[ad_1]

Justin Sullivan

The pandemic was a major tailwind for many individual sports and just getting outside in general. Dick’s Sporting Goods (NYSE:DKS) no doubt benefited from people gearing up to ‘get into the out there.’ Golf, hiking, cycling, and other apparel are particular areas of strength for the firm that also has a solid omni-channel presence. Still, like many retailers in this environment, managing inventory is a major challenge right now. The stock sports a strong 3-month performance as investors remain optimistic about DKS execution. Mixed signals from Nike (NKE) and Adidas (OTCQX:ADDYY) earlier this earnings season create added uncertainty ahead of next week’s Q2 earnings report.

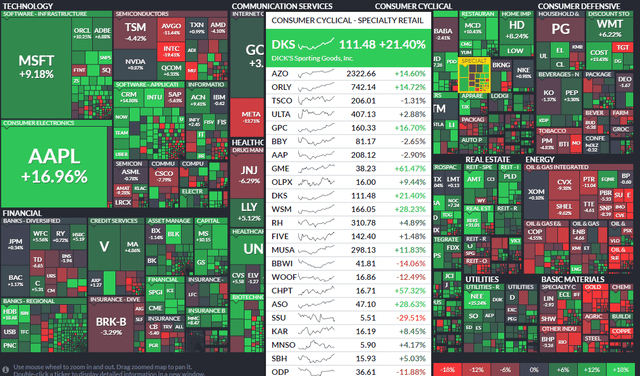

Three-Month Performance Heat Map: DKS A Retail Standout

According to Bank of America Global Research, Dick’s Sporting Goods, Inc is a full-line sporting goods retailer that offers a broad assortment of brand and private label sporting goods apparel, footwear, and equipment in a large box store format. The company also operates specialty standalone golf stores under the Golf Galaxy name and an Outdoor specialty store under the Field & Stream banner.

The Pennsylvania-based $9 billion market cap Specialty Retail industry company in the Consumer Discretionary sector features a trailing 12-month price-to-earnings ratio of just 8.7, according to The Wall Street Journal. Its dividend yield is 1.7%, about even with that of the S&P 500. Importantly ahead of earnings next week, the stock’s short interest ratio is very high at 27.3%. DKS is part of the equal-weight S&P Retail ETF (XRT).

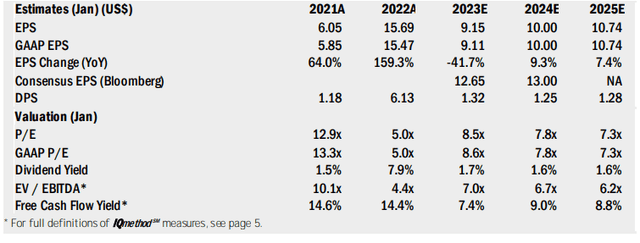

Analysts at BofA see DKS earnings climbing abnormally this year, then retreating in 2023. A steadier EPS growth rate is seen in 2024 and 2025. The firm paid a special dividend almost a year ago, so investors should be on watch for another possible distribution, but that is not the forecast. DKS trades at a reasonable EV/EBITDA multiple and it generates solid free cash flow. So the valuation picture looks favorable.

DKS Earnings, Dividend, Valuation Forecasts

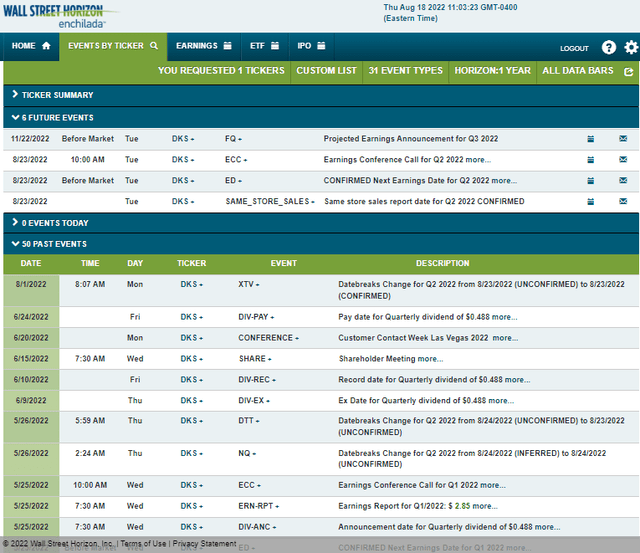

DKS has a confirmed earnings date of Tuesday, August 23 BMO, according to Wall Street Horizon. A conference call begins that morning at 10:00 am ET. You can listen live here.

DICK’S Corporate Event Calendar: Earnings On Tap

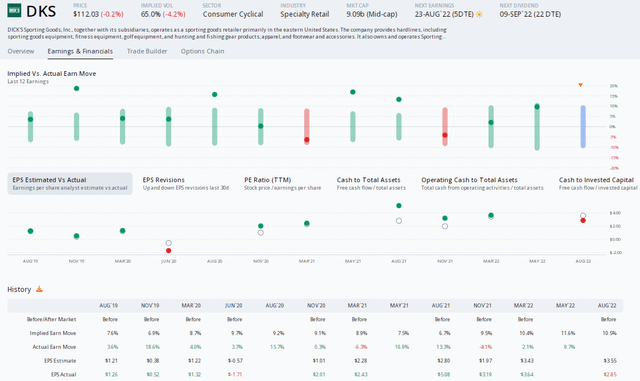

Looking closer at Tuesday’s Q2 earnings report, analysts expect $3.55 of EPS, according to data gathered by Option Research and Technology Services. Traders have priced in a 10.5% earnings-related stock price swing using the at-the-money straddle on the nearest-expiring options. DKS has beaten profit forecasts in the past eight quarters using ORATS data.

DKS Options Information: A Big Implied Move

The Technical Take

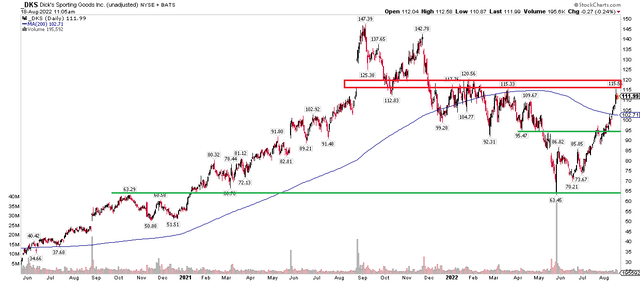

DKS has rallied impressively off its May low. Nearly doubling in less than three months, shares have found some resistance at a congestion area from January and February. The pause coincides with its October 2021 low. What I like, though, is that the stock has climbed above its flattening 200-day moving average. While most stocks have a negative-sloped 200dma, the DKS long-term trend is not so bearish.

I see support in the mid-$90s if we see a pullback post-earnings. I think the stock will indeed back off on this first try to climb above the year-to-date high. It’s certainly a ‘buy-the-dip’ candidate to me, though.

DKS: Shares Pause Under Its 2022 High

The Bottom Line

DKS looks good from a fundamental demand story as well as with its valuation. Technically, shares could pull back toward the 200dma if we see a negative earnings reaction, based on implied moves in the options market.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.