[ad_1]

Oselote

This analysis typically starts with gold, but the activity in platinum is a major event that should not be overlooked.

See the article What is the Comex? for a bit of backstory.

Platinum

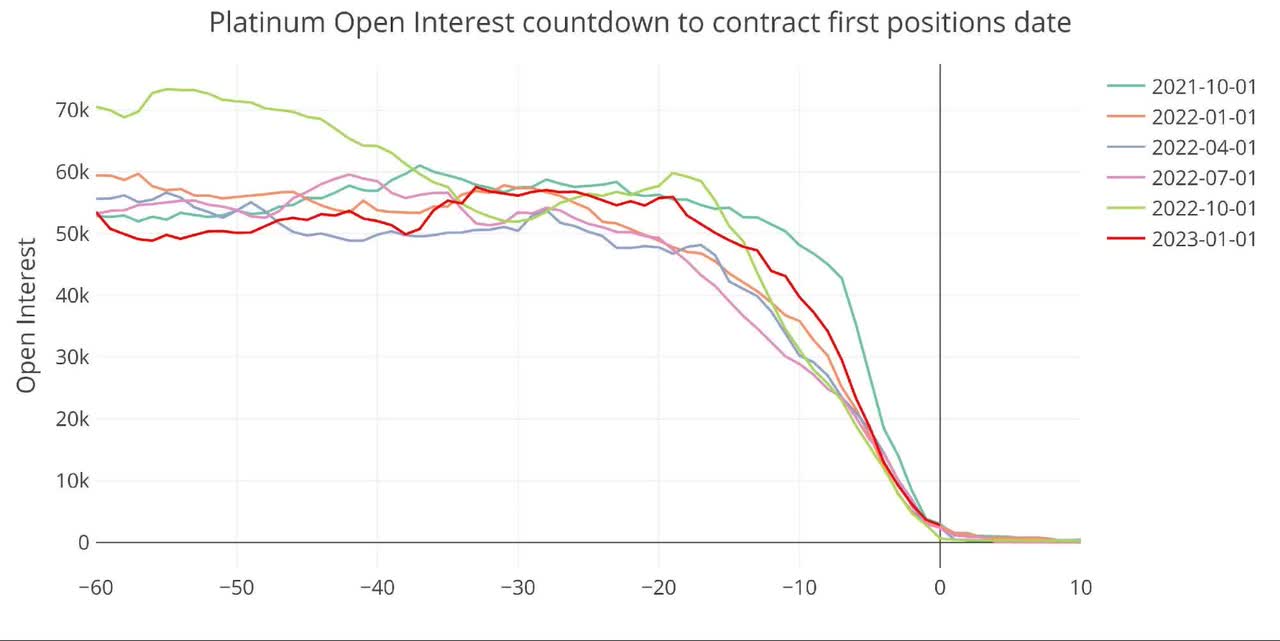

The major months in Platinum are January, April, July, and October. During major months, Platinum behaves a lot like silver and gold with lots of open interest that dives as first position approaches. This is when contracts need to roll or stand for delivery.

The current month looks like it followed a similar trajectory as past months.

