the capital structure. Since the IPO in 2006, Compass Diversified has made more than $6.4B in aggregate transactions and generated more than $1.1B in realized gains. Year-to-date, Compass Diversified has returned -32.34% compared to S&P 500’s return of -16.54%.

Strong Portfolio Performance

Compass Diversified has reported another quarter of substantial financial performance, most notably on net sales and operating income. Management reported a YoY quarterly revenue growth of 19% and a YoY operating income growth of 38%. Management cites the revenue growth to strong performance in the branded consumer and niche industrial subsidiaries. For example, portfolio companies such as 5.11 (designer of purpose-built technical apparel) saw a 6.7% YoY 1H 2022 revenue growth while other companies like Dialed In posted a 44.5% YoY revenue growth in the same time frame. Management also noted that across the subsidiaries, the adjusted EBITDA margin was 20% which shows the company’s efficient management of its portfolio. These strong results among the portfolio companies have allowed the company to post great overall results for the quarter.

Reasonable Valuation

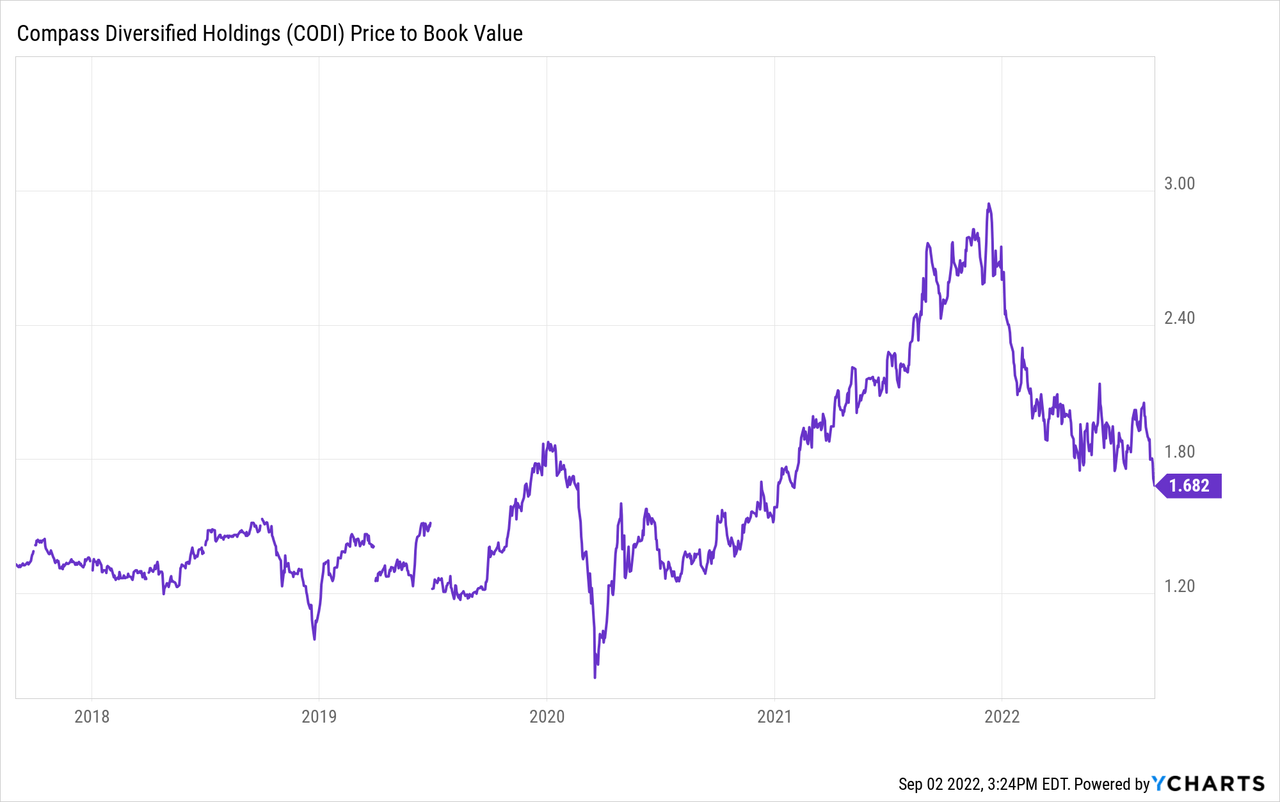

We believe that Compass Diversified is trading at a reasonable valuation multiple and looks attractive on a few metrics. First and foremost, we believe that on a price-to-book value, the company trades at a reasonable multiple, trading nearly 40% below its 2021 highs. Given the growth in all segments and a bright financial outlook, we believe that this multiple could rise when market sentiments change.

