[ad_1]

Gam1983

Global stocks and bonds rallied sharply to start the second half of 2022 despite renewed worries on both the inflation and economic growth fronts. Early last month, the U.S. CPI reading came in much hotter than expected, notching yet another fresh 40-year high. That came on the heels of a very robust June employment report, which showed that the domestic economy added a whopping 372,000 jobs.

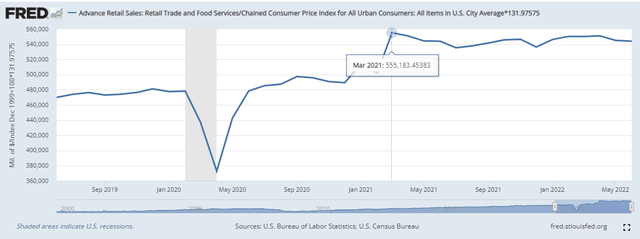

Retail sales for June came in strong, too, though adjusted for inflation, real spending was slightly negative and well off the highs notched in March of last year.

Inflation-Adjusted Retail Sales Fell In July

St. Louis Federal Reserve

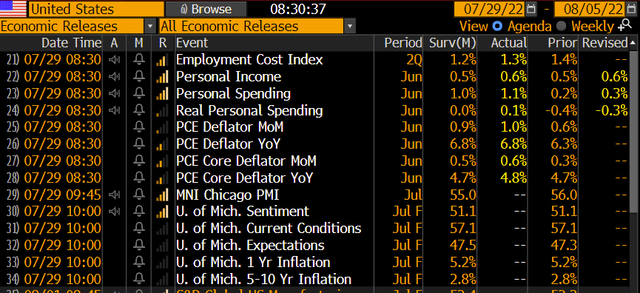

We got more troubling inflationary data to end July, too. Last Friday’s Employment Cost Index verified above market forecasts at 1.3%. The market looked past that data point, and stocks jumped to end the week and month.

Inflation Data Last Friday: Still Very Hot

Bloomberg

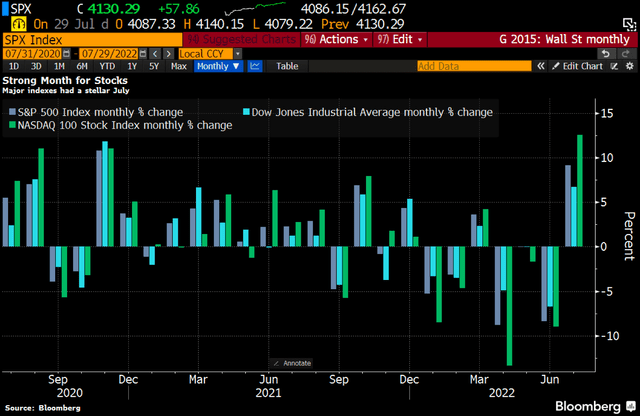

In all, the S&P 500 rose 9.1% in July for its best month since November 2020. Stocks were already sharply higher in advance of the Federal Reserve’s two-day meeting last week. Traders expected a 0.75 percentage point hike in the Fed Funds Target Rate, and that is just what they got, along with re-assuring words from Chair Powell during the press conference. The FOMC meeting was the final catalyst to spark a wave of risk-on appetite in July.

U.S. Stocks Post Best Monthly Gain Since November 2020

Bloomberg

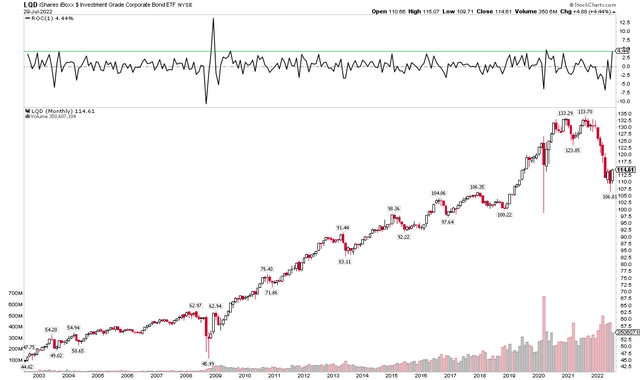

Global bonds rallied big too after a first-half drubbing. The yield on the benchmark U.S. 10-year Treasury note plunged from a June peak near 3.5% to under 2.7% to settle on Friday. Speculative-grade debt also caught a bid as the iShares iBoxx $ High Yield Corporate Bond ETF (HYG) had its best month since late 2011. Homing in on high-grade credit, the iShares iBoxx $ Inv Grade Corporate Bond ETF (NYSEARCA:LQD) benefited from both a risk-on appetite and lower market interest rates. Investment grade corporates had its best month since April 2020 as buyers finally returned to that market.