Figure: 1 Cumulative Net New Contracts

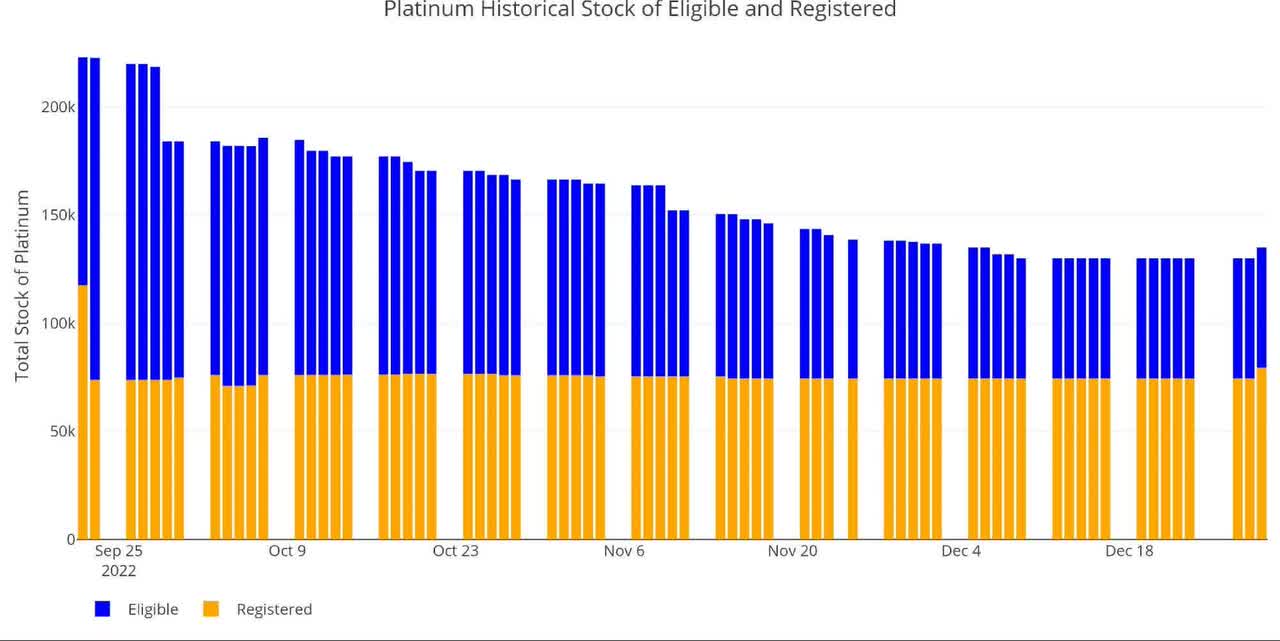

However, when you zoom in and look closely at the data, there are some very key nuances. Registered metal represents metal that is available to satisfy delivery requests. Eligible metal is in Comex vaults but typically owned by someone and is not (yet) available for delivery.

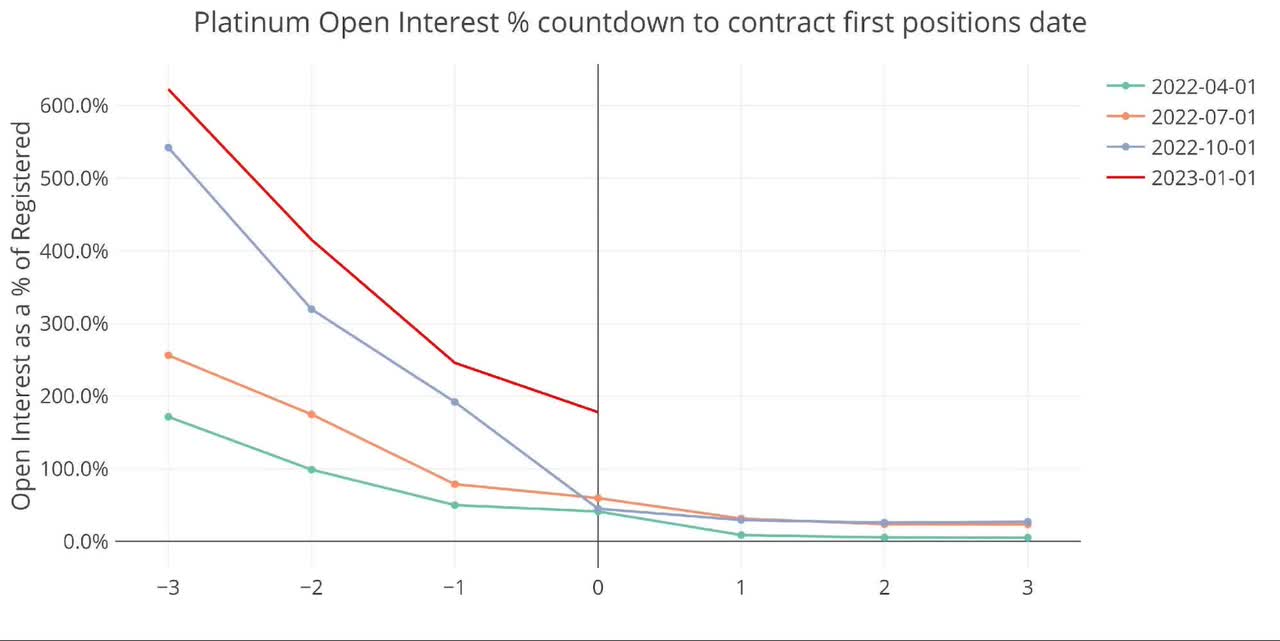

The chart below plots the open interest for major months as a percentage of Registered. While things in October looked quite bleak for the Comex (OI represented 192% of Registered with 1 day to go), there was a major drawdown in open interest on the final day to bring OI to 45% of Registered at First Position.

