[ad_1]

FrozenShutter

Thesis

The leading media companies in the US have fallen by an average of about 30% YTD versus a loss of approximately 10% for the S&P 500. Among the leading three, Netflix (NFLX) has fallen by about 50%, Disney (NYSE:DIS) by 25%, Warner Bros. Discovery (WBD) by almost 50%. The sell-off was provoked by a slowing streaming narrative, generally increasing risk aversion and stock premia and a very challenging macro-environment.

In my opinion, Disney’s Q3 2022 has highlighted that the YTD sell-off is an attractive buying opportunity: The streaming slowdown has not really materialized for the company and, more broadly speaking, Disney has performed very well despite the highly challenging macro-economic backdrop.

Disney’s Strong June Quarter

During the period from April to end of June, Disney grew revenues by about 26% year over year to $21.5 billion, which is about 6% above analyst consensus estimates. Even more notably, Disney’s net-income surged by 53% respectively to $1.4 billion, and earnings per share of $1.09 – which is another strong analyst consensus beat. Bob Chapek, Disney’s Chief Executive Officer commented the quarter as follows:

We had an excellent quarter, with our world-class creative and business teams powering outstanding performance at our domestic theme parks, big increases in live-sports viewership, and significant subscriber growth at our streaming services. With 14.4 million Disney+ subscribers added in the fiscal third quarter, we now have 221 million total subscriptions across our streaming offerings

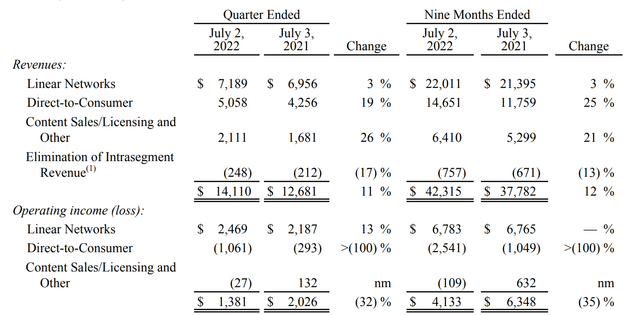

On a segment basis: Disney reported Media & Entertainment revenue of $14.1 billion, which is about 1% below analyst estimates; Linear Networks revenue was about 7.2 billion, 1% above consensus; DTC revenue was $5.1 billion, 3% below consensus; and Content Sales/Licensing revenue was $2.1 billion, about 1% below consensus. Finally, Parks, Experiences, and Products, was significantly better than estimated (9% beat) and was recorded at $7.4 billion.

Disney said that the company’s strong quarter wasn’t driven by pent-up demand and appears ‘far more resilient and far more long-lasting’ than what a pandemic-induced would recovery imply:

We continue to transform entertainment as we near our second century, with compelling new storytelling across our many platforms and unique immersive physical experiences that exceed guest expectations, all of which are reflected in our strong operating results this quarter.

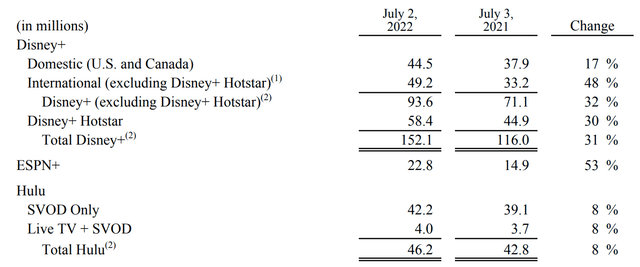

Streaming Now Bigger Than Netflix

Disney now has more subscribers than Netflix: 221.1 million. During the June quarter Disney+ added 14.4 million subscribers and now claims a subscriber base 152.1 million, which is about 5 million higher than what has been expected by analyst consensus estimates. Hulu subscribers base was 42.2 million and ESPN+ subscriber base was 22.8 million. To monetize the streaming business in line with its growth, the company will raise its monthly subscription fee to $10.9, up $3. In addition, Disney is planning to also create a new ad-supported subscription that costs $7.99. A notable, but acceptable, negative for the streaming business was that Disney reduced the estimated 2026 subscriber base by about 15 million, down to 245 million.

At this point I would like to highlight that the market, despite a very bad year, still ascribes significant value to Netflix’s streaming business. In fact, it is a multi-billion dollar stock, approaching the $100 billion. But arguably, the market does not really price any notably value to Disney’s streaming arm. If we discount and sum up the earnings of Media & Entertainment, Linear Networks and Parks/Experiences, we find that Disney’s $225 billion market cap could be justified. But if analysts also include the streaming business, with a similar valuation as Netflix, the logic does not add up.

Implications for Investors

There are arguably not many consumer-centric businesses like Disney that can perform to a similar degree during an economic slowdown. Those companies that can, but whose stock still sells off by more than 30% irrespectively, are enormous buying opportunities. I have no doubt that Disney can…

…continue to transform entertainment as we near our second century, with compelling new storytelling across our many platforms and unique immersive physical experiences that exceed guest expectations.

Accordingly, I believe Disney’s Q3 results will likely spark a sustainable rebound for the stock. And personally, I argue that within 12 months, DIS stock can rebound to its all-time-highs seen in March 2021. That said, my target price is $165/share, implying more than 40% upside from current levels. Disney is a Buy.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.