[ad_1]

Thomas Barwick

Everbridge (NASDAQ:EVBG), an enterprise SaaS business primarily involved in mass notification and critical event management (CEM) software, hosted an upbeat investor day presentation earlier this month. The key takeaway was the shift to a more CEM-driven subscription model, which should create a more predictable, high-margin income stream. In line with this goal and its steady CEM suite progress thus far, management has introduced a new ~$1bn annual recurring revenue (or ARR) target.

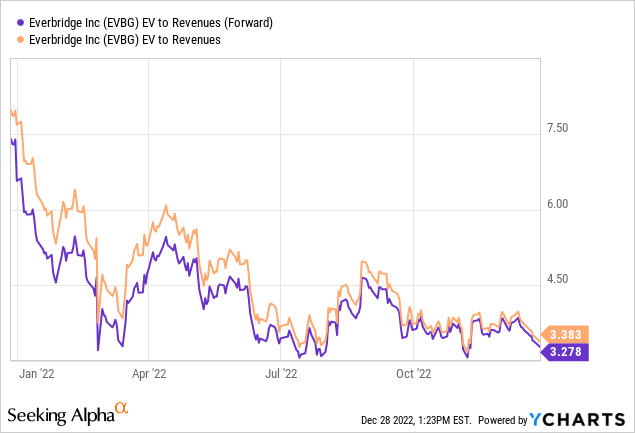

While the mid to long-term ambitions are positive, near-term financial risks remain unaddressed, particularly in light of the deteriorating macro outlook and potential execution challenges amid the CEO transition. Plus, the legacy mass notifications business is already seeing a slowdown amid competitive pricing pressure, implying a narrowing funnel for the adoption of premium CEM solutions. With the stock still trading at a pricey ~3x fwd EV/Sales, I see more risk than reward here.

Large TAM Opportunity, but Growth Uncertainty Remains

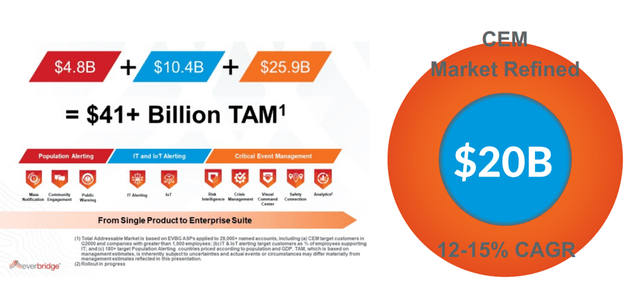

EVBG has maintained its leadership in the CEM space, despite intensifying competition, as it continues to tackle the large ~$20bn total addressable market (or TAM) opportunity. Backed by a strong suite of CEM modules, the company has the tools to emerge as a category leader as long as it navigates the early stages of its market transition well. Recent investments in vendor education and partner collaborations should keep the inorganic growth engine going, although the revenue base needs to scale to cover the elevated marketing expenses as well.

That said, unlocking sustained CEM platform growth will not be straightforward. The post-COVID impact is a case in point – while SaaS peers like Zoom (ZM) and 8×8 (EGHT) saw accelerated revenue growth, EVBG has seen a marked deceleration. Going forward, progress on the product acceptance front will be worth monitoring – increased CEM platform traction should drive higher pricing and net new annual contract value (ACV) growth, while a more gradual adoption will likely result in continued P&L weakness.

