[ad_1]

SolStock

Investment Thesis

Conn’s, Inc. (NASDAQ:CONN) recently posted disappointing Q3 FY23 results. They saw a decline in sales in every department. Their debt also increased in the quarter. In this thesis, I will analyze their Q3 FY23 results and give my opinion on the company’s future. Given the macroeconomic headwinds, I believe they will continue to struggle in the future. I assign a sell rating on CONN.

About CONN

CONN is a home goods retailer, including consumer electronics, home furniture, and mattress. They operate through two segments, credit and retail. They provide home goods like refrigerators, dishwashers, and dryers. They also offer consumer electronics like LED, 8k televisions, video game consoles, home theater, and portable audio equipment. They have 160 retail stores across 15 states with over 3500 employees. They also operate through its online site (Conns.com) providing next-day delivery facility and installation services. It was founded in 1890 and is headquartered in the Woodlands.

Financial Analysis

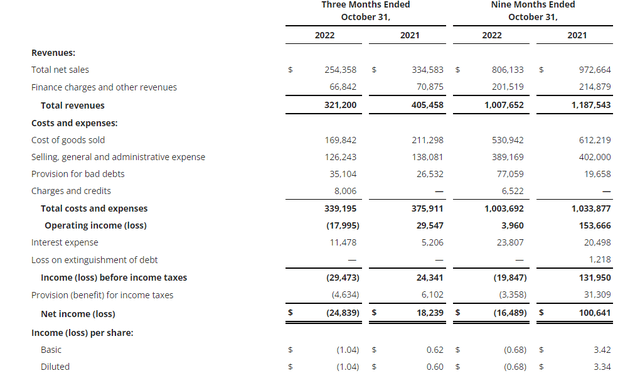

CONN recently posted its Q3 FY23 results. They beat the market EPS estimate by 6% and the market revenue estimate by 1.8%. Their reported revenues for Q3 FY23 were $321.2 million, a decrease of 20.7% compared to the corresponding quarter of last year. I believe there were several reasons behind this decline; the sale of furniture and mattress in Q3 FY23 saw a drop of 25% compared to the Q3 FY22, the sale of home appliances in Q3 FY23 decreased by 20% compared to the Q3 FY22, revenue from home office products in Q3 FY23 saw a decline of 50.3% compared to the Q3 FY22, sale of consumer electronics also saw a decline of 31.7%. Inflation severely impacted their sales in Q3 FY23. They struggled in every department, due to which their revenues fell in Q3 FY23. The reported net loss for Q3 FY23 was $24.8 million, compared to the net income of $18.2 million in Q3 FY22. I believe the primary reason behind the decrease was the increased bad debts. The reported bad debts for the Q3 FY23 was $34.8 million, an increase of 31.3% compared to the Q3 FY22.

The reported diluted loss per share for the Q3 FY23 was $1.04 compared to the EPS of $0.6 for the Q3 FY22. In my view, their financial performance in Q3 FY23 was disappointing; everything went downhill for them, macroeconomic headwinds like inflation challenged their retail sales. I believe recession fears might impact their sales in upcoming quarters.

Technical Analysis

Technically, CONN is looking very bearish. It is currently trading at $6.5, down 90% from its all-time high of $80. The stock is continuously forming lower highs and lower lows formation since the last one year, which is considered a very bearish pattern. It is well below its 200 ema, which is at $11; when a stock trades below its 200 ema, it is considered in a downtrend. There is a saying, “Don’t try to catch a falling knife,” same applies here. In my opinion, there is no buying opportunity in CONN. It might fall up to the level of $3. One can only enter the stock if it breaks the level of $11, forming a new high. If it breaks the level of $11, then it might be a sign of trend reversal, but till then, in my view, one should avoid entering the stock.

Should One Invest In CONN?

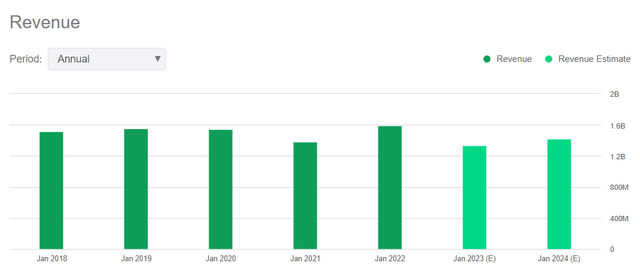

Quant has a sell signal for CONN, and I agree with it too. With a market cap of $157 million, they have total debt of $972.3 million, which is huge and a matter of concern. Companies with healthy revenues can pay off their debt and interest expenses, but if we talk about CONN, there has been close to no revenue growth from the past four financial years. If we look at the revenue estimates, the company expects its FY23 revenue to be around $1.34 billion, a decrease of 18.6% compared to the FY22 revenue. I believe the revenue decrease will surely put a burden on the company. With macroeconomic headwinds like inflation and recession fears, they might have a hard time in 2023. So in my view, it is best to stay away from it.

They have an EV/EBITDA (FWD) ratio of 26.8x compared to the sector ratio of 8.9x, which shows that they are overvalued with limited growth potential.

Risk

High Competition

The market for consumer electronics and furniture is highly competitive. They compete against a specialized group of national retailers, home improvement stores, and independent retail specialty stores. Some of their competitors have a financial advantage over them. The competitors might be able to purchase inventory at lower costs, and they might be able to provide products at a lower price when compared to CONN. They have to spend a lot on advertising and find ways to offer products at a better price to survive in the market. If they fail to attract customers, then it might affect their sales. They already have considerable debt, and the effect on sales might severely impact the company’s balance sheet.

Bottom Line

In my opinion, it is better to stay away from loss-making companies. Conn’s, Inc. is looking technically and fundamentally weak. Their revenues are declining with every quarter, and debt is also increasing. Given the recession fears and other macroeconomic headwinds, I believe Conn’s, Inc. will continue to struggle in upcoming quarters. So after analyzing all the parameters, I assign a sell rating on Conn’s, Inc.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.