This was discussed back in September as Platinum shorts had lived to see another day.

The January contract ended up not seeing the same relief. As shown below, the OI on First Position (yesterday) represented 178% of total available Registered. This means that there are 1.7 delivery requests for each available ounce of Platinum.

Figure: 2 Platinum Countdown Percent

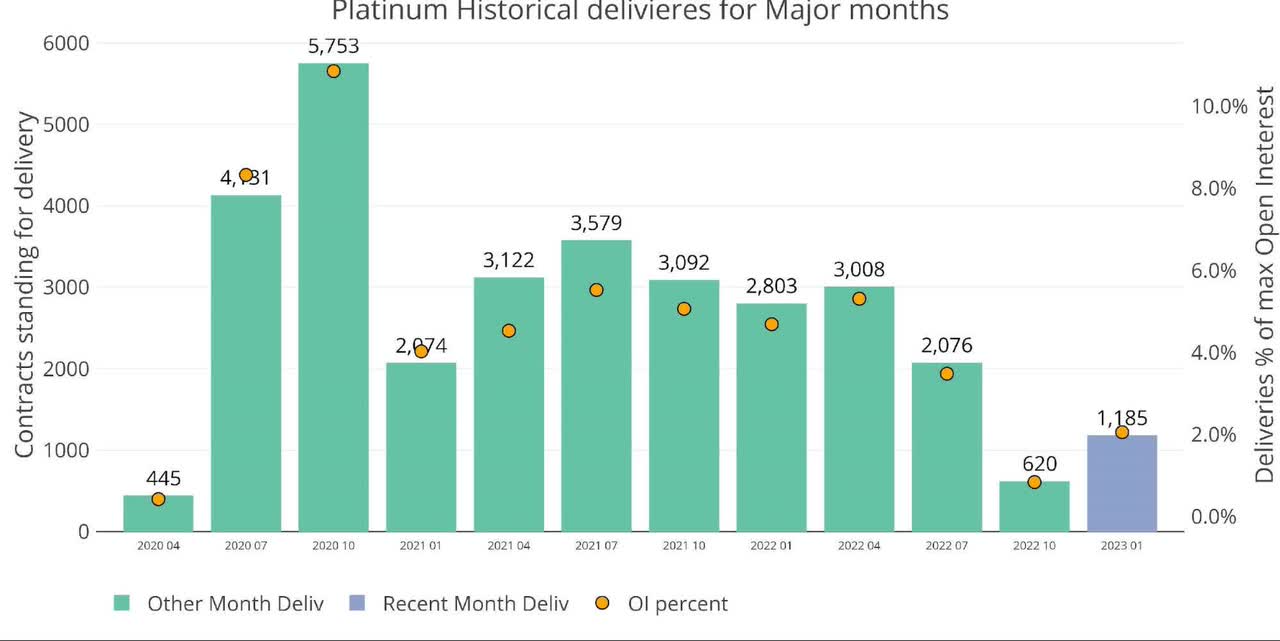

The chart below shows major month delivery volume. First, the October month should be highlighted for how much it diverged from other months. Delivery volume had been above 2k contracts (100k ounces) for over 2 years and then all of a sudden delivery volume drops to 620 contracts (31k ounces).

Figure: 3 Recent like-month delivery volume

Delivery volume had to drop because there were only about 75k ounces in Registered available for delivery as shown below.

In fact, total current platinum available in Comex vaults is around 135k ounces. So far, 1,185 contracts (~60k ounces) have been delivered (Figure 3) with 1,640 (82k) remaining in open interest. This exceeds ALL platinum in Comex vaults by 8k ounces.

You may notice a slight increase in inventory that occurred yesterday. This was 5,000 ounces being deposited directly into Registered on the day before First Notice. Considering this covers only about 100 contracts, it will not be nearly enough to satisfy all the demands currently outstanding in open interest.

