[ad_1]

aluxum

The iShares J.P. Morgan USD Emerging Markets Bond ETF (NASDAQ:EMB) yields 7.3%, thanks to elevated US Treasury yields and relatively high credit spreads. This yield is highly attractive relative to long-term inflation expectations and even emerging market stock indices and could decline either due to falling UST yields or improving credit risk, both of which look likely in the near term.

The EMB ETF

The iShares J.P. Morgan USD Emerging Markets Bond ETF seeks to track the investment results of an index composed of U.S. dollar-denominated, emerging market government and government-backed bonds. EMB holds bonds of governments with more than USD1bn outstanding and at least two years remaining in maturity. The largest issuer in the ETF is Mexico, with a 5.9% weighting. The fund charges an expense fee of 0.39% which is relatively high for a bond fund but is still low compared to the current yield to maturity of 7.3%. In terms of credit quality, just over half of the issuers are investment grade, while the average maturity is 12.5 years.

EM Assets Staging A Key Reversal

As I noted in recent article on the Vanguard FTSE Emerging Markets ETF (VWO), EM stocks are looking very bullish. The EMB has been extremely closely correlated with EM stock prices over the past year and the upside equity move bodes well for further EMB upside.

VWO Vs EMB (Bloomberg)

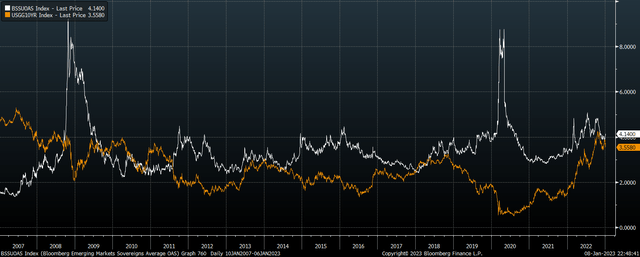

The EMB performs well when either credit spreads narrow in response to improving expectations of the global economy and liquidity conditions, or US Treasury yields fall. As improving risk appetite is often associated with rising UST yields, these two forces tend to act against each other. Over the past 12 months, however, credit spreads and UST yields have actually been positively correlated.

EM Sovereign Credit Spreads Vs UST Yields (Bloomberg)

Aggressive Fed tightening led to both higher risk-free rates and declining global liquidity, which was devastating for the performance of EM bond funds. This trend has begun to reverse, however, with the EMB benefiting over the past three months from narrower credit spreads and falling UST yields. And there is significant room left to run with yields at current elevated levels. If the global economy avoids recession, credit risk is likely to fall sharply, driving up EM bond prices. Alternatively, any global recession or credit crunch that caused EM credit spreads to remain elevated would result in significantly lower Treasury yields, supporting EM bond prices.

Yields Are Attractive Relative To Inflation And Stocks

The 7.3% yield on the EMB is particularly attractive when measured against long-term US inflation expectations. 10-year US Breakeven Inflation Expectations currently sit at just 2.2%, meaning that investors should expect to beat inflation by over 5 percentage points over the next decade. The chart below shows the Bloomberg EM Sovereign yield over inflation expectations. This measure has only been higher during the global financial crisis and the height of the Covid panic.

Bloomberg EM Bond Index Yield Over 10-Year Inflation Expectations (Bloomberg)

The EMB even looks attractive relative to EM stocks. The MSCI Emerging Market Index offers a dividend yield of 3.1%. In order for EM stocks to outperform bonds, therefore, dividends would have to grow by 4.2% annually, which has not been the case over the past decade of relatively strong GDP growth.

The higher returns likely on EM bonds relative to stocks contrasts with the much lower degree of volatility in the former. The largest decline seen in the EMB was during the global financial crisis when the ETF fell 34%. The second largest decline was during the Covid crash, when the ETF shed 26%. While not small, these declines compare favorably to EM stock benchmarks, which lost around 63% and 34% during these two episodes. Even during 2022, which was somewhat of a perfect storm for bonds, the EMB still outperformed EM stocks.

Summary

The EMB is well placed to benefit from a recovery in Emerging Market risk appetite and/or a decline in Treasury yields. With a weighted average yield of 7.3%, the EMB is likely to significantly outperform inflation over the coming years, and even outperform EM stocks, with much less volatility.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.