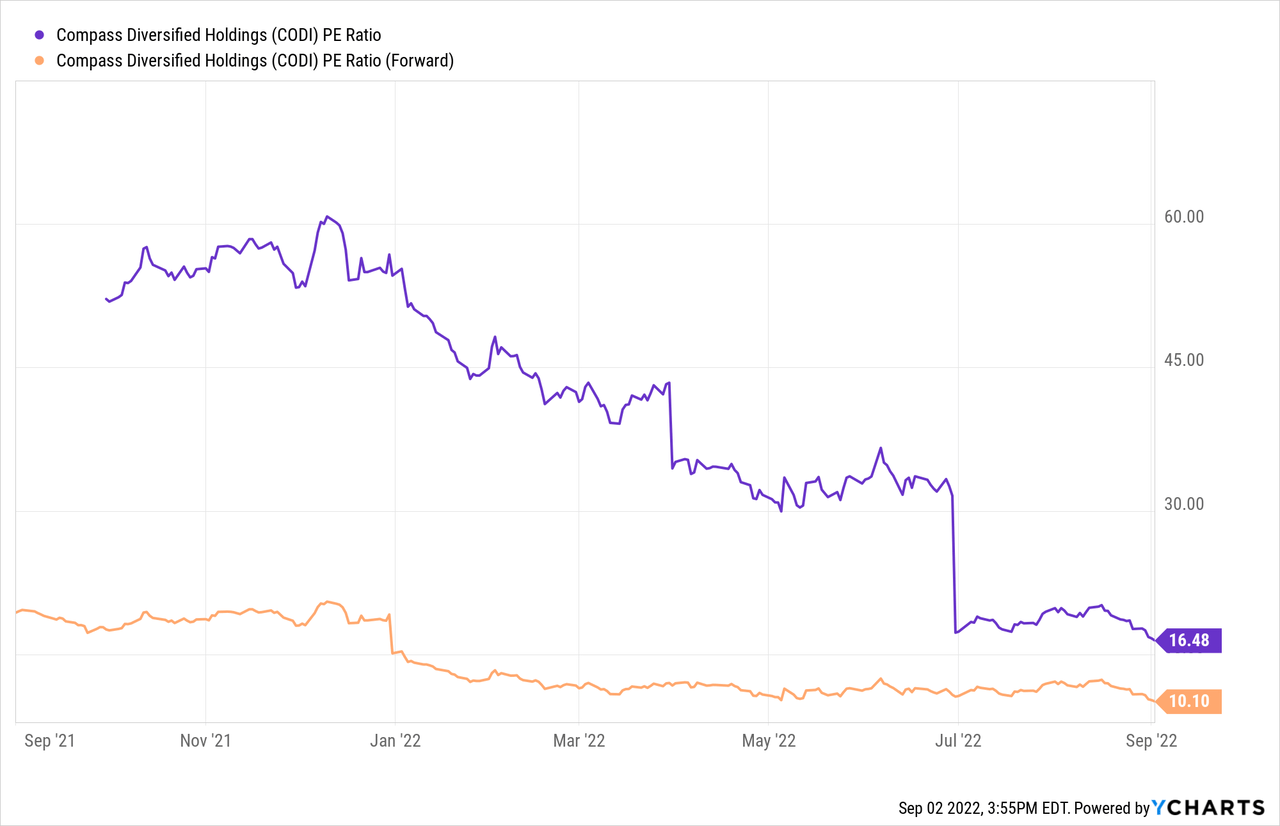

In addition, company management has guided that the earnings this year will be $130 million to $145 million on an Adjusted EBITDA of $445 million to $470 million. Taking the midpoint of the FY 2022 net earnings guidance ($137.5 million), the company current trades at around 10.6x P/E ratio. The estimated P/E ratio is far lower than the financial services industry forward P/E multiple average of 21.86x. Even when accounting for the trailing P/E ratio of 16.48x, Compass Diversified is well below the industry average.

