[ad_1]

Eugene Gologursky/Getty Images Entertainment

The cybersecurity space remains in high demand, but the products aren’t always as crucial as most investors think. CrowdStrike Holdings (NASDAQ:CRWD) has run into this scenario where macro issues have caused customers to delay new projects, lengthening sales cycles and adding costs to close deals. My investment thesis remains Bearish on the stock with investors still too bullish on the cybersecurity specialist.

Not So Crucial

CrowdStrike has top notch cybersecurity products in demand, but the products don’t appear as crucial as promoted. At the recent Barclays 2022 Global Technology conference, CEO George Kurtz highlighted a sales cycle where customers freely pushed off deploying products in an endpoint security market where the company only has 12% market share.

Non-enterprise customers:

One was on the non-enterprise deals where we saw at the end of the quarter, we saw them push out to the tune of $15 million. And we saw sales cycles in that non-enterprise market increased 11% over the last quarter.

Enterprise customers:

…structure for our enterprise deals, where we saw some of the enterprise folks have staggered start dates. We’ve always had staggered start dates but we saw an increase over the last quarter to the tune of about $10 million.

And that’s — and to be very clear what that is, is that if a customer has 100,000 endpoints that they want to deploy our workloads, they might do 50,000 in this quarter and 50,000 next. That would be one example. Another example is a customer buys 7 modules, whatever it is. And the sixth or seventh they might push into the next quarter.

So SMBs are delaying deals while enterprise customers are pushing out the implementation of large deals to multiple quarters. CrowdStrike claims next generation endpoint security products, but customers appear in no major rush to start a new subscription when already deploying security products from the likes of Microsoft (MSFT) and other legacy vendors.

In the cybersecurity space, the issue is the tricky process of replacing legacy vendors or internal tools. Customers value cybersecurity, but most target customers already have existing security. Outside of those customers with a recent major breech, executives will always question whether implementing CrowdStrike is so crucial.

The big reason this matters is that SG&A costs start pilling up to close new sales deals. Shareholders make money when software and goods sell like hotcakes, not when a whole sales department has to spend months upon months to close a deal.

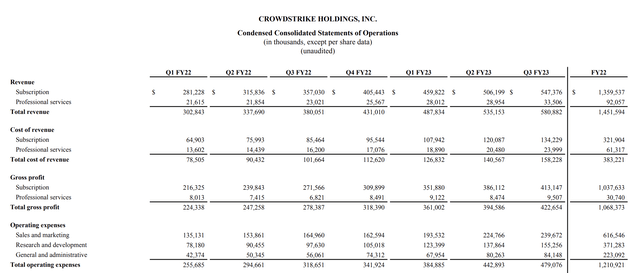

In the last 18 months, S&M expenses have risen $105 million to $240 million. Even G&A costs have doubled during the period to $84 million per quarter in FQ3’23.

Source: CrowdStrike FQ3’23 earnings report

The non-GAAP costs haven’t risen as much, but this is one analysis where investors should focus on GAAP costs to fully appreciate the higher expenses whether related to stock-based compensation or something else.

Excessive Hope Continues

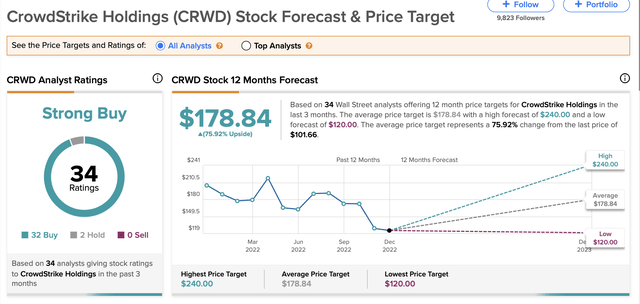

The shocking part of CrowdStrike is that investors still appear uniformly Bullish on the stock after the dip to $101. The company even guided to growth slowing, yet the average analyst is still handing out fake gifts with a $179 price target on the cybersecurity stock.

Note, CrowdStrike trades at 11x FY23 (Jan.) sales targets and the multiple only dips to 8x FY24 numbers of $2.98 billion. A lot of investors make the mistake of deriving whether a stock is cheap based on current prices, but one really needs to comprehend the multiple needed to generate the 20% or 50% gain an investor hopes to achieve in the next year or so.

CrowdStrike already trades at a rich multiple. To hit the analysts’ targets, the stock would need to surge to reach a multiple of nearly 15x FY24 sales targets.

A prime example of this excessive hope are analysts placing CrowdStrike on top 2023 pick lists. William Blair analyst Ralph Schackart recently placed the stock on the top tech list for 2023 with Alphabet (GOOG, GOOGL) and Workday (WDAY). BTIG suggests CrowdStrike is derisked, yet the stock has one of the more premium valuations and price targets around.

Takeaway

The key investor takeaway is that CrowdStrike would be a lot more appealing if the stock still wasn’t trading at a typical peak valuation at the market trough. Until analysts start forecasting CrowdStrike with the most downside risk in 2023 versus the current view of the best upside potential, the stock won’t become an appealing investment for the long term.

In our view, the Grinch has yet to arrive to steal the gifts being handed out by analysts.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.