Figure: 4 Platinum Inventory

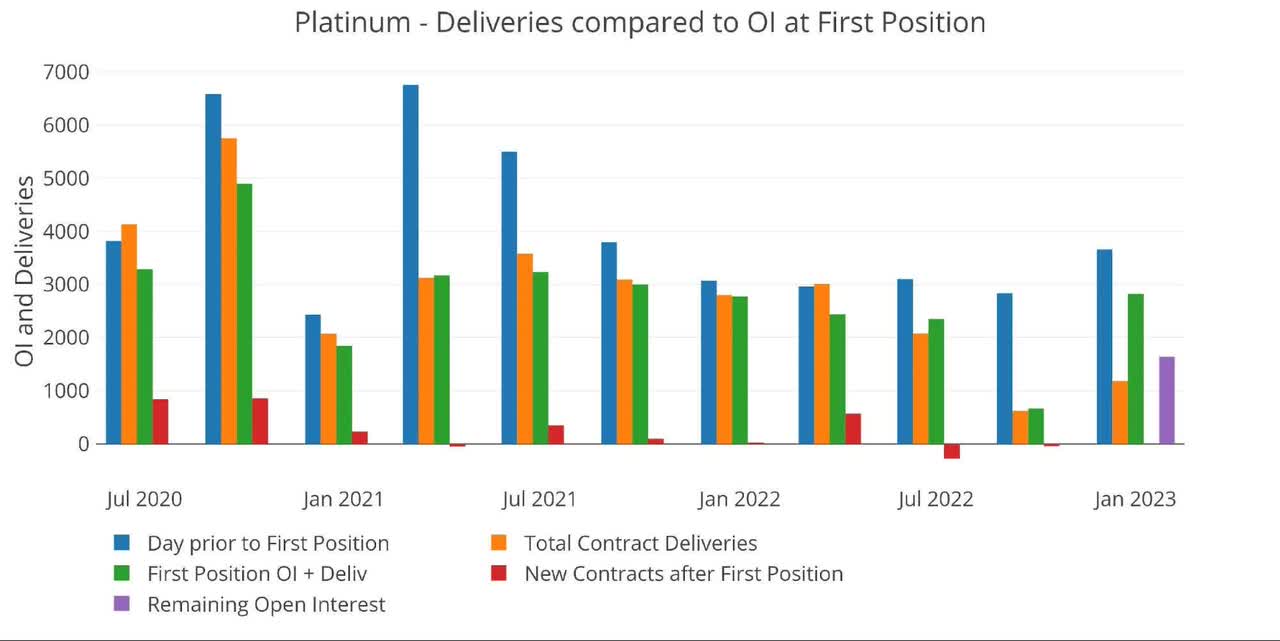

The chart below reiterates the big drop into close seen in October (difference between blue and green bars), but it also highlights a key variable which is net new contracts (red bars). Typically, platinum sees net new contracts open during the month for immediate delivery.

That has changed for the last two major months as contracts close mid-month rather than settle for delivery. More than likely, the trend will continue this month and will probably increase. It has to because there is not enough metal to deliver.

Figure: 5 24-month delivery and first notice

Implications

So, what does this all mean? Probably not much in the immediate future (i.e., platinum is not going to double overnight). The Comex is a major institution and platinum is a small, thinly traded metal. That said, this is likely a preview of what is to come in silver and gold.

Platinum has been ahead of silver, and silver is ahead of gold. “Ahead” in this case means thinner supplies of metal and oddities in the data like platinum saw for October. Instead, what we are likely about to see is a preview of what will happen in silver in 2023 and gold in 2024. How will the Comex bridge the shortage gap? What will happen to the price? How many contracts will cash settle mid-month? And what happens in April when platinum sees another major month?

This will play out slowly for now, but it could accelerate at any time. If investors sense weakness or a shortage at the Comex, things could get ugly very quickly. As silver supplies have been drained over the last year, it is becoming more likely that silver will see a similar event to platinum. When that happens, it will likely not be a minor event, but a major event. It will be a setup for the final event which will be a physical shortage in gold.

It would be wise to get your physical metal before this happens. Stay tuned!

Please note: Silver and gold are both in minor months with low delivery to start out so nothing major to report for this update. An analysis was provided last week and another will follow in a few weeks as gold prepares to enter February – a major delivery month.

Data Source: Futures & Options Trading for Risk Management – CME Group

Data Updated: Nightly around 11 PM Eastern

Last Updated: Dec 29, 2022

Gold and Silver interactive charts and graphs can be found on the Exploring Finance dashboard: Gold and Silver Analysis

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.