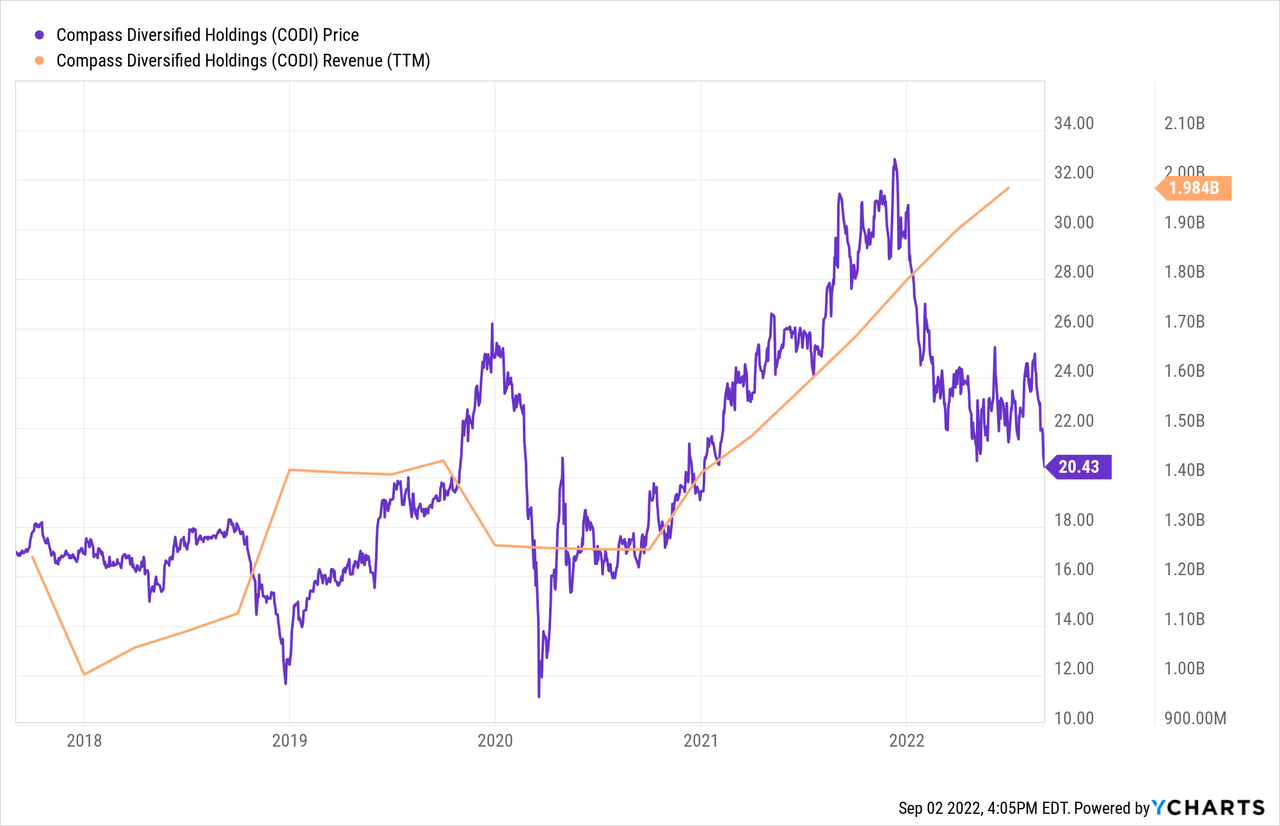

Are Distributions Safe?

Compass Diversified currently has a dividend yield of 4.79% at an annualized dividend payment of $1.00. At this rate, the dividend payout ratio is ~40% which gives room for the company to increase dividend payouts and/or sustain dividends during a financial downturn. We believe that at this price point, the current yields are very attractive, especially given S&P 500’s current yield of 1.69% and treasury yields at around ~3%. In addition, one can see the divergence in the company’s performance and the stock price. At the start of this year, we see a divergence in the stock price and the revenue growth. Though some of the revenue growth is from acquisitions, we believe that the stock price has largely been impacted by fearful market sentiment and worries of a heightened recession. However, the company has continued to post strong YoY results, and the company has ample access to liquidity. Management has stated that they have more than $100 million in cash and has access to $500 million in additional liquidity through a revolver. They also have no debt maturing until 2029, which should provide ample time for the company to navigate through any prolonged recession scenarios in the coming years. As a result, we are confident in the company’s ability to maintain this dividend, and we believe they have enough financial flexibility to raise dividends once macroeconomic conditions improve.

Conclusion

Compass Diversified is another investment worth taking a look during times of uncertainty. The company has posted strong financial growth in its subsidiaries, and the stock price is currently at historical valuation lows. In addition, we believe that the current yield is attractive, and based on our assessment, we believe that dividends will likely grow over time given the strong fundamentals or at the very least be maintained for the foreseeable future.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.