[ad_1]

Every year-end, I write a short review article to announce DivGro’s best and worst performers for the year. I consider only positions I owned throughout 2022, including dividend growth stocks, dividend-paying stocks, growth stocks, and closed-end funds.

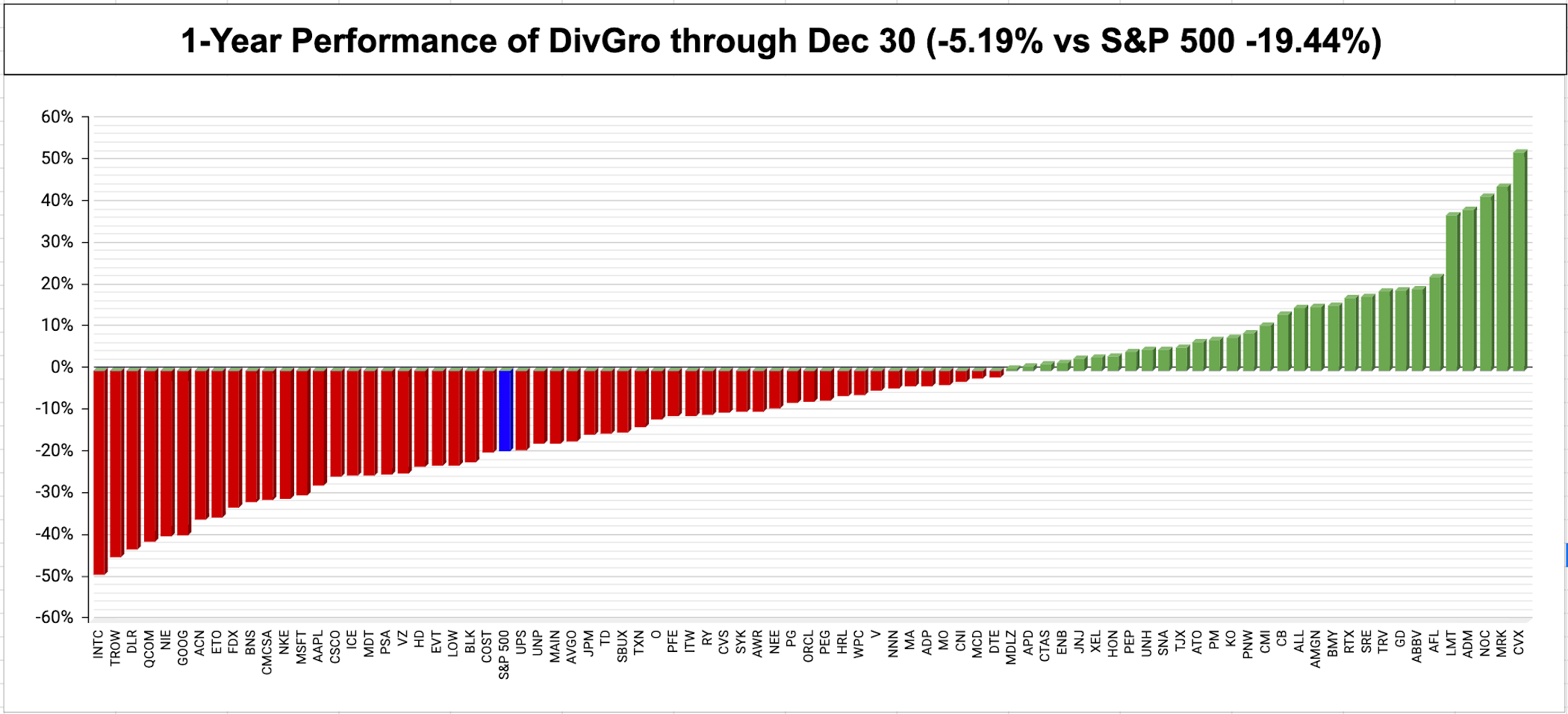

Of the 84 positions I’ve owned throughout the year, 53 stocks had negative returns, and 31 stocks had positive returns for the year. So it’s not surprising that DivGro had a down year in 2022!

This year’s best performer is Chevron (CVX), with a stock price increase of 51% in 2022! My worst performer in 2022 was Intel (INTC), down 49% since 1 January 2022.

Here is a chart showing the price performance of DivGro positions I owned each and every day in 2022:

This year was one of stock market turmoil, inflation concerns, interest rate increases, and geopolitical strife. The major U.S. market indexes suffered their worst year since 2008, with the Dow Jones Industrial Average down about 8.8%, the S&P 500 down 19.4%, and the tech-heavy Nasdaq Index down 33.1%!

Given these circumstances, I’m happy with DivGro’s overall performance. Being down only about 5% versus nearly 20% for the S&P 500 is no small feat!

