[ad_1]

The much awaited IPO of Vedant Fashions is open for subscription!

After years of seeing Amitabh Bachchan, Virat Kohli, Anushka Sharma, Aliaa Bhatt, Ranveer Singh and Kartik Aaryan celebrate Indian weddings in TV ads in Manyavar’s traditional attire, we now get to celebrate the listing of the company on the Indian stock exchanges.

About Vedant Fashions IPO:

Vedant Fashions Limited is the largest company in India in the men’s Indian wedding and celebration wear segment.

Their flagship brand, Manyavar, is a category leader in the branded Indian wedding and celebration wear market with a pan India presence.

It is primarily engaged in the manufacturing and trading of readymade men and women celebration wear like sherwanis, lehengas, sarees, kurtas, and related accessories.

It offers its products both, offline via its exclusive brand stores (EBOs), multi-brand stores (MBO’s) and large format stores (LFS) and online through its website, app and lateral e-commerce platforms.

The company has established a multi-channel network, building a portfolio of brands with on-trend designs by identifying gaps in the under-served and high growth Indian wedding and celebration wear category.

It has a portfolio of 5 brands – Manyavar, Mohey, Mebaz, Twamev, and Manthan.

As of June 2021, Vedant Fashions Ltd had:

525 Exclusive Branded Outlets (EBOs) across 207 cities and towns in India and 12 EBOs in USA, Canada, and UAE covering 1.1mn sq ft in retail footprint.

Overview of Vedant Fashion Brand Portfolio

Vedant Fashions Business Model:

Vedant Fashions is primarily asset-light since its Exclusive Brand Outlets (EBOs) are largely operated by franchisees on a pan India basis.

The company commands a high initial capital commitment from these 300 franchisees and in return, provides support in identifying and approving potential locations for new stores, managing advertising, supply chain and inventory management, and providing training programmes to franchisees and store staff.

70% of its franchisees have operated stores for 3 or more years and 61% of the sales of franchisee-owned EBOs is derived from franchisees having 2 or more stores.

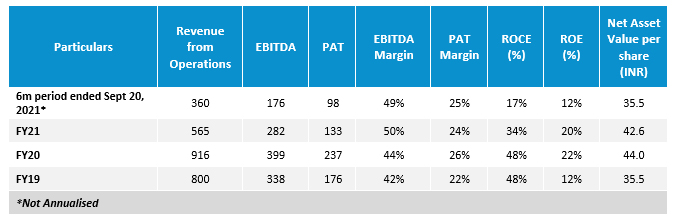

Vedant Fashions Key Financials (INR Cr):

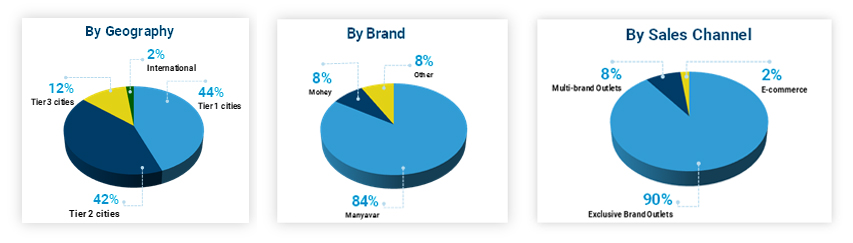

Vedant Fashions Revenue Mix:

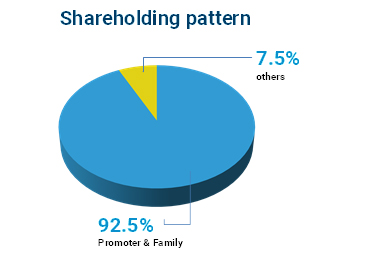

Vedant Fashions Promoter & Shareholding Pattern:

VFL is headquartered in Kolkata and led by Mr. Ravi Modi, a first generation entrepreneur.

VFL’s pre-offer shareholding pattern is as below,

Vedant Fashions IPO Details:

Offer Period: Friday, 4th Feb – 8th Feb

Price Band: INR 824 – INR 866

Lot Size: 17 equity shares & in multiples of 17 equity shares thereafter

Face Value: INR 1 per share

Issue Size: Sale of 36,384,838 Equity Shares

Type of Issue: Offer for Sale

Offer to Public: 15%

Issue Size (in ₹): ₹3149cr

- QIB: 50% of net issue – ₹1574 cr

- NIB: 15% of net issue – ₹474 cr

- Retail: 35% of net issue- ₹1102 cr

How to apply for Vedant Fashions IPO

You can apply for the Vedant Fashion IPO in these ways:

a) Existing PL Client

Proceed to book Vedant Fashion IPO shares using our E-IPO Facility and using the UPI ID, confirm the payment on the UPI app, and block the amount for allotment.

Visit this link to apply: https://eipo.plindia.com/

b) New Demat Account

If you’re a new investor open your demat account for free with Prabhudas Lilladher to begin your investment journey.

Click https://instakyc.plindia.com/ to get started

Check out this video walkthrough to learn how to open a demat account at PL.

If you face any difficulties while opening an account online, you can leave us a missed call at 07968350270 and our agents will call you right back!

Alternatively, you can walk into any of our branches across India – Check out our locations at https://www.plindia.com/contact-us.aspx.

From some other city? No Issues! Just leave us a message at info@plindia.com and we shall ask our closest partner office out of our 1000 plus partner network to assist you!

So don’t wait any longer! Prabhudas Lilladher, started in 1944, is your reliable financial services provider to help you fulfill all your wealth building needs! With our services ranging from trading cum demat, mutual fund investing, IPO investing, fixed deposits, bonds, portfolio management services, personal loans, loans against shares , life insurance, health insurance and lots more, we have everything you and your family may ever need to manage finances!

Happy Investing!

All data from the Vedant Fashions RHP

[ad_2]

Image and article originally from www.plindia.com. Read the original article here.