[ad_1]

Justin Sullivan

How tough has the current year been for the retail sector? It depends on whom you ask.

On August 25, Dollar General (NYSE:DG) delivered top and bottom-line beats on solid comps that came alongside a bump in full-year guidance. The Tennessee-based company, which had been one of the first to drop the mic amid a devastating start to the COVID-19 crisis in 2020, proved that it can also execute well in a very different macroeconomic environment of rising rates, record-high inflation, and fears over economic deceleration.

I continue to think that DG is a stock to own for the long run, despite rich valuations, for reasons that I discuss below.

On Dollar General’s Q2 numbers and outlook

First, let’s take a look at the retailer’s numbers in the most recent quarter and the guidance for the rest of the year.

There was not much, if anything, about Dollar General’s Q2 report that could raise a yellow flag about the company’s performance in the July 2022 period. From total revenues to same-store sales and from gross margin to EPS, the retailer topped consensus expectations across the board.

Comps of 4.6%, better than estimated by 110 bps, probably impressed me the most. The number may seem small on the surface, but keep in mind how strong revenues have been in the past two years (comps in Q1 of 2020 reached an astounding 21%). Total Q2 sales, in fact, have increased by a respectable 11% annualized over a period of three years that has been quite challenging – think about the lingering impact of the tariff wars with China, the pandemic, rising consumer prices, rampant labor and logistics costs, economic uncertainty, etc.

The key components of revenues suggest that Dollar General’s business is in good shape. Traffic increased slightly, according to the company, and so did average transaction size. Strength in consumables more than offset weakness in apparel, seasonal, and home, which speaks to the benefits of Dollar General’s diversified product portfolio. The company’s traditionally aggressive footprint expansion strategy also played an important role in driving top-line growth.

Very importantly, gross margin of 32.3% was about 70 bps higher YOY. Considering higher input costs, which Dollar General recognized as a headwind in Q2, it is very encouraging to see margin expanding amid an inflationary environment. It speaks to the company’s ability to pass at least some of the higher costs on to the end consumer and to protect its profitability.

Due to improved business dynamics in the back end of Q2 and what CEO Todd Vasos called “a strong start to Q3” during the earnings call, Dollar General’s outlook for the rest of the year improved. Same-store sales are now projected to increase by an extra percentage point in 2022 compared to the management team’s previous estimates.