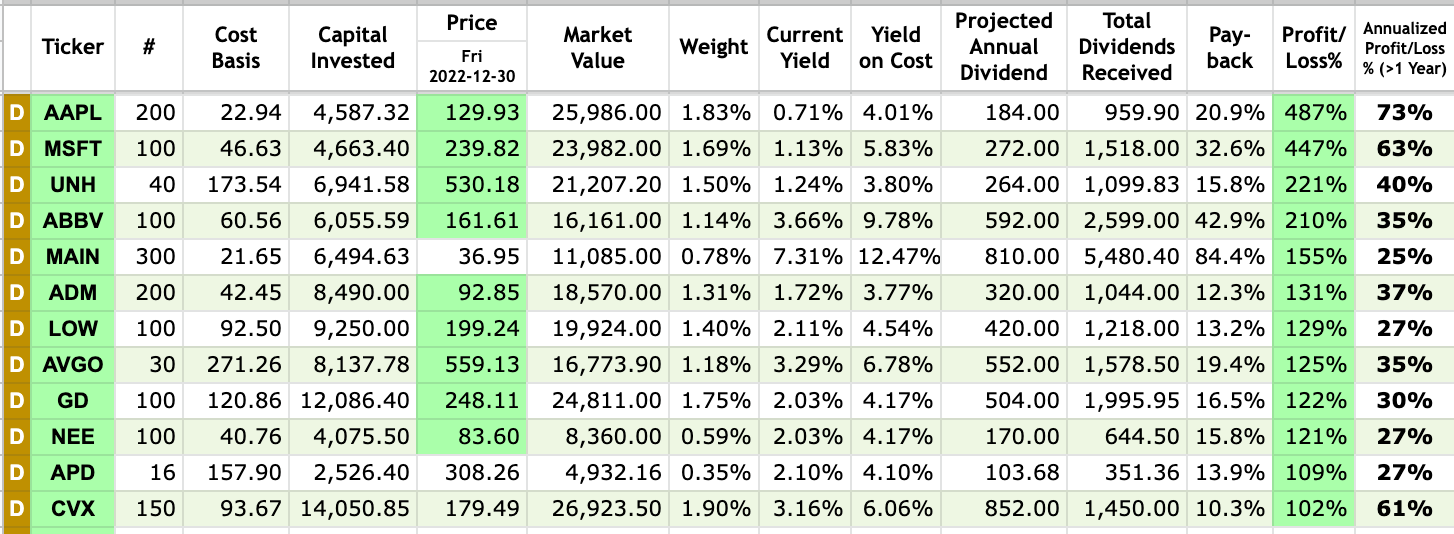

I have 12 positions with triple-digit percentage returns (including dividends):

Ten Worst Performers

The following table presents DivGro’s ten worst-performing positions in 2022. These are all stocks I owned on 1 January 2022 and that I still own today:

| DivGro’s Worst Performers of 2022 (Excluding Dividends) |

|||

|

Ticker |

Company |

Sector |

Total Return |

| INTC | Intel | Information Technology | -41% |

| TROW | T. Rowe Price | Financials | -45% |

| DLR | Digital Realty Trust | Real Estate | -43% |

| QCOM | QUALCOMM | Information Technology | -41% |

| NIE | AllianzGI Equity & Convertible Income Fund | Closed-End Fund | -40% |

| GOOG | Alphabet | Communication Services | -39% |

| ACN | Accenture plc | Information Technology | -36% |

| ETO | Eaton Vance Tax-Advantaged Global Dividend Opportunities Fund |

Closed-End Fund | -35% |

| FDX | FedEx | Industrials | -33% |

| BNS | Bank of Nova Scotia | Financials | -31% |

Ten Best Performers

The following table presents DivGro’s ten best-performing positions in 2022. These are all stocks I owned on 1 January 2022 and that I still own today:

| DivGro’s Best Performers of 2022 (Excluding Dividends) |

|||

|

Ticker |

Company | Sector |

Total Return |

| CVX | Chevron | Energy | 52% |

| MRK | Merck & Co | Health Care | 44% |

| NOC | Northrop Grumman | Industrials | 42% |

| ADM | Archer-Daniels-Midland | Consumer Staples | 39% |

| LMT | Lockheed Martin | Industrials | 37% |

| AFL | Aflac | Financials | 22% |

| ABBV | AbbVie | Health Care | 19% |

| GD | General Dynamics | Industrials | 19% |

| TRV | Travelers | Financials | 19% |

| SRE | Sempra | Utilities | 18% |

No stock in this year’s best-performers list was in last year’s best-performance list or in last year’s worst-performers list.

Concluding Remarks

You can follow me on Twitter and Facebook.

[ad_2]

Image and article originally from divgro.blogspot.com. Read the original article here.