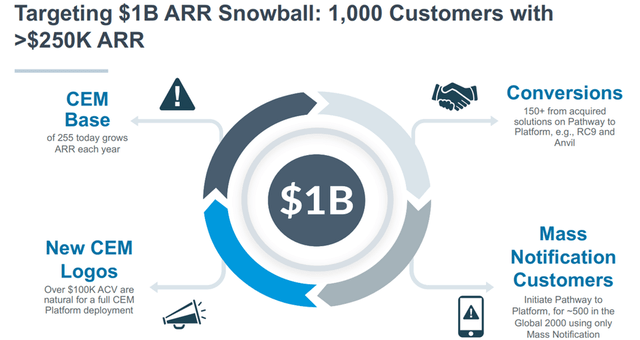

Unveiling a New $1bn ARR Target

A positive takeaway from the event was EVBG’s introduction of a CEM-driven $1bn ARR target, which management will hold itself to over the mid-term. The clear message is that EVBG is prioritizing a subscription-based CEM model over the legacy mass notification business, which is slower growth and less predictable.

While a successful transition would be positive for shareholder value, I remain hesitant about underwriting the CEM growth targets. For one, CEM customer acquisition still depends on a mass notifications business, which has been weighed down by competitive pricing pressures and slowing growth. As a result, revenues from mass notification now contribute ~36% of revenue (down from >40% in FY21).

Plus, in a macro slowdown, customer budgets are likely to suffer cuts, and this could weigh on CEM adoption in the meantime. Relative to a premium CEM platform-based solution, a cheaper mass notification point solution might seem more appealing to new and existing customers.

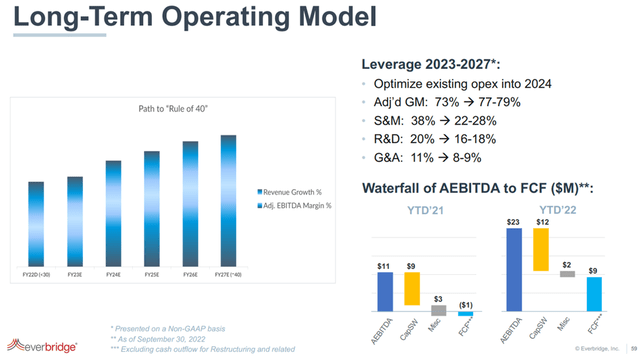

Strategic Realignment Underway; Focus Turns to Profitability

EVBG’s strategic realignment remains in progress following its prior CEO departure. New CEO Wagner joined the company in July this year and will continue to execute the initiative following the announced extension in Q3 2022. The difference, however, is that Wagner will focus on streamlining the portfolio and driving profitable growth instead of further major product launches. In conjunction with the updated ARR target, management has guided to ~11%pts of opex leverage, entailing a 22–28% target through FY27 (vs. ~36% for FY22). This was accompanied by further R&D leverage and G&A targets of 16–18% and 8–9%, respectively.

The renewed focus on costs and profitability is prudent, in my view. Reemphasizing the need for successful post-acquisition integrations also moves the development of the CEM platform forward. Plus, the mid-term path toward achieving the ‘Rule of 40’ (i.e., adj EBITDA margins + revenue growth) represents an important mindset shift. From the prior ‘growth at all costs’ objective, introducing cost discipline is crucial in ensuring sufficient runway heading into a challenging capital market outlook. Balancing profitability and growth in its CEM platform will be no easy feat, though, and EVBG will likely undergo a multi-year journey before it builds a sustainable growth profile.

A Pricey Play on CEM Adoption

EVBG management is as bullish as ever on the CEM platform growth potential, outlining the path to building out a subscription-focused model with recurring revenues. Yet, recent competitive pricing pressures are a concern, with the mass notifications business seeing growth slowing YoY as a result. In turn, weakness here could affect the pace of CEM adoption, as mass notifications have been the key customer acquisition funnel. With a macro slowdown on the horizon as well, customer budgets are likely to shrink, leaving limited room for premium, platform-based CEM solutions.

Near-term execution is another key risk – having lost its prior CEO, the company is currently in the midst of a transition, with new CEO Wagner only just appointed in July. The stock isn’t cheap either at ~3x fwd EV/Sales, likely embedding optimism following activist investor Ancora Advisors’ push for the Board to sell the company. With no news since, however, a takeout scenario seems unlikely, and thus, the risk/reward seems unfavorable here.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.