[ad_1]

ugurhan

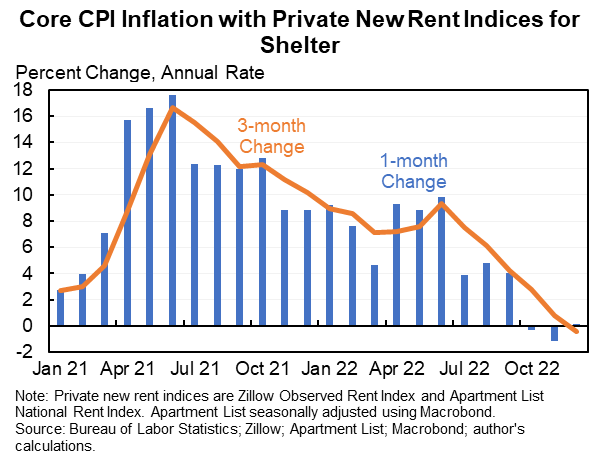

Core inflation has gone negative for the past 3 months, October through December of 2022, if one employs non-lagging metrics for Owner’s Equivalent Rent [OER], which makes up roughly 40% of core inflation. I previously wrote about this possibility a month ago, and this article builds on that one.

It turns out I overestimated how long it might take in my first article. Deflation is here, right now. Here’s a chart from Harvard economist Jason Furman, showing the effect, updated to include the inflation data release this morning. Core inflation is now negative over the past 3 months. I challenge anyone to look at that chart, and then tell me you are sure we are not going to see more deflation ahead. Because it sure as heck looks down and to the right to me.

Jason Furman

The importance of non-lagging rent

The US Federal Reserve’s preferred inflation metric is “core inflation”, and roughly 40% of this metric is the OER, which is essentially a measure of the average rent paid by US renters. OER is unfortunately a lagging indicator, since rents go up slowly as people sign new leases. If the rental market were to head sharply higher, it still takes a while before average rent metrics have time to catch up to reflect this.

One way to reduce the lag, and to get a more current view of inflation today, is to replace the OER with the average rent paid for new leases, for example using only those signed within the last three months, or even the last month. Harvard Economist Jason Furman has done exactly that, using private market rent indexes provided by e.g. Zillow (Z), and created the more current core inflation picture seen in the graph above.

Conclusion

Deflation is here, right now. A graph of inflation over the past 18 months is down and to the right, with one brief respite, from over 16% last June to a negative number the last 3 months. The trend may or may not continue. This seems important, and I don’t think it should be ignored.

Thanks for reading my research. If you want to learn even more about my research process and what stocks I like, check out my subscription marketplace service Concentrated Value with MVI. You’ll get:

- my portfolio of top ideas

- detailed write ups with regular updates

- extensive commentary

- access to the chat room

- one on one communication with me.

The best opportunity is when the other folks are panicking, but you keep your head. And that time is right. Now.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.