[ad_1]

hapabapa/iStock Editorial via Getty Images

Most of the EV market stocks have crumbled this year due to questionable business models. EVgo (NASDAQ:EVGO) is a poster child for the EV charging station stocks with no real path to profitability despite strong growth. My investment thesis remains ultra Bearish on the stock as the company starts diluting shareholders to fund a large cash burn rate.

Bleeding Edge

While EVgo remains in the early stages of rolling out an EV charging network, the company already has a large domestic network. In fact, EVgo is already running into problems with needing to replace outdated chargers in a sign of ultimate bleeding edge of the EV charging station business.

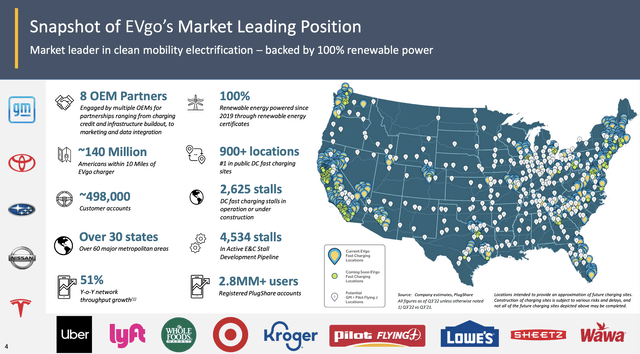

The company has 900+ locations with 2,625 DC fast charging stalls. EVgo has another 4,534 stalls in the development pipeline and an additional 10,000 identified locations in a sign of the potential scale over the next few years.

Source: EVgo Q3’22 presentation

The problem is that the company has already had to update 125 stalls YTD and EVgo is working with more site hosts to replace or just remove over 100 additional stalls in 2023. The company forecast an adjusted EBITDA loss for 2022 of at least $80 million, yet stalls are already out of date.

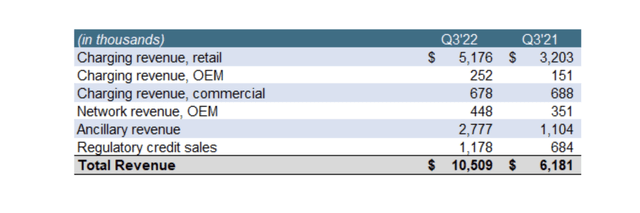

For Q3, EVgo only produced $10.5 million in revenues while capital expenditures for the period were $61.6 million. EVgo burned a combined $80.4 million of cash in the quarter.

The promising EV charging network provider doesn’t have a business model that comes anywhere close to matching the costs of the business. EVgo only forecasts 2022 revenues of $48 to $55 million, despite quarterly capex soaring past those yearly revenue metrics.

The company obtains very limited revenues for actual customers, charging on the DC fast network. For Q3, actual charging revenue was only $6.1 million, while ancillary revenue and regulatory credit sales were $4.0 million.

Source: EVgo Q3’22 presentation

The whole problem with the business is the utter focus on new installs with a business model that will somehow just work in the next few years. The Q3’22 earnings call spent the majority of the conversation on how much the company could expand the network next year, with little to no conversation on the limited gross margins and why the EV charging network was looking to double and triple the stalls on the network before boosting utilization on existing stalls to expand margins.

As with most alternative fuels, the business models appear to never focus on customary same-store sales and any common financial metrics. EVgo already admits to having a charging station within 10 miles of 140 million people, questioning the vast need to add more stations at an aggressive pace with unused charging stalls all around. A normal business would look for 40% to 50% gross margins before selectively adding additional locations without cannibalizing existing locations.

In Q3 alone, the adjusted gross margin was only 19.0%, down from 22.2% last Q3. EVgo had to spend $8.5 million on costs (mostly electricity) while total cost of sales were $13.7 million when including the site depreciation costs.

Considering EVgo already has plans to replace over 250 stalls, or nearly 10% of the current base, the depreciation costs are not ones to exclude from the profit picture via the EBITDA calculation. The company already has a $22.2 million quarterly EBITDA loss before adding back depreciation, which would make for a loss of $27.5 million, an amazing large amount with revenue of only $10.5 million.

Massive Dilution Ahead

EVgo ended the quarter with a cash balance of $301 million. The company ended 2021 with a cash balance at $485 million and has burned $184 million in the first 9 months of the year already.

While EVgo has a large cash balance now, the company has already lined up a $200 million ATM in order to raise additional funds. The former SPAC has 265 million shares outstanding and quickly could dilute shareholders by another 50 million shares, pressuring the stock even lower when a lot of cash could’ve been raised via the exercise of warrants at much higher prices.

The stock valuation has already plunged to $1 billion, leading to the prime problem with EVgo and other SPACs. The stock surged to $12 back in August, yet the company now wants to sell shares at $4 due to a complete misunderstanding by these newly public companies of the public market dynamics.

Takeaway

The key investor takeaway is that EVgo remains on the bleeding edge. The company is burning so much cash and ATM had to be established despite a previous cash balance of $300 million. Until the business model ties actual end user demand with the installation of new charging stations, investors must dump shares.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.