LQD: Best Month Since Early 2020

Stockcharts.com

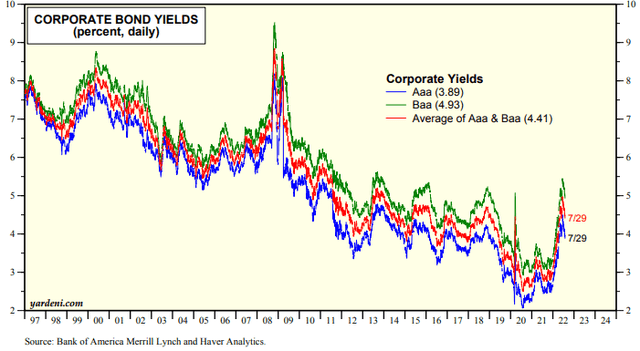

The yield on LQD remains well above where it traded during 2020 and 2021. At 4.5%, it sports a positive real yield when compared to inflation expectations looking out 10 years, which stand at 2.53%, according to the St. Louis Federal Reserve. Still, high-grade credit is simply back to where it closed out the month of May. This could simply be a pause in the broader downtrend—we need to see more signs of life in that slice of the fixed income market. And the August-September period is notorious for being risk-off, so the bulls have their work cut out for them.

Corporate Bond Yields Drop In July

Yardeni Research

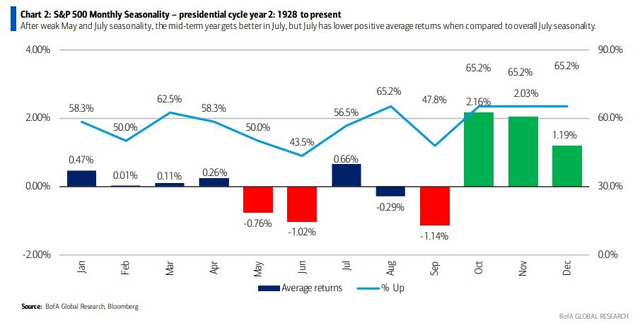

August and September Are Often Tough During Mid-Term Years

BofA Global Research

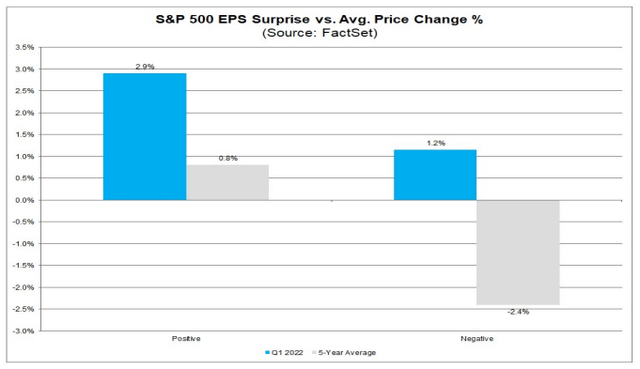

Finally, amid key price action and economic data, we also have the all-important second-quarter earnings season in full swing. According to John Butters, Senior Earnings Analyst at FactSet, 73% of S&P 500 companies have reported a positive EPS surprise so far during this reporting period.

What I found particularly revealing is that firms missing earnings estimates have actually rallied big. FactSet’s data show firms with a negative EPS surprise have seen a share price rise of 1.2% in the two days before announcing earnings and over the subsequent two trading sessions post-earnings. That’s above the five-year average change of –2.4%. Perhaps much of the bad news is now baked in.

Earnings Missing Met With Buying

FactSet

The Bottom Line

Stocks and bonds had a great month despite troubling economic data. The end of July featured a pivotal Fed meeting which was met with buying. Moreover, the Q2 corporate earnings season is fairing much better than expected so far. Traders should look to cues from the corporate credit market but also be mindful of the often-shaky August-September period now underway.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.