[ad_1]

articles (including this one), DivGro has seen more than 3,468,000 million

page views!

I’ve averaged an article every 2.7 days or about 11.3 articles every month and

about 950 page views per day.

The number of articles and page views are nice numbers to track, and I’m happy to celebrate

these milestones. But DivGro is all about generating a reliable and growing dividend income stream, and tracking DivGro’s projected annual dividend income (PADI) is much

more relevant!

DivGro’s PADI now stands at $45,885, which means I can expect to receive about $3,823 in dividend income per month, on average, in perpetuity, assuming the

status quo is maintained.

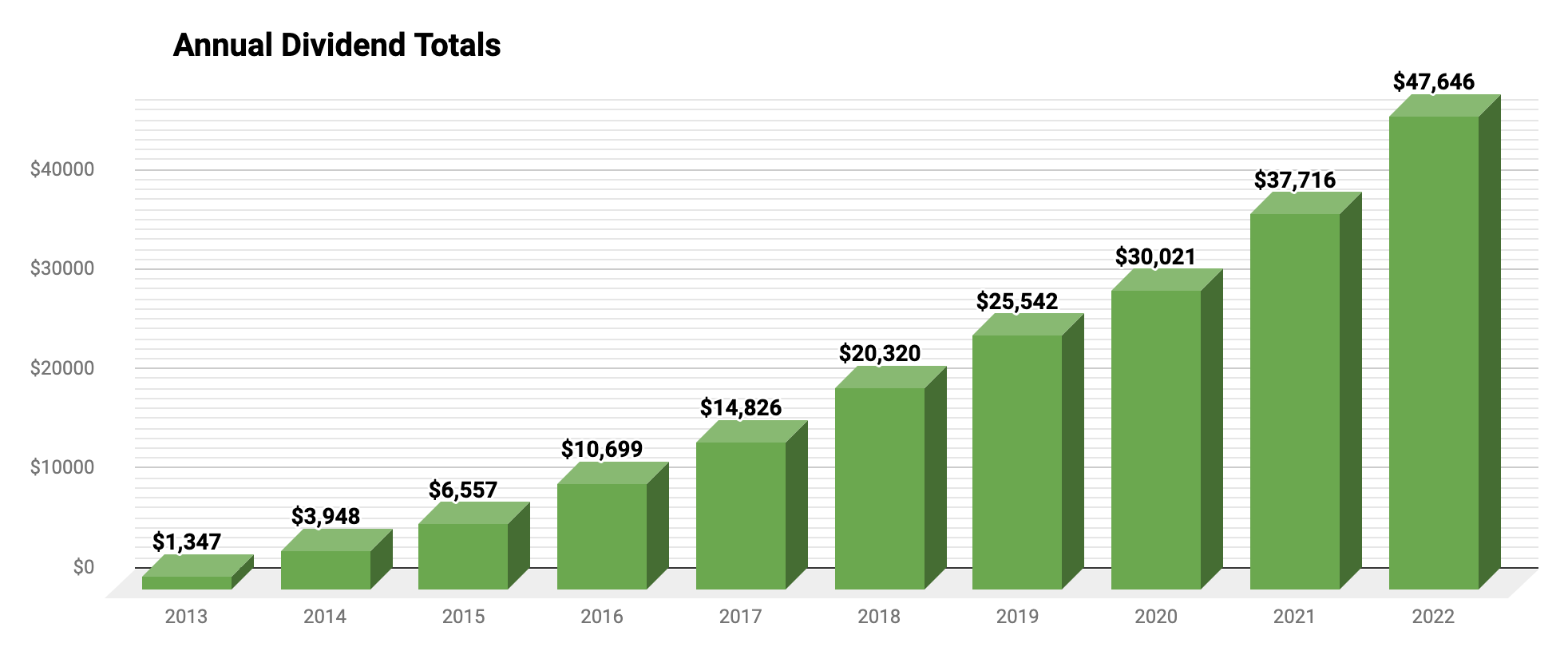

In ten years of dividend growth investing, I’ve collected more than $200,000 in dividend income, with just more than 23% or $47,646 collected in the last year alone!

The power of dividend growth investing is having your money generate more money through dividend income and doing so at an accelerating rate through dividend growth and reinvestment.

The following chart illustrates the power of dividend growth investing best, in my view:

The chart shows exponential, not linear, growth. Every year, more dividend income is added as compared to the previous year, much like a snowball rolling down a hill that picks up more and more snow with every rotation.

Below is a table with year-over-year increases in annual dividend income for DivGro:

| 2013→2014 | 2014→2015 | 2015→2016 | 2016→2017 | 2017→2018 | 2018→2019 | 2019→2020 | 2020→2021 | 2021→2022 |

| +193% | +66% | +63% | +39% | +37% | +26% | +18% | +26% | +26% |

Note that year-over-year growth of over 20% is only possible with continued capital investments. DivGro’s current yield is about 3.12%, whereas its 5-year dividend growth rate is about 9.39%. Dividend reinvestment adds another 3% or so.

Here’s to the next ten years, which, hopefully, will take me into retirement and beyond!

[ad_2]

Image and article originally from divgro.blogspot.com. Read the original article here.