[ad_1]

wildpixel

Elon Musk Warns Of A Severe Recession Like 2009

As we approach 2023, not all investors (like energy investors) have been hammered by the bear market that engulfed tech and growth investors in 2022. The Fed’s unrelenting hawkish pivot has caused tremendous pain to these investors, as the pandemic-induced liquidity craze caused valuations to surge to unsustainable heights.

However, once the FOMC realized that inflation was no longer “transitory,” the unraveling of the market was devastating. Accordingly, SPX (SPX) (SP500) (SPY) lost nearly 30% from its January highs toward its October lows. We postulated in an article that those lows looked robust and continue to expect them to hold.

We also updated our members to be wary about the recent bull trap that occurred at the initial rally, post-November CPI release. Accordingly, the SPX pulled back nearly 10% from its December highs to its recent lows as market operators drew over-optimistic buyers into a well-laid trap.

As the market attempts to consolidate above its October highs, we discuss whether investors should consider taking a more defensive approach or getting more aggressive in 2023.

One thing is for sure. If a recession takes place in 2023, it could be the most well-telegraphed recession that market strategists/economists/investors have been anticipating.

Despite that, company analysts have remained defiant over the economists’ consensus forecasts of a recession, which Fed Chair Jerome Powell has emphasized as “unknowable.“

Accordingly, analysts’ bottom-up estimates for the SPX suggest a 2023 price target (PT) of 4,493.50 (nearly 17% above its December 23’s close). Hence, analysts are likely not expecting a recession of any sort.

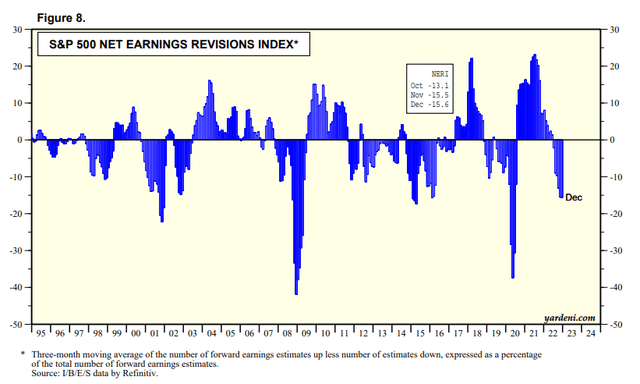

S&P 500 net earnings revisions % (Yardeni Research, Refinitiv)

Furthermore, as seen above, they accelerated their downward revisions of earnings projections through December, suggesting analysts have likely baked in significant pessimism into their forecasts.

So, are analysts too sanguine? Tesla (TSLA) CEO Elon Musk warned that we could be in a “serious recession” in 2023, reminiscent of the recession following the Global Financial Crisis of 2007-08. Musk articulated:

I think we are in a recession, and I think 2023 is going to be quite a serious recession. It’s going to be, in my opinion, comparable to 2009. I don’t know if it’s going to be a little worse or a little better, but I think it’s, in my view, likely to be comparable. That means demand for any kind of optional, discretionary item, especially if it’s a big-ticket item, will be lower. – Bloomberg

Still, Musk added that “booms don’t last forever, but neither do recessions,” as he postulated that “dawn breaks roughly in Q2 2024.” Notwithstanding, whether Musk’s admonition could turn Powell’s head remains to be seen.

The Fed Will Be Key To The Market’s Recovery

Accordingly, while consumer spending has slowed, it remains robust as consumers shift their spending to services. Moreover, inflation-adjusted spending “in October and November was an annualized 3.3% higher than the monthly average in the third quarter.” Therefore, the recent low jobless claims data corroborate that it’s likely for consumer spending to remain robust.

However, with inflation stubbornly high, we are operating in a different market environment than what we have been familiar with over the last ten years. Hence, the Fed could also be compelled to hold/or even raise its median terminal rate higher for an extended period to deal with the robust labor market.

Therefore, investors need to be prepared for a potential “stagflationary-light environment with slow growth and sticky inflation” that could threaten the recovery of tech/consumer discretionary/growth stocks over the next few years.

However, the silver lining of markedly lower medium-term inflation expectations could still bolster growth investors’ confidence in a medium-term recovery. Accordingly, the 5Y breakeven inflation rate has declined considerably to 2.29% (down from October highs of 2.69%).

As such, we highlighted to our members the extent of the current pullback could determine what market operators anticipate about the severity of the coming recession:

[The] Price action is looking constructive after [the] massive bull trap [post CPI release]. If the S&P 500 can continue consolidating without re-testing October lows, it’s a pivotal development, corroborating that October lows are the ultimate lows. Notably, it would set up the S&P for a higher-low development, even though it needs to eke out a higher-high subsequently. It’s still too early [to determine], but the market action is constructive. – Market Update December 23 – Ultimate Growth Investing

Takeaway

Hence, investors need not be so downcast as we celebrate Christmas and usher in 2023. Remember that the market is forward-looking, and it’s possible that we could have bottomed/near bottom despite a recession in 2023. As usual, the timeless advice of Warren Buffett comes to mind in his October 2008 Op-ed, as the Oracle of Omaha articulated:

Let me be clear on one point: I can’t predict the short-term movements of the stock market. I haven’t the faintest idea as to whether stocks will be higher or lower a month or a year from now. What is likely, however, is that the market will move higher, perhaps substantially so, well before either sentiment or the economy turns up. So if you wait for the robins, spring will be over. – NYT

Happy Holidays to all!

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.