On DG stock

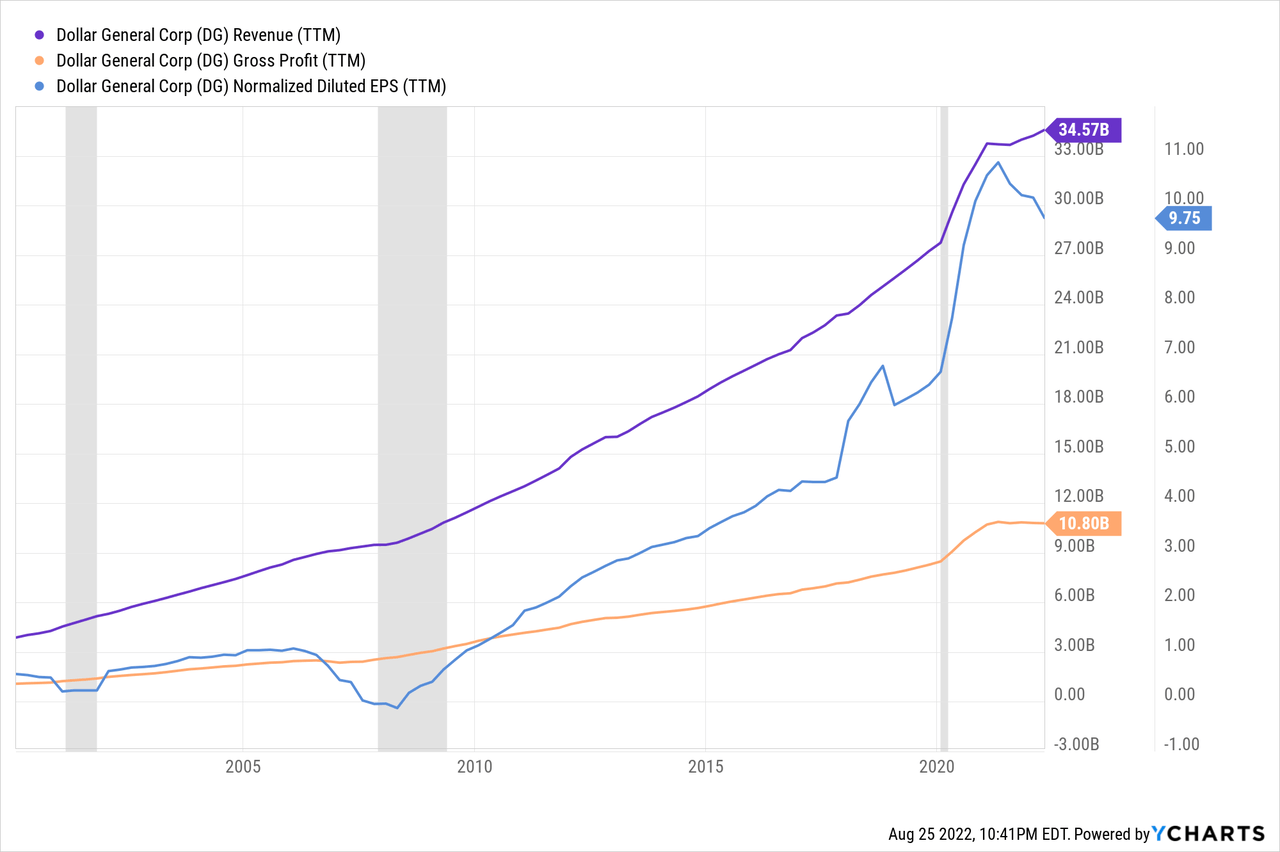

The chart below helps to explain why I have been a DG bull for as long as I have been covering this stock. It would not be accurate to say that Dollar General has been agnostic to economic cycles, but the company’s results have been remarkably resilient through periods of boom and bust.

While many retailers debate (and fear) the impact of a potential recession and pullback in consumer spending and sentiment, Dollar General’s management team probably has much less to worry about. The CEO’s remarks on Q2 earnings day help to explain how the company can even be a beneficiary of an eventual economic deterioration relative to the rest of the peer group:

We saw additional signs of our core customers shopping more intentionally and closer to need, as well as an increase in trade-down activity. […] We also saw growth in the number of higher-income households shopping with us, which we believe reflects more consumers choosing Dollar General as they seek value.”

In other words, Dollar General would probably do best when consumers have money in their pockets to spend, which tends to be the case for virtually any player in the retail sector. But even when things go south, Dollar General is more likely to have the products that consumers want at a more affordable price point during a downturn.

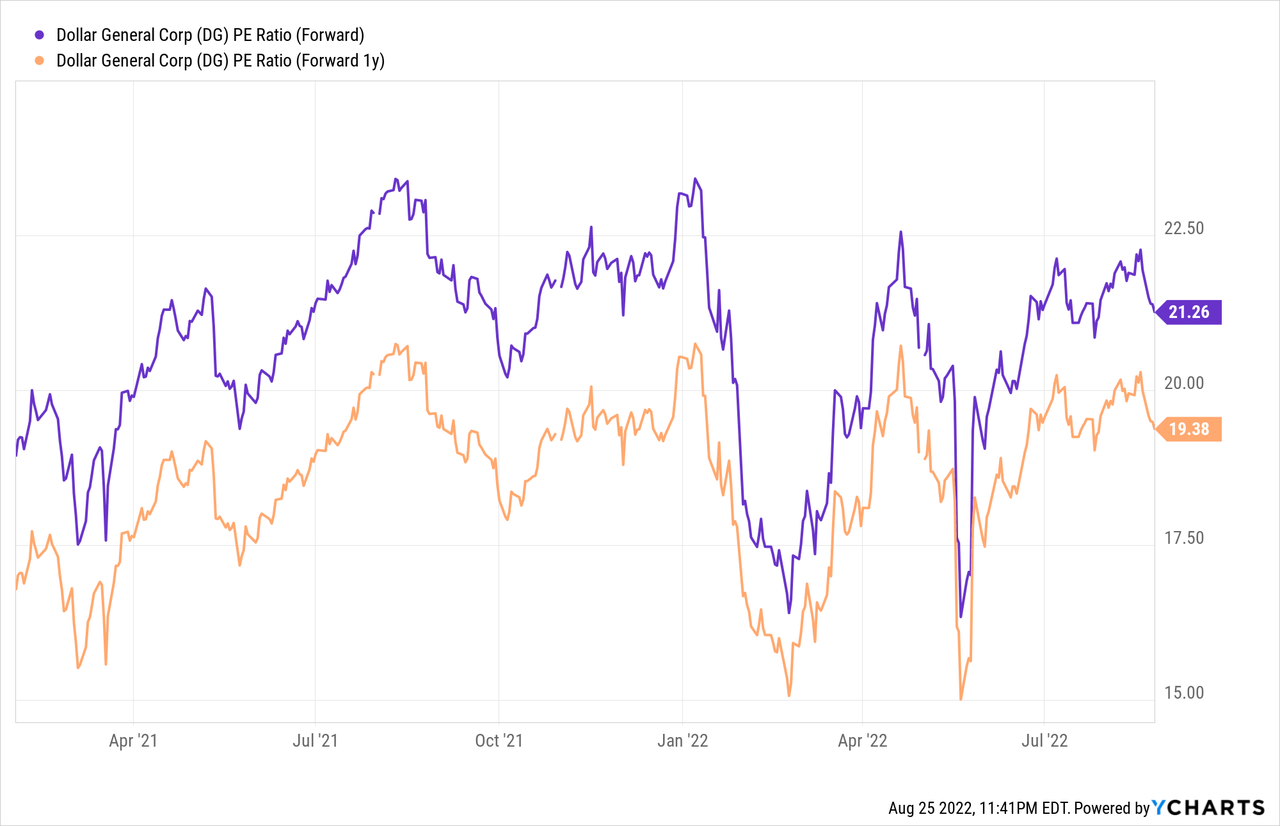

This is why I believe DG commands such a rich earnings multiple (see chart above): 21 times current year P/E and PEG (using next-year EPS growth consensus) of 2.3 times. While value investors might choose to find a bargain elsewhere, I think that holding quality, even if at higher valuations, makes the most sense in the current market environment.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.