[ad_1]

Wolterk

Taking crazy things seriously is a serious waste of time. – Haruki Murakami

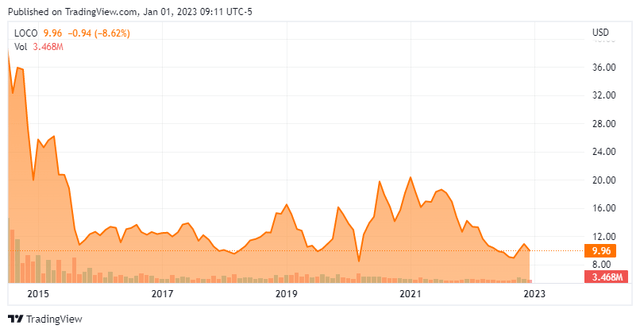

Our first and only article on a restaurant management company called El Pollo Loco Holdings (NASDAQ:LOCO) was just after its IPO. At the time, we stated that an investor would have to be ‘crazy‘ to put money in this name at the valuations it was trading for at that time. As we concluded “the chances are low that El Pollo Loco can live up to expectations set by investors that have bid up its stock to sky-high levels and this leaves the stock little room for disappointment.“

That turned out to be a prescient call as the shares, some eight years later trade for around 30% of what they were fetching back then. Valuations have come down tremendously as well. Is El Pollo Loco now a sane investment at current trading levels? An analysis follows below.

Company Overview:

The Southern California based restaurant operator develops, franchises, licenses, and operates quick-service restaurants under the El Pollo Loco name. The company operates approximately 480 restaurants comprising of 189 company-operated and 291 franchised restaurants located in California, Nevada, Arizona, Texas, Utah, and Louisiana. The stock trades right at $10.00 a share and sports an approximate market cap of $370 million.

Third Quarter Results:

On November 3rd, the company posted third quarter numbers. On a non-GAAP basis, the company made 14 cents a share in profit as revenues rose 3.6% on a year-over-year basis to just under $120 million. Both top and bottom line numbers slightly beat the consensus even as El Pollo Loco posted earnings of 28 cents a share in 3Q2021. Company-operated restaurant revenue contributed to the bulk of overall sales and came in at $103.2 million, which was up 3.4% from the prior year period.

Adjusted EBITDA came in at $11.6 million, considerably below that of $18.9 million in 3Q2021. It should be noted that the company recognized a one-time $3.2 million employee retention credit that positively impacted earnings in the same period a year ago. Management mentioned wage, commodity and utilities inflation impacting margins in the third quarter. Staffing levels did improved during the quarter it should be noted.

Management reiterated guidance that plans to open four new company-owned restaurants and seven to nine new franchised restaurants in FY2022 and capital expenditures will run between $19 million to $22 million this fiscal year.

Analyst Commentary & Balance Sheet:

There has been little in the way of analyst firm activity around this equity in 2022. In early August, Truist Financial lowered its price target from $15 to $12 while maintaining its Hold rating on the stock. Robert W. Baird reissued its Hold rating and $10 price target on LOCO in mid-October. The same week, Jefferies reaffirmed its Buy rating and $15.50 price target on the shares.

Approximately nine percent of the outstanding float in the shares is currently held short. The previous Chief Operation Officer at the company sold approximately $315,000 in February, but that was the only insider activity in the stock in 2022. On October 12th, the company announced it would pay a $1.50/share special dividend that was paid in early November. Management also stated it was implementing a repurchase program of up to $20 million, effective immediately. This news pushed the stock up 20%.

It should be noted that El Pollo Loco borrowed $46 million on a revolver to fund this special dividend payment which brought its outstanding borrowings up to $66 million. After payment of the special dividend, the company is had approximately $10 million in cash and marketable securities on hand.

Verdict:

The currently analyst firm consensus has the company making 55 cents a share on low single digit revenue growth in FY2022. Earnings are projected to pop to 75 cents a share in FY2023 on similar sales growth.

The stock trades at just over 13 times forward earnings and roughly 0.8 times revenues – certainly much more reasonable valuations than when we first looked at El Pollo Loco in 2014. That said, there is no compelling reason to own El Pollo Loco at current levels. The company should continue to generate low sales growth in the year ahead and the restaurant industry will likely face a litany of headwinds in 2023. These include inflation, a weakening economy and falling consumer confidence. Add in the fact the company degraded the quality of its balance sheet to pay out a special dividend, I will still pass on making an investment in LOCO even though its valuations are no longer insane.

Some are born mad, some achieve madness, and some have madness thrust upon ’em. – Emilie